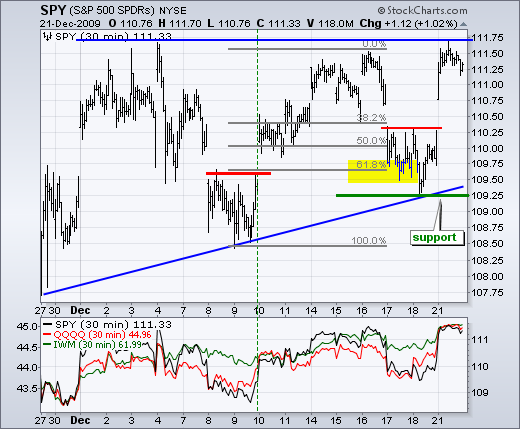

On the 30-minute chart, price action is like a pinball bouncing off the noisy bumpers (support and resistance). The bulls are perking up as SPY managed to hold above the prior low and reverse near the 62% retracement mark. This retracement was featured in the Friday morning commentary. Even after Thursday's gap down, I still considered the glass half-full for the bulls. Now that SPY is challenging resistance, the bulls still have the definitive edge, but the glass is half empty because the short-term risk-reward ratio is not good for new longs. In fact, the current risk-reward ratio favors short positions. However, I do not consider bearish positions an option when both the short-term and medium-term trends are up and seasonality is bullish.