In the very near-term, we have options issues that could take a toll on key technology (XLK) and consumer discretionary (XLY) stocks. If those options issues kick in this week, the overall market is likely to struggle. That will definitely be one headwind as we start the new week. But don't overlook the strength we're seeing in critical areas of the market. Industrials (XLI) have come to life too. Below is a one month performance chart of all 11 sectors:

Clearly, those discretionary and technology names have lifted the stock market out of the cyclical bear market. Call it a bear market rally if you'd like.....and good luck with that. This is the resumption of the secular bull market that we've enjoyed since the April 10th, 2013 breakout on the S&P 500 above the double top from 2000 and 2007. I'd estimate we have another 10 years of this bull market, where I expect the S&P 500 to triple from here. Yep, I'm looking for 12000 to 15000 on the S&P 500 by the early-2030s. Then batten down the hatches.

But let's not get too far ahead of ourselves. We need to focus on the here and now. The sector that's really begun to perform well, other than discretionary and technology, is industrials. Here's a 1-year relative chart of the XLI vs. the benchmark S&P 500:

In the top panel, you can see the clear relative uptrend throughout 2022. The XLI is on the verge of another relative breakout. In the bottom panel, we see the absolute strength of the XLI. I've drawn a few key support/resistance lines where many bottoms had formed through April. Then after breaking down, these prior support levels became key resistance. The XLI has now cleared EVERY one of them. This is not bear market rally behavior. We have a new uptrend in place and the group is poised for yet another new relative high in 2022.

So now let's look at which industry groups within the XLI are most appealing. There are several that have improved considerably in recent months, but let's look at two in particular:

Waste & disposal services ($DJUSPC) and heavy construction ($DJUSHV) have broken out to all-time highs! What bear market? Not in these two industry groups. The natural reaction and question is "Why?" As a technical analyst, I learned to stop asking WHY questions a long, long time ago. Wall Street is speaking to us. The only real question is "Are we listening?" WAY too many traders try to outsmart the market, rather to simply listen to its story.

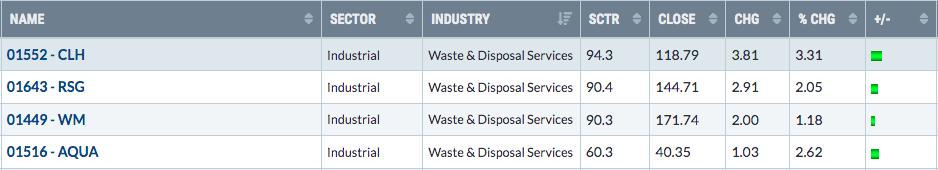

So then we take it to the next level. Which stocks within these two industry groups are performing well? That's where all of our research at EarningsBeats.com comes into play. From our Strong Earnings ChartList (SECL), I can quickly view this list in "Summary" form and sort it by industry group. Let's look at the waste & disposal services ($DJUSPC) group:

CLH has been on fire since reporting blowout earnings on August 3rd, as you can see below:

I don't like chasing a stock like CLH, but it would definitely be on a Watch List. I'd pounce on it after a pullback. The second stock above is Republic Services (RSG), which is one of our Model Portfolio stocks at EarningsBeats.com. It's been a great performer for us and now trades at an all-time high:

We need to be thinking bull market and trade accordingly. Pullbacks to key price and moving average support will provide excellent opportunities.

I'll feature a heavy construction stock from our Strong Earnings ChartList (SECL) in tomorrow's EB Digest newsletter that'll show you exactly what to look for. If you sign up for our FREE event on August 27th, 2022 at 10:00am ET, we'll automatically add you to our FREE EB Digest newsletter so that you can receive tomorrow's stock. You can CLICK HERE for more information on the event and provide your name and email address to save your seat!

Happy trading!

Tom