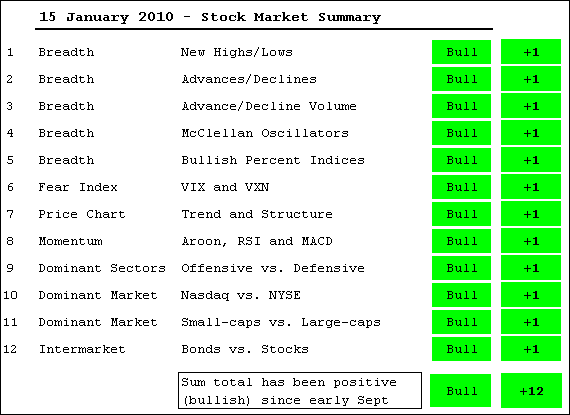

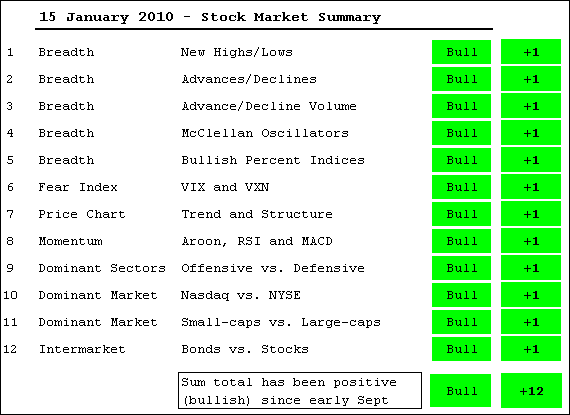

Even though stocks seem overbought and ripe for a correction, there is still more evidence of buying pressure than selling pressure. This means that a correction would be just that - a pullback within a bigger uptrend. It is hard to say when a correction might hit because everyone seems to be looking for it. Keep in mind that this table is designed to identify the general direction for stocks and follow until proven otherwise. With all indicators bullish, the stock market is far removed from a downtrend right now. There are some bullet points after the jump. Detailed commentary can be found in Friday's Market Message.

-NYSE AD Line hits new high

-AD Volume Lines hit new highs

-New highs continue to exceed new lows

-McClellan Oscillators have been largely positive since December

-Nine Sector Bullish Percent Indices are above 70%

-Volatility Indices hit new lows in January

-SPY, QQQQ, DIA and IWM hit new highs in January

-Momentum oscillators for SPY remain in bull mode

-XLF surges in January - XLY, XLK and XLI hit new highs in January

-Nasdaq led the NY Composite in December

-Small-caps led large-caps in December

-Bonds cratered as rates surged in December

-AD Volume Lines hit new highs

-New highs continue to exceed new lows

-McClellan Oscillators have been largely positive since December

-Nine Sector Bullish Percent Indices are above 70%

-Volatility Indices hit new lows in January

-SPY, QQQQ, DIA and IWM hit new highs in January

-Momentum oscillators for SPY remain in bull mode

-XLF surges in January - XLY, XLK and XLI hit new highs in January

-Nasdaq led the NY Composite in December

-Small-caps led large-caps in December

-Bonds cratered as rates surged in December

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More