Back on April 1st, in the midst of the COVID-19 pandemic, the initial episode of The Pitch was aired on StockCharts TV. Grayson Roze, VP of Operations here at StockCharts.com, Mary Ellen McGonagle, President of MEM Research, and I joined host David Keller and provided our Top 5 stocks for the "Stay at Home" theme. They turned out to be quite fortuitous. Here were our picks and the average return from that date through Friday, October 9th:

Grayson - TEAM, FIVN, MSFT, AMZN, SHOP. Average return: +79.27%

Mary Ellen - NET, MSFT, RNG, CHWY, NVDA. Average return: +68.59%

Tom - PTON, REGN, ZM, AMZN, SHOP. Average return: +139.95%

Performance relative to the S&P 500 is what really matters, so it should be pointed out that the S&P 500 rose 34.53% over the same period. As you can see from the returns above, we all crushed the benchmark, which is always my goal. A good analogy might be golf, where professionals are trying to go as low as possible vs. par. They want to beat par (and all of their competition, of course). If pro golfers keep shooting scores above par, they'll be out of a job soon. I feel the same about stock picking, although this doesn't seem to be a criteria on CNBC as they parade guest after guest with awful track records.

If once wasn't enough, Grayson and I decided to take on the same challenge on June 8th when he joined me for our EarningsBeats.com webinar, "Integrating StockCharts.com's Features and Tools Into A Successful Trading Plan". We each provided 5 stocks at that time and here are the stocks and average returns:

Grayson - AVLR, MDB, NOW, SMAR, VEEV. Average return: +37.71%

Tom - LVGO, ENPH, PYPL, LIVX, DOCU. Average return: +69.68%

S&P 500: Return: +18.68%

There's one common thread to the work that Grayson, Mary Ellen and I do. We all seek momentum and leadership and I believe the results speak volumes. We gave our selections in real-time. Trust me, it's not easy to outperform the benchmark index. Most fund managers don't do it. Here was a headline from 2019 in a Trader Talk column on cnbc.com:

They shouldn't be on the PGA Tour of investing. StockCharts.com is your best resource for advancing your financial future. My fellow contributors here do not continue to tout losing stocks. I'm speaking for myself and perhaps for others on StockCharts, but I am not a fan of diversification AT ALL. I believe you are knowingly putting your money to work in stocks that are not performing well. And trust me, I'm putting it mildly. Do you think the S&P 500 (SPY is the ETF that tracks the index) is a great place to park your money? Here are the 6 month returns of the bottom 20 stocks in the S&P 500:

81 stocks in the S&P 500 have lost money over the past 6 months, while the S&P 500's chart looks like this:

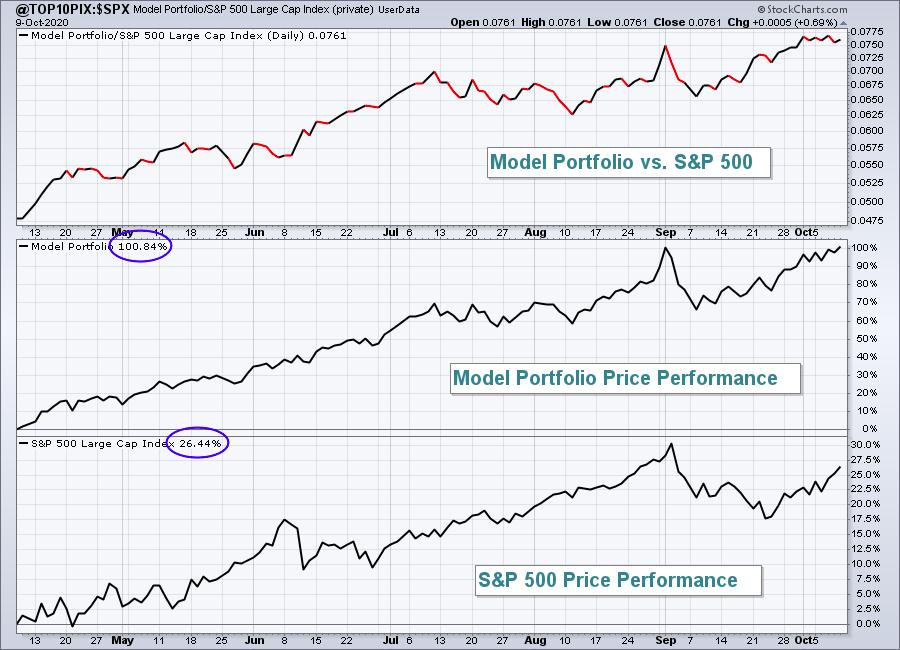

In the meantime, our Model Portfolio at EarningsBeats.com contains ONLY those stocks that are leading stocks. Wall Street is favoring these companies, so they're companies we want to own. Check out our performance over the past six months in our Model Portfolio vs. the S&P 500:

Sticking with leaders pays off. Our Model Portfolio has doubled (!!!!) during the pandemic rally, while the S&P 500 has gained 26%. Imagine your S&P 500 performance if you didn't own those 81 stocks that lost money during one of the biggest rallies in U.S. stock market history.

But here's the good news!

Grayson Roze is joining me again this morning, Saturday, October 10th, for an education-oriented 2 hour webinar, "The Power of StockCharts tools with EarningsBeats Research Engine". It's 100% free and we'd love to have you join us. In addition to an overview of StockCharts new Advanced Charting Platform (ACP), Grayson and I will unveil our next Top 5 stocks. We'll see if we can do a "3-peat"!

If you'd like to join us, simply click on the room link below. The room will open at 10:30am ET and the webinar will begin promptly at 11:00am ET. Those joining the webinar that are not already FREE EB Digest subscribers (published 3x per week) will be added to our newsletter and community. There is no credit card required and you may unsubscribe at any time. Here's the link!

https://us02web.zoom.us/j/87945264831

Happy trading!

Tom