Catching an industry group as it bottoms and begins to lead the market can be very profitable. We're seeing tons of rotation in the stock market, which is the biggest reason why selling doesn't last long. Money comes out of one group and then rotates into another. Right now, oil equipment & services ($DJUSOI) is one of the strongest industry groups after rising 12-13% last week. But prior to that move, short-term momentum traders probably wouldn't have taken a second look at the group. Consolidation and selling, however, set up many of the best trading opportunities. Let's look at that hourly chart and try to learn from it:

I'm a fan of false breakdowns in an otherwise bullish market. Early on Wednesday, May 26th, the DJUSOI appeared to break below support, only to recover quickly back above that key support. As it turned out, that was the final low before we saw an explosion last week. Not every industry group will act like the DJUSOI last week, but hanging onto support and consolidating can lead to big rallies.

I have one group in mind that I believe could see huge gains ahead.

Clothing & Accessories ($DJUSCF)

Let's first look at a long-term chart to gain perspective:

The DJUSCF surged in April and has since been selling/consolidating. As you can see below on its daily chart, every selloff of roughly 3-5% (or more) has produced excellent trading opportunities in this space. Check out this daily chart:

Every setup is different and there is certainly no guarantee of a successful rebound here. I do like the increasing likelihood of a reversal based on past history, however.

As a last look at the DJUSCF, let's pull up the hourly chart, the same chart I started this article with when looking at the DJUSOI:

We've seen a test of both absolute and relative price support. Clearly, if this group breaks down, you'll want to be careful. Keep in mind that this industry did not perform well during the period leading up to those hyped-up CPI/PPI reports. We could see similar behavior. If consumer discretionary holds up reasonably well, though, the DJUSCF could be primed to benefit. Another trip to the low-380s on the index could set up individual stock trades in this group quite well.

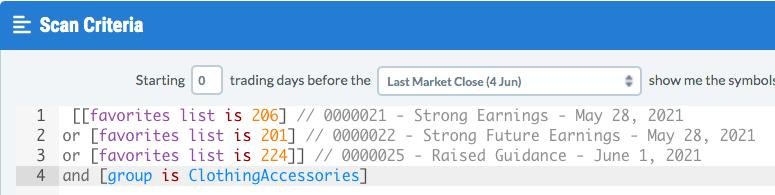

Scanning for individual stocks in this space on our various ChartLists at EarningsBeats.com, here's how simple the scan was, along with a dozen or so returned that might be worth considering:

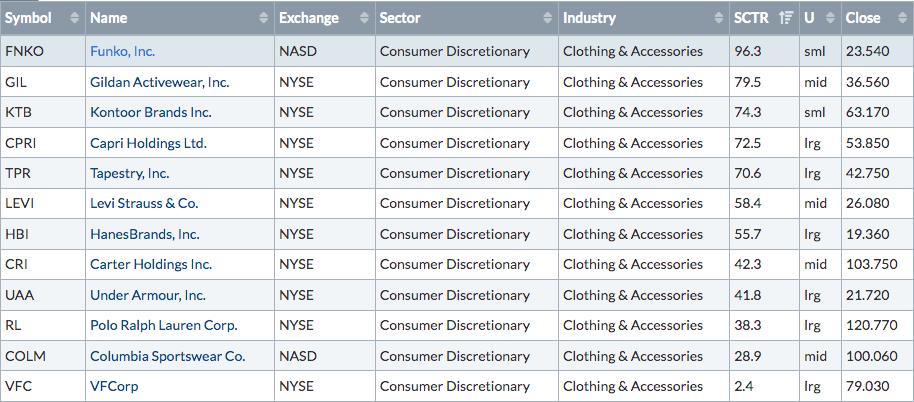

.....and the results:

Here is one chart from the above list that I believe sets up as a nice reward to risk trade, especially if the group rebounds:

LEVI:

LEVI is now close to price, trendline, and relative support simultaneously. It's been a leader in the DJUSCF for the past nine months and its price/volume combination has been quite bullish. I believe it's simply been the weakness in the industry that's held the stock back. A reversal could light a fire under LEVI. I'd view the current range to be 25 to 31.

The biggest risk short-term to the stock market is the inflation data that will be released on Thursday, June 10th (CPI) and Tuesday, June 15th (PPI). We saw a very steep 4% drop in the S&P 500 from its May 7th close to its May 12th close - just before and after these April inflation reports were released. It's important to know which areas you want to avoid this week in the event a similar reaction occurs as the headline numbers will be quite shocking. I'll be discussing all of this during a very special event on Monday, June 7th at 4:30pm ET, "Preparing for Shocking Inflationary Data". Our entire EarningsBeats.com community is invited, free of charge. Instructions for attending will be mailed in our Monday EB Digest newsletter. If you're interested in attending and you're not already a free subscriber to our EB Digest newsletter, CLICK HERE, then scroll down and enter your name and email in the boxes provided. No credit card is required and you may unsubscribe at any time.

I hope to see you on Monday!

Happy trading!

Tom