When I speak to anyone about ETFs, the conversation nearly always revolves around performance. I'm not saying that performance isn't important. Ultimately, it's what we all look at. But I'm surprised that many ETF investors have no plan. They hear about this great ETF at the water cooler, buy it, and immediately believe they're diversified. As we end 2020 (finally!), I want to challenge you as you begin to think about your 2021 financial future and beyond.

Know what you own.

That should be rather obvious. I mean, who's going to put many thousands of dollars to work, perhaps hundreds of thousands of dollars to work, and not know what they own? Unfortunately, more than you might think.

The Checklist

In approaching ETF investing in 2021, go through this checklist:

(1) What is your primary goal - just to make money or to beat a benchmark?

(2) If it's the latter, which I certainly hope it is, which benchmark?

(3) What's your process for selecting ETFs?

(4) Do you know what your ETFs own? Which stocks? Their sector allocations?

(5) How often do you re-evaluate your ETF portfolio?

I could add a few more questions to this list, but the above represents 5 really important questions.

Our ETF service at EarningsBeats.com officially "kicks off" on January 1, 2021. Our theme is quite simple - know what you own. We have already started our Model ETF Portfolio, which is nearly 4 percentage points ahead of our benchmark - the S&P 500 - after just two months, in order to give our EarningsBeats.com members an opportunity to understand our ETF strategy and approach. Maintaining a level of HUGE outperformance with ETFs will be difficult because of diversification. ETFs typically own dozens, if not hundreds, of individual stocks, so lining a portfolio with multiple ETFs will automatically provide significant diversification. This is appealing to some, not so appealing to others. Warren Buffett famously said, "diversification is a protection against ignorance" and added "it makes little sense for those who know what they're doing". Mr. Buffett, considered by many to be the most successful investor of all time, has invested 40% of his entire portfolio in one stock before.

I believe that diversification is a killer, which is why I favor individual stocks in a portfolio - stocks that I can hand-pick from a list of thousands of candidates. ETFs are more difficult, because the stocks have already been picked for you. Many investors, however, feel "safer" owning ETFs and I understand that even if I don't agree with it. The good news, though, is that you can still structure an ETF portfolio that's positioned to beat the S&P 500. That's what we'll help you do at EarningsBeats.com.

Understanding Secular Bull Markets

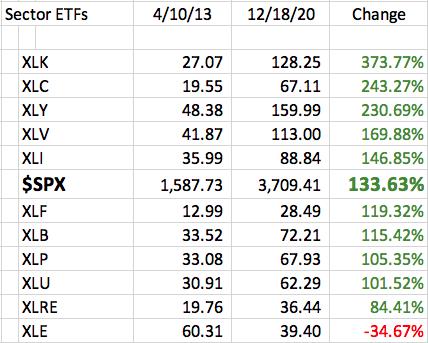

If setting new all-time highs in the midst of a pandemic doesn't underscore the type of bull market we have, I don't really know what to tell you. The stock market is going higher. I believe 2021 will be a HUGE year for the bulls because of the pent up demand from 2020 restrictions and lockdowns. The Fed has already upped GDP for 2021 and I suspect this will be the first of many upward revisions to GDP. When the S&P 500 cleared its 2000 and 2007 highs on April 10th, 2013, the secular bull market began. These "long-term" bull markets have a history of lasting up to two decades, with meaningful corrections and cyclical bear markets along the way, of course. The aggressive sectors tend to perform much, much better during these long-term advances. Here is the performance of every sector ETF since the dawning of the current secular bull market on April 10th, 2013, and through Friday's close:

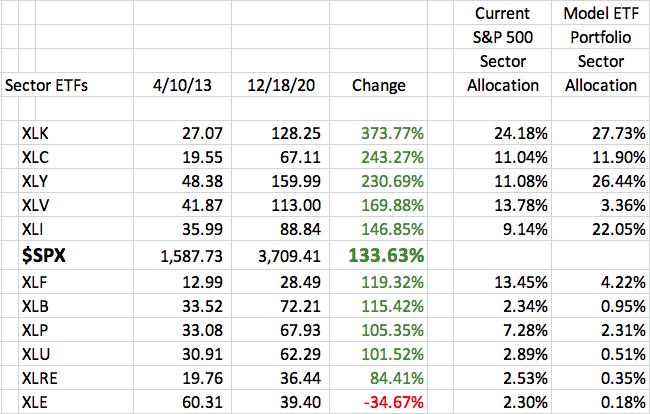

I think it's pretty clear that the aggressive sectors (XLK, XLY, XLC, XLI, and XLF) tend to outperform during a secular bull market. Next, I'm going to add two columns to this analysis. The first column will represent the current sector allocation of the benchmark S&P 500. The second will represent the sector allocation of our Model ETF Portfolio:

Note the over-weighting of the XLK (technology), XLY (consumer discretionary), and XLY (industrials) in the Model ETF Portfolio. This is deliberate. If we want to beat the S&P 500, then we need top performing ETFs that allocate to sectors in a way that takes advantage of the secular bull market and the outperformance of the aggressive sectors. We plan to modify our Model ETF Portfolio every 90 days based on current market conditions, keeping the secular bull market thesis in mind.

If you're not currently a member at EarningsBeats.com and would like to view our current Model ETF Portfolio holdings, I'd be happy to send you a link. My email address is "tom@earningsbeats.com". Write "Model ETF Portfolio" in the subject line. If you're an Extra or Pro member at StockCharts.com, you'll be able to download this ChartList right into your StockCharts.com account.

Also, I'd love to have you join our EarningsBeats.com community. We offer a FREE EB Digest newsletter that's published 3x per week on Mondays, Wednesdays, and Fridays. There's no credit card required and you may unsubscribe at any time. CLICK HERE to enter your name and email address.

Happy trading!

Tom