Trading success, to some degree, is simply understanding the laws of supply and demand. There is a finite supply of shares available to buy of every stock traded on the various public exchanges. When the demand to buy those shares exceeds the supply available, price rises. Many of those involved in the stock market don't understand the concept of shorting a company's stock. In essence, those who short are betting on a company's stock price to move lower. Shorts benefit when a company falters.

Here's an example. Let's say company ABC sells widgets and analysts have projected $xx in revenues and profits for a quarter. But the 800-lb gorilla in the industry decides to sell "advanced" widgets, which could render ABC's product much less valuable. If I believe the value of ABC's stock will suffer, I can make money by selling shares first, then buying those shares back later. It's simply the reverse order of how stock trading is normally done. We usually buy, hope for appreciation in a company's stock value, then sell at a profit. Shorting changes the logical order and you sell at a high price, then hopefully buy at a lower price. On a chart, let's look at Delta Airlines (DAL). At the start of this pandemic, around March 1st let's say, you believed airlines were likely to suffer for years from COVID-19, this is how shorting could have played out for you on DAL:

In this example, you saw the breakdown below prior price lows and as DAL attempted to recover back to price resistance, you shorted, or sold borrowed shares, at $49.00. For purposes of this illustration, I'll assume 100 shares were shorted for proceeds of $4,900. Over the course of the next two weeks, DAL fell precipitously and your timing couldn't have been better. You decided to buy, or cover your short position, at $20.00. That purchase cost you $2,000 (100 shares times $20 per share). You benefited by selling DAL at $49 and buying it back at $20 to the tune of $2,900. Congrats!

But wait.......how do I sell shares that I don't own? Ok, a couple more things before I get to that. In order to "short" stocks, you'll need a margin account. There are rules that must be followed if you intend to short. Protections are in place because, in theory, you have unlimited risk. When you buy a stock like DAL at $49 per share, your risk is limited. You can only lose $49 per share. It cannot go below zero. If you buy 100 shares at $49 and DAL goes bankrupt, the most you can lose is $4900. But when you short, your profit is limited, while your risk is unlimited! So back to that example. Let's say your timing was horrible. You shorted DAL when it was $20 and one week later it hit $35. At that point, you were losing $1500 on paper, assuming that you had shorted 100 shares (100 times $15 price increase per share). But what if DAL were to climb back to $50? Or what if a cure were suddenly announced for COVID-19 and airline stocks soared? Every dollar that DAL climbs, you lose $100. That's what's called a short squeeze, which is a very emotional trade to simply get the heck out of something that begins costing you a fortune on paper. Buying pressure mounts from both new investors and shorts that have no choice but to buy back their shares.

Shorting creates opportunities for longs because all stocks sold short must be bought back at some point. The stock has future guaranteed buyers, which is kinda cool when you own a stock that breaks out technically. The ensuing "short squeeze" forces those who are on the short side to scramble to buy those shares back and stop the bleeding. The combination of technical buyers and those covering shorts can send a stock surging higher! I'll give two examples in just a minute, but first let's get back to that earlier question.

How do you sell a stock that you don't own?

You borrow them. Now, from a practical matter, that doesn't mean you have to go door-to-door in your neighborhood looking for someone who owns DAL stock and ask to borrow it. The broker has plenty of clients that own DAL shares, so you can borrow those "anonymously". But like anything else, when you borrow something, you must return it.

Now let me show you how a short squeeze can send a stock scurrying higher. On December 20, 2019, I wrote an article in ChartWatchers titled, "Here's A Stock Breaking Out With 21% Of Its Float Short!". Here was the chart that I included that day, updated for action since then:

The only things I added to this chart were (1) the red-dotted vertical line, which helps to illustrate where TSLA's price action was at that time and (2) the green-shaded area that highlights the more than 100% surge over the next 5-6 weeks after my article. If you are shorting a stock like TSLA in late-December or early-January, your emotions will definitely get the best of you. How long are you going to hang onto a short position when the stock price continues to spiral higher? If you shorted 100 shares of TSLA, there were days when you were losing $3,000 or $4,000 or more. How much pain can you take before you finally throw in the towel and take your big loss? That's how knowing the "short % of float" (the number of shares held short divided by the number of shares available for trading in a company's stock) can aid you trading a stock long. When you see a big technical breakout and you know there are TONS of shorts (high short % of float), those are guaranteed buyers that can really escalate your gains.

I've discussed many times how much I love Peloton Interactive, Inc. (PTON). Before we look at the chart, I want you to see the short % of float in PTON shares per Yahoo Finance:

The "short ratio" tells us, given PTON's average daily volume, how many days' worth of buying could occur simply by shorts covering their positions. There are more than 17 million shares short on PTON and its average daily volume is around 8 million shares.

PTON was 1 of the 5 stocks that I provided on StockCharts TV's new show "The Pitch", which aired back on April 1, 2020. I loved it because their exercise products fit perfectly into the new "stay-at-home" paradigm shift, but I also knew there could be a MASSIVE short squeeze given so many traders betting against the stock. Here's PTON's chart:

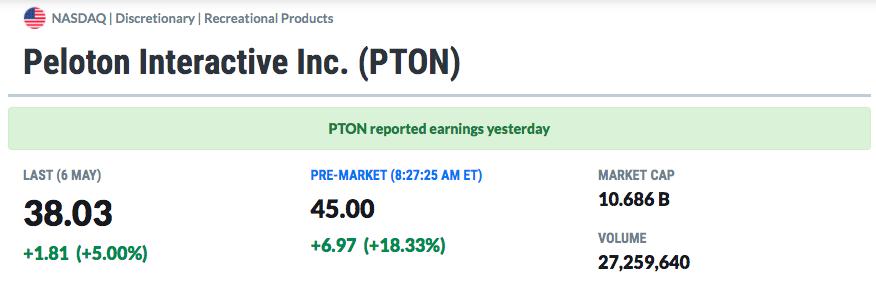

The very heavy volume and strong price action the past few days likely had some short sellers running for the exits. But that could pale in comparison to action today. PTON reported its quarterly results after the closing bell on Wednesday and its subscriber growth CRUSHED estimates. With nearly an hour to go before the opening bell, check out PTON's pre-market action:

It's up another 18% in pre-market action this morning. Now imagine having shorted a few hundred borrowed shares and trying to figure out what to do today. Many will decide to cover their short positions, sending the price higher. But you'll also have lots of holders of the stock taking profits after such a HUGE surge in price. Today promises to be extremely volatile for PTON, but both the technical and fundamental pictures have clearly improved for the company.

On Saturday, May 9th, at 2:00pm EST, EarningsBeats.com will be having another "WebinAR (WAR) Room" special. I'll be joined by Grayson Roze and Bill Shelby from StockCharts.com. They'll cover very important topics like organizing ChartLists, using ChartStyles and ChartStyle buttons (awesome shortcuts!), setting up powerful scans, using scans against ChartLists, etc. I'll also discuss opportunities created by short sellers. Do you know which technically-strong companies stand to benefit the most from potential short squeezes, like the examples I provided above, TSLA and PTON? I'll hand those to you on a silver platter.

Best of all, the event will be FREE!!! I'll be providing an update on this webinar Friday morning in our free newsletter, EB Digest. If you're not already a subscriber, it's simple. CLICK HERE and provide us your name and email address. We'll do the rest! VOILA!

Happy trading!

Tom