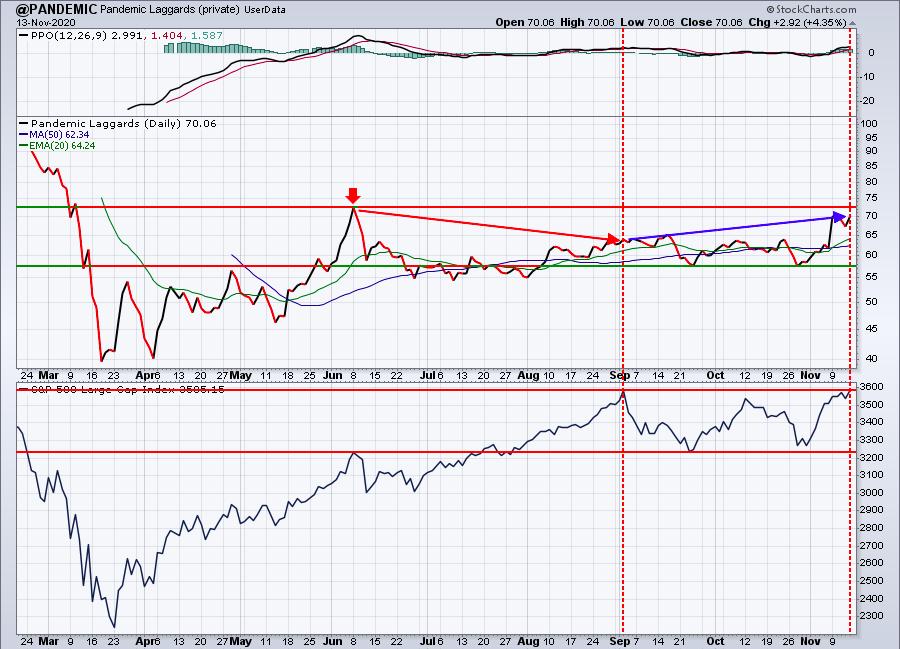

Ever since the worst industry groups in March and April revealed themselves, I've been tracking what I refer to as my Pandemic Index. It's an equal-weighted index of the 10 worst performing industry groups during the pandemic's first few months. A key resistance level for this index was established at the June 8th high and we're rapidly approaching that watermark now:

If you look from that June 8th high through the early-September high, you'll see that the Pandemic Index underperformed. It was falling while the S&P 500 was rising. But it's been a different story since that September high. The Pandemic Index has become a relative leader. The real relative strength, however, has really occurred over the past two weeks - since the late-October low. I still want to see the Pandemic Index clear the June high, but I believe that will happen in time. In fact, 3 of the 10 industry groups included in the Pandemic Index have already cleared their June 8th high. I'll provide one of them below:

Dow Jones U.S. Hotels Index ($DJUSLG)

The key here for me is the relative breakout. Hotels are now trading at an 8 month relative high and breaking out. That's a good combination. Finding a leader in this industry group is the next step.

I'll be discussing this group and many others in what I believe will be one of the most important webinars in EarningsBeats.com history. It starts later today at 4:30pm ET and is for EB members only. It's actually the first of three very important members-only webinars this week. For more information, CLICK HERE.

Happy trading!

Tom