- Staying Overbought

- Earnings Driving the Advance

- XLF Breaks Flag Resistance

- KRE Surges off July Low

- Bonds Falter as Stocks Surge

- Link to today's video.

- Stock setups video around 9AM ET.

- Next update will be Tuesday (July 28) by 7AM ET.

*****************************************************************

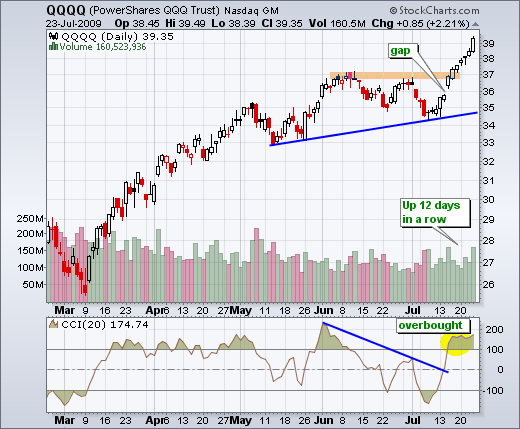

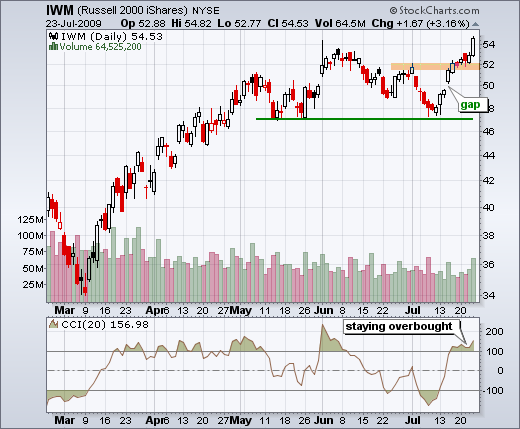

Staying Overbought

You got to know when to hold ‘em, know when to fold ‘em, know when to walk away and know when to run (Kenny Rogers, The Gambler). What would the gambler do if he was a trader? With the S&P 500 up over 10% in 12 days and the Nasdaq up over 12% in 12 days, I bet the gambler would either walk away or run. The Nasdaq is also up 12 days in a row. It is an extraordinary run, but the run is getting out of hand. At this point, the market is too strong to justify shorts and too overbought to justify longs. With the rally extending further, it is time to raise potential support levels. On the daily chart, I am focusing on broken resistance levels for potential support levels on a pullback (orange areas). QQQQ is by far the strongest with broken resistance from the June highs turning into first support. Broken support from the late June/early July highs turns into first support for SPY and IWM. All three charts show 20-perid CCI. CCI remains both overbought and bullish as long as it holds above 100. A move below 100 would provide the first sign of momentum loss.

*****************************************************************

Feeding on Earnings

The 60-minute charts show a steep rally that refuses to buckle. The yellow areas mark the first support levels based on broken resistance. RSI dipped below 70 earlier this week, but the ETFs did not break down. As RSI moved below 70, QQQQ held Monday's gap and simply moved sideways for a day or two. SPY also held above the Monday morning low and never breached 94. IWM had the deepest setback on Tuesday, but support from broken resistance held around 51.5-52. This rally smacks of an upside blow-off, which is the opposite of a selling climax. As far as I can tell, earnings reports have been driving this rally (feeding frenzy). With the earnings calendar full next week, prices may hold up until the end of July.

*****************************************************************

Financials Perk Up

Relative weakness in the Financials SPDR (XLF) and the Regional Bank SPDR (KRE) has been a concern overall, but both perked up over the last two days. XLF broke above flag resistance with a surge to 12.5 on Thursday. The ETF also broke above the wedge trendline. KRE firmed at support from the early July lows on Wednesday and then surged on Thursday. The ETF remains short of a trend-reversing breakout though. In addition, the price relative remains in a clear downtrend. A little follow through is needed to complete a reversal here.

*****************************************************************

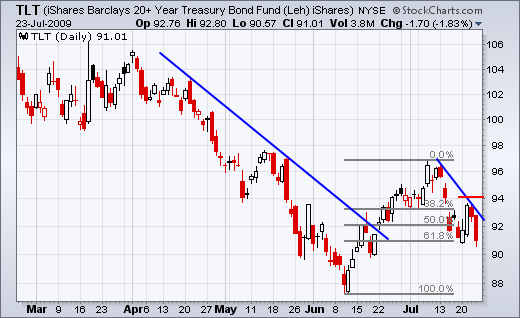

Bonds Falter

With money rushing into stocks, there was an exodus from the bond market. The 20+ Year Treasury ETF (TLT) surged off its 62% retracement mark at the beginning of the week, but gave it all back over the last two days. There is still a chance that TLT will hold support from Monday's low. It is now or never though. As long as stocks remain strong, bonds are likely to remain under pressure and TLT could even test support from the June lows.

*****************************************************************