- Charts Worth Watching: AET, CAKE, IHF, ITB, IYR, TLT, UNH, XHB

- Link to today's video.

The next update will be Friday (July 24) by 7AM ET.

*****************************************************************

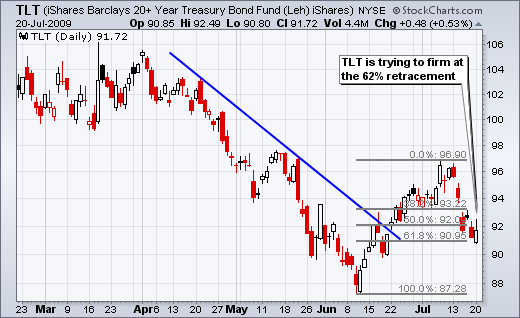

The 20+ Year Treasury ETF (TLT) is trying to firm near the 62% retracement line. TLT surged above 96 with its biggest move since December. Strength in the stock market zapped the bond market though and TLT pulled back sharply over the last six days. Despite this setback, TLT managed to firm near the 62% retracement mark on Monday. This is a good spot for a little reversal. Watch for a break above 93.

*****************************************************************

The Home Construction iShares (ITB) and Homebuilders SPDR (XHB) led the market higher over the last two weeks with big wedge breakouts. Also notice that the price relatives broke resistance in a show of relative strength. Based on the sharpness of the surge, these breakouts look valid. However, both are overbought already and ripe for a pullback or consolidation. A pullback could retrace 38-50% of the two week surge and broken resistance levels could turn into support.

*****************************************************************

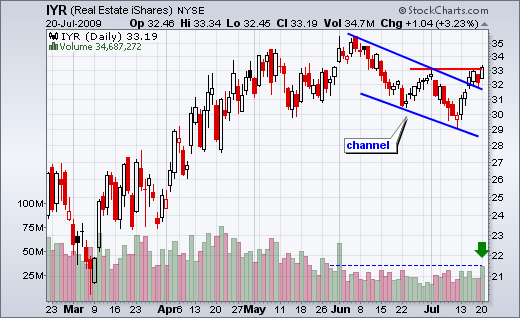

The REIT iShares (IYR) is also perking up with a channel break and resistance challenge over the last four days. Also notice that IYR surged over 3% on Monday with the highest volume since 1-June.

*****************************************************************

The Healthcare Providers iShares (IHF) is stalling at resistance as healthcare reform hangs in the balance. With Congress scheduled to recess on August 8th, the next three weeks hold the key for these stocks. On the chart, IHF hit resistance at 39 in May, June and July. The ETF formed a triangle consolidation over the last four weeks. A break above the July highs would be bullish, while a break below the July low would be bearish.

*****************************************************************

Aetna (AET) formed a rising wedge over the last seven weeks. The stock also shows relative weakness as it lags the S&P 500. A break below wedge support would reverse the seven week advance.

United Healthcare (UNH) gapped down in mid June and stayed down with a triangle consolidation. While the market moved higher the last two weeks, UNH showed relative weakness with flat trading. Watch the triangle boundaries for the next signal.

*****************************************************************

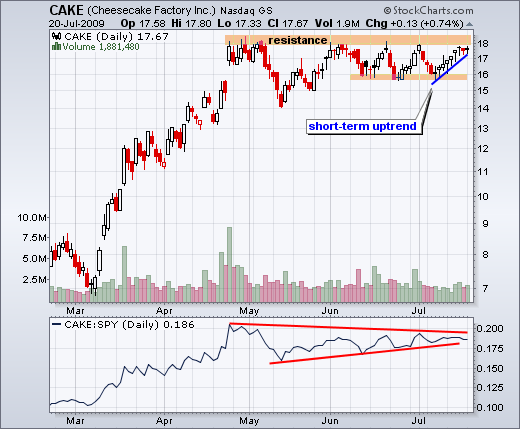

Cheesecake Factory (CAKE) remains on the watch-list as it stalls near resistance. The 9-day trend is up as long as support at 17 holds. A break below this level would be the first sign of weakness. Support from the consolidation lows hold the medium-term key.

*****************************************************************