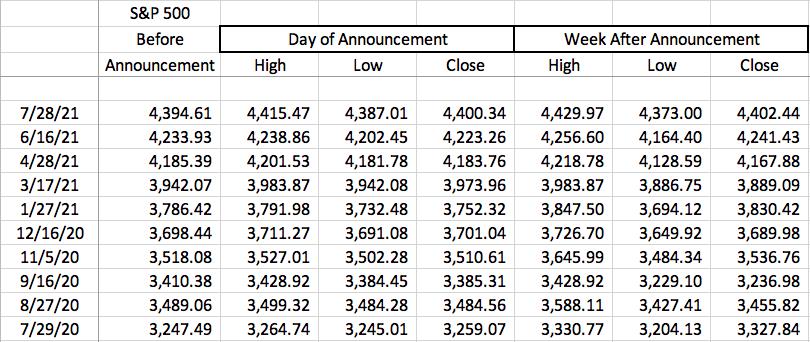

The Fed began its latest 2-day meeting this morning and it'll release its latest FOMC policy decision on Wednesday at 2pm ET. From past experience, I know there's been significant volatility after Fed announcements, so I thought I'd summarize the S&P 500 performance during the day of the Fed announcement and over the following week. Quite honestly, there hasn't been nearly as much volatility as I would have guessed. The table below provides the price action subsequent to each of the last 10 Fed meetings:

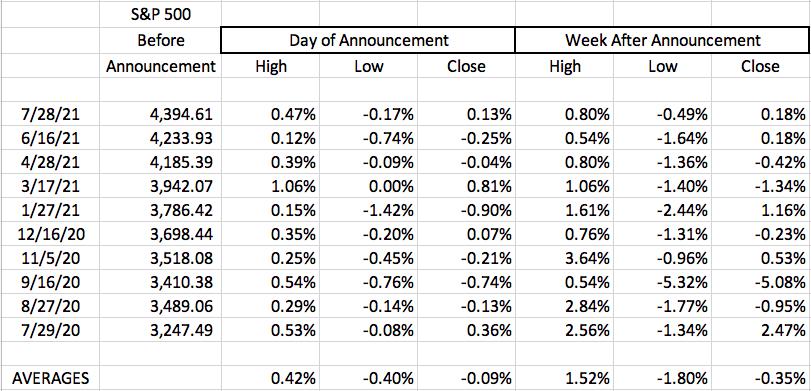

It's hard to make much of the numbers, so I also summarized this information using percentages, which I think is a little easier to follow:

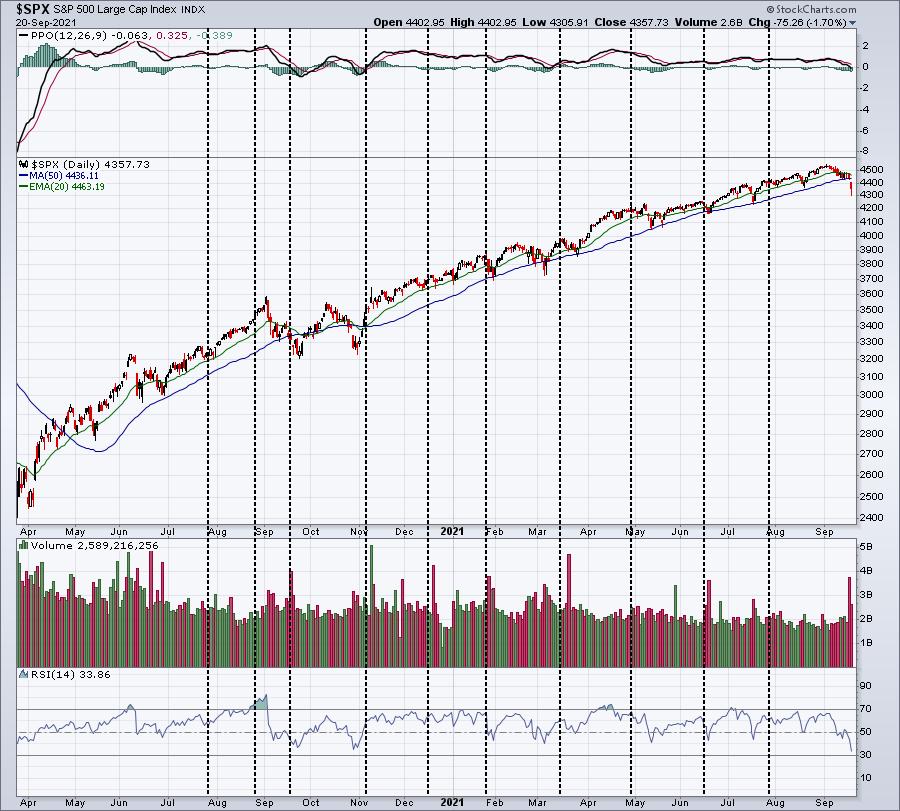

It may also help to visualize the Fed announcement dates on an S&P 500 daily chart, so here goes:

The black-dotted vertical lines approximate the dates that the Fed announced its interest rate policy/decision. I thought for sure there'd be TONS to write about, but I don't see much earth-shattering information to pass along. If anything, I'd say the market doesn't really react that overwhelmingly to Fed announcements. Yes, we see "knee-jerk" reactions right after the announcement, but then it becomes pretty much "back to normal" over the next week.

I did note that prior to nearly every Fed meeting, the stock market was trending higher going INTO the announcement, so it's as if Wall Street knows the Fed won't do anything to end the bullish party. There was one exception to this "pre-Fed rally" scenario and it occurred last year......in September (coincidence?). The S&P 500 was already under selling pressure heading into the Fed meeting, which occurred, quite coincidentally, just as the historically-bearish second half of September kicked in. The selling actually accelerated AFTER the Fed announcement and the S&P 500 dropped another 5% in the week following the announcement. Might we see that again in September 2021? It's certainly a possibility.

One another thing I want to pass along. After the last 10 Fed meetings, the S&P 500 jumped more than 1% over the next week 5 of 10 times, or 50% of the time. However, it lost more than 1% 8 times out of 10, or 80% of the time. Most Fed meetings have occurred in the second half of calendar months, which typically performs weaker than its first half of the calendar month counterpart. It seems that the market is skewed a bit more to the bearish side after Fed announcements, but not significantly so.

Listen, I'm bullish U.S. equities. Very bullish in fact. I would not short this market. I simply don't short secular bull markets. When I grow cautious, I build cash. Then I use weakness as an opportunity to buy cheaper, so that's what I'd do if the market weakens after the Fed announcement on Wednesday. I'd find my favorite 5 or 10 stocks and I'd be buying them into weakness over the next 1-2 weeks. Or if you prefer trading ETFs, I'd be buying the aggressive sector ETFs - XLK, XLY, XLC, XLF, XLI - as they fall during any upcoming weakness.

I'm not a Registered Investment Advisor (RIA), so please don't construe any of this as advice. I'm not licensed to provide advice. Instead, I'm simply passing along information that I've learned over the years and you can feel free to use that information to develop your own strategy based on your own situation and financial objectives.

We do a lot of research at EarningsBeats.com and one way that we pass along our findings is via a free newsletter, our EB Digest. It's published 3x per week and it's completely free with no credit card required. If you'd like to join our fast-growing community, simply provide us your name and email address HERE.

Happy trading!

Tom