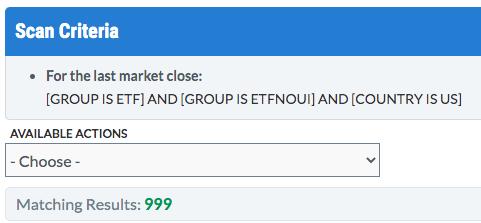

Selecting and investing in ETFs is a daunting task. I ran a very basic scan to identify all of the ETFs to consider and this is what was returned:

There were 999 ETFs returned. That's helpful. NOT! The 999 ETFs returned were listed in alphabetical order by ticker symbol and the 999th ETF listed was still in the I's. In other words, 999 ETFs is just scratching the surface. I don't know how many there are, but it's accurate to say it's in the thousands.

There were 999 ETFs returned. That's helpful. NOT! The 999 ETFs returned were listed in alphabetical order by ticker symbol and the 999th ETF listed was still in the I's. In other words, 999 ETFs is just scratching the surface. I don't know how many there are, but it's accurate to say it's in the thousands.

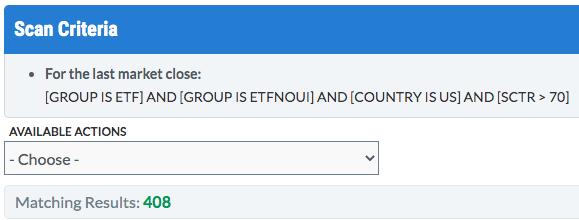

So my next step with the scan engine was to ignore leveraged ETFs and foreign ETFs. Surely, that would bring the number down to a more reasonable level. And the result........

Hhhhmmmm. The good news is that the 999th ETF was now in the R's. We clearly need to further filter this list. At EarningsBeats.com, relative strength plays a vital role in selecting individual stocks. StockCharts.com provides SCTR scores for ETFs to evaluate relative strength, so adding a filter for ETFs that are in the top 30% of SCTR (SCTR > 70) scores might make sense. And the result.....

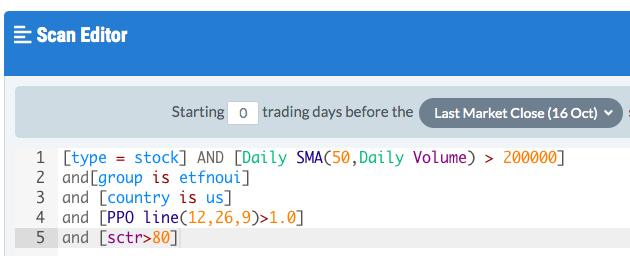

I am now going to skip to the scan syntax that I used in coming up with our first-ever Strong ETF ChartList, which will be provided to EarningsBeats.com members on Monday.

That returned 59 ETFs, a much more manageable number. I believe this is a solid starting point in figuring out a strong ETF portfolio. I have my own approach as to how I'd set up an ETF portfolio as I'm a fan of leading stocks in leading industry groups. No matter what your criteria, just keep one thing in mind with ETF investing always:

Know what you own.

Review the top holdings. Evaluate those charts. Watch for changes to the composition within the ETFs you hold. That's what we plan to do for our members at EarningsBeats.com when we unveil our Strong ETF ChartList and our Model ETF Portfolio on Monday. The goal of the Model ETF Portfolio will be to beat the benchmark S&P 500. We'll plan to do it by reviewing the best ETFs and making sure that our sector weighting is designed in such a way to benefit from market strength and rotation.

If you'd like to receive a copy of our first Strong ETF ChartList and listen in as I announce the ETFs that we "draft" for our Model ETF Portfolio at 4:30pm ET on Monday, October 19th, please take us up on our fully-refundable $7 30-day trial offer. If you're more interested in ETFs than individual stocks, this webinar will be a perfect fit for you. CLICK HERE to get signed up!

Happy trading!

Tom