Trading Places with Tom Bowley February 23, 2025 at 11:13 AM

Let me start by reminding everyone that I believe the most important relationship in the stock market is how consumer discretionary stocks (XLY) perform relative to consumer staples stocks (XLP). This ratio (XLY:XLP) has a VERY strong positive correlation with the S&P 500... Read More

Trading Places with Tom Bowley February 16, 2025 at 02:18 PM

For us at EarningsBeats.com, earnings season is the time to do our research to uncover the best stocks to trade over the next 90 days, or earnings cycle. We do this in various ways... Read More

Trading Places with Tom Bowley February 15, 2025 at 11:38 AM

It was another mildly bullish week as our major indices climbed very close to new, fresh all-time highs. We also saw a return to growth stocks as we approached breakout levels, which is a good signal as far as rally sustainability goes... Read More

Trading Places with Tom Bowley February 09, 2025 at 12:58 PM

Sometimes an industry group looks good technically, sometimes fundamentally, and then other times seasonally. But what happens when they all line up simultaneously? Well, we're about to find out with the travel & tourism group ($DJUSTT). On Friday, Expedia (EXPE, +17... Read More

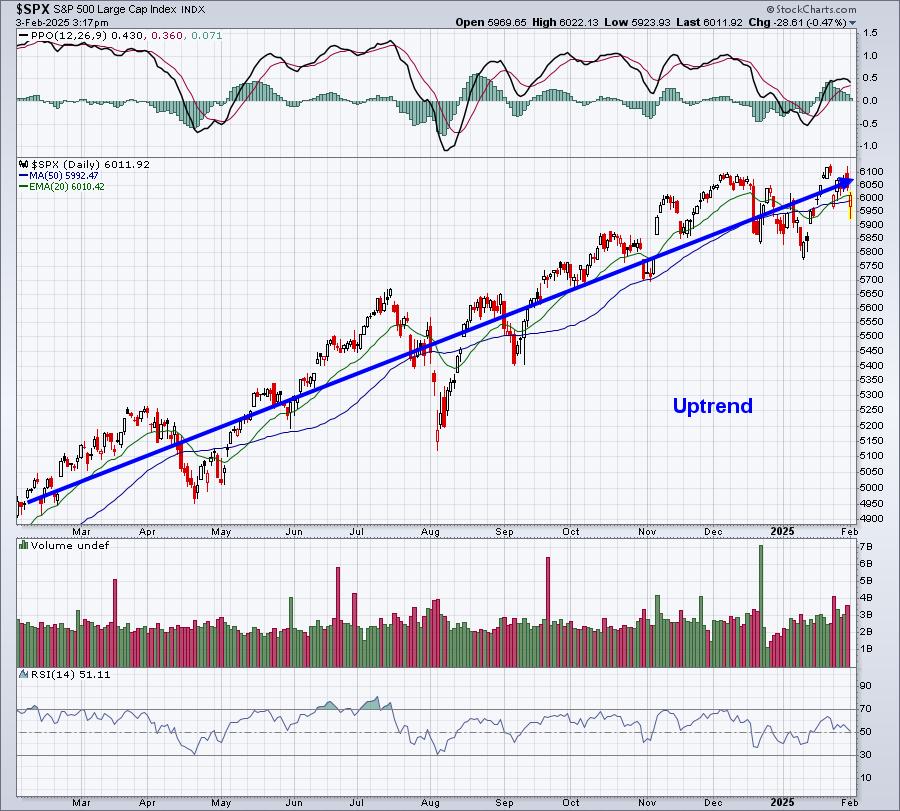

Trading Places with Tom Bowley February 03, 2025 at 03:52 PM

Secondary market signals are beginning to line up for a further drop, which can sometimes provide false signals. The primary indicator for me is always the combination of price/volume... Read More

Trading Places with Tom Bowley February 02, 2025 at 11:17 AM

"When do I sell?" is easily the most-asked question I've received over the years. There are multiple answers to this question based on certain variables. The first key variable is whether you're a day trader, short-term swing trader, or long-term buy and holder... Read More

Trading Places with Tom Bowley February 01, 2025 at 05:46 PM

Listen, I'm generally a fairly optimistic guy. I tend to see the good in the stock market, while many others continuously focus on potential selloffs ahead. I remain mostly bullish for good reason as the S&P 500 has risen 75% of all years since 1950... Read More