I wrote an article earlier this morning in the free EarningsBeats Digest newsletter that showed the Invesco S&P SmallCap Industrials ETF (PSCI) outperforming its larger cap counterpart industrials sector ETF (XLI) over the past few months, a change from what we'd grown accustomed to since August 2018. That leads to a direct question. Should the PSCI be bought or should individual stocks within that area be bought? It's probably more of an individual strategy question. Some traders simply prefer owning a basket of stocks (ETF) as opposed to risking capital on one or two individual names. The latter strategy provides much more upside potential, but the former would help to contain risks.

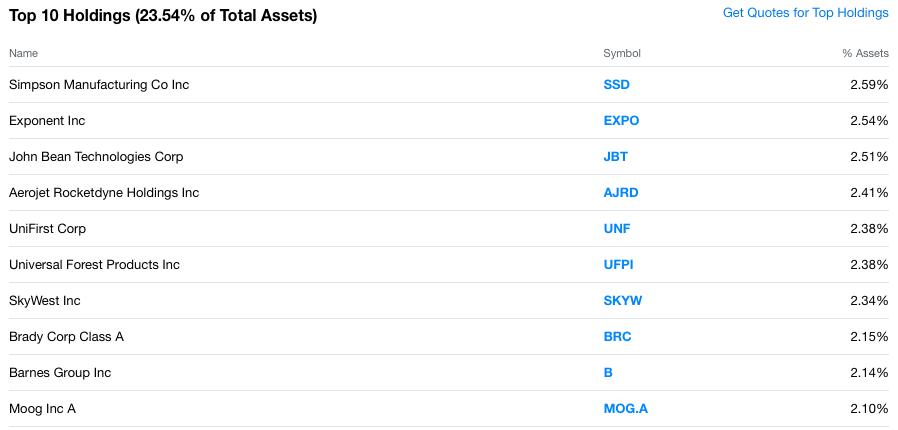

If the PSCI is truly beginning a new uptrend, the first step in identifying stocks leading the charge is to check out the top components in the ETF. Here they are as of :

Source: Yahoo Finance

This is a very diversified small cap portfolio. The largest-weighted stock is Simpson Manufacturing (SSD), which comprises only 2.59% of the entire portfolio. The top 10 largest holdings represent just 23.54% of the portfolio. Clearly, one or two poor performers won't have that big of an impact. But the flip side is that if SSD jumps 50% over the next year, the impact to the portfolio won't be that great either.

I reviewed the charts of those top 10 holdings and wanted to comment on a couple:

SSD:

SSD is a stock that I provided to EarningsBeats.com members as one likely to report solid earnings results. Check out the relative strength panels above as SSD was set to report earnings. The blue-dotted vertical line separates pre-earnings action and post-earnings action. SSD was being accumulated into the report, which is generally a good sign. There are no guarantees as management teams can be misleading sometimes. They may not tell Wall Street all truths ahead of an earnings report. I see that plenty of times. In my experience, when a company is trading strong into an earnings report and then delivers a revenue miss, earnings miss and lowered guidance, just take your lumps at the next day's opening bell and move on. Wall Street has little sympathy for such management teams. As a former practicing CPA, I don't blame them.

SSD remains a very strong stock, though overbought. Upcoming tests of the 20 day EMA would seem to be the best short-term entry level.

AJRD:

Defense stocks ($DJUSDN) have been very weak the past month or so and that's definitely been a drag on AJRD shares. But the stock gapped up from roughly 42.60 with its recent strong earnings report and, a little over a week ago, had another strong move with an intraday low near 42.00. So I'd consider that 42.00-42.60 range to be excellent support....until it's not.

My conclusion is that the "safer" play is to simply enjoy the PSCI small cap industrials ETF and sleep a little better knowing you own dozens of stocks within one investment. If you enjoy the Vegas casinos, however, SSD on a pullback and AJRD near key price and gap support make sense.

Should small cap strength persist into 2020, there'll be tremendous opportunities for my Model and Aggressive portfolios at EarningsBeats.com. Since its inception on November 19, 2018 (nearly one year ago), my Model portfolio has outperformed the S&P 500 by roughly 30 percentage points. The past 60 days has been a challenge, however, given the market's recent preference for value stocks over growth stocks. I'll discuss that thematic change, along with several potential portfolio stocks in a free "Top 10 Stocks Sneak Preview" on Monday, November 11th, after the closing bell at 4:30pm EST. This event will be open to our EarningsBeats.com community, including our free EB Digest subscribers. Make sure you SUBSCRIBE to this newsletter if you haven't already and we'll send you instructions on how to join the webinar on Monday!

Happy trading!

Tom