Stock market rotation occurs on a small level each and every day, but longer-term "big picture" themes emerge and it's critical for us to spot them early in their development in order to take advantage and ensure a much better chance of outperforming the major indices. I can already sense changes occurring as the S&P 500 has made its latest breakout to all-time highs. Transportation stocks ($TRAN), for one, have been scorching higher on the wheels of truckers ($DJUSTK). Railroads ($DJUSRR), which had taken a 4-5 month breather, also have regained strength and leadership.

But I'm going to focus this article (and my show this morning) on two other very important industrial areas to watch as they near breakouts:

Industrial Machinery ($DJUSFE)

Here's a 3 year chart. Pay close attention to how this group performed from late-2016 through early-2018 with a strengthening economy:

We've seen two years of basing with the 670-680 area marking very important overhead price resistance. A breakout here would require at least consideration for component stocks.

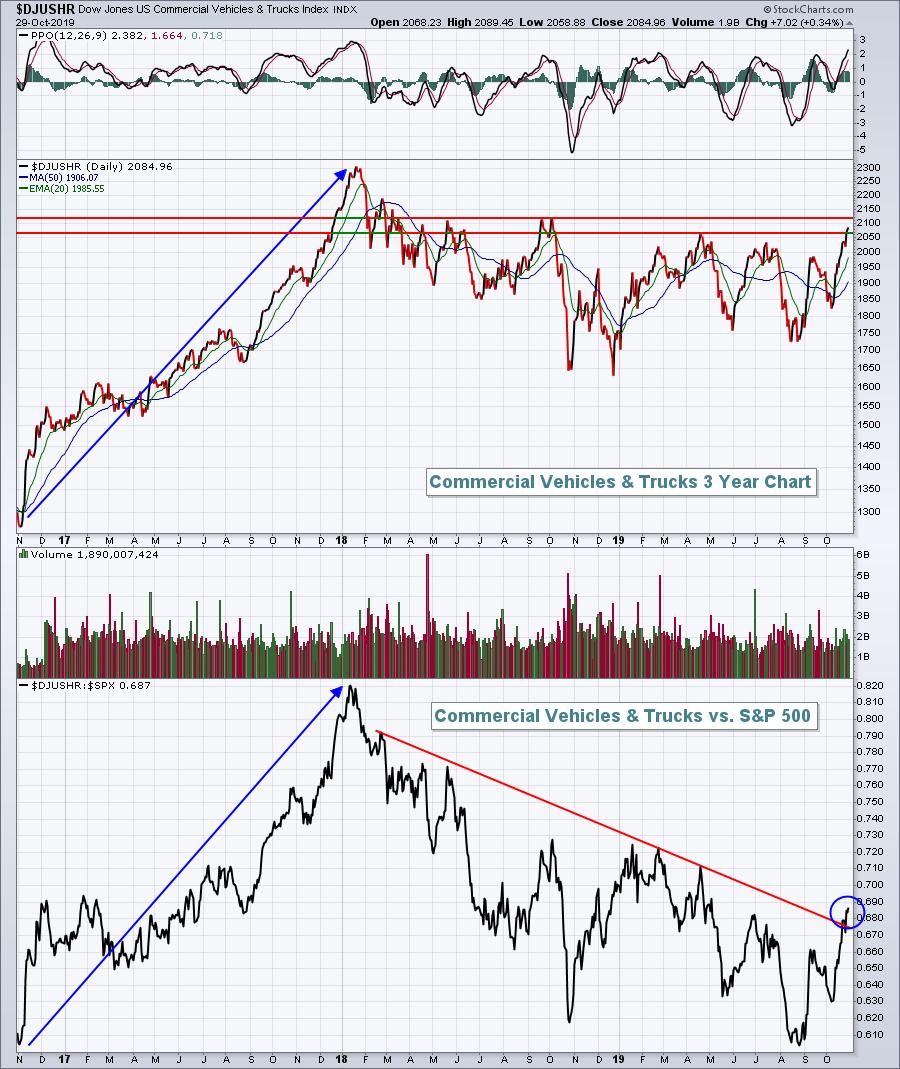

Commercial Vehicles & Trucks ($DJUSHR)

The DJUSHR is in a somewhat similar position:

Over the past two years, while the S&P 500 has moved little to the upside, the DJUSHR has consolidated with a slight downtrend in place, underperforming the benchmark S&P 500 rather steadily. But don't lose hope. In 2017, while the economy was strengthening and U.S. stocks were soaring, the DJUSHR was a primary leader on both an absolute and a relative basis.

I have one other VERY important (and extremely bullish) fact about these two groups that I'll be sharing during my Trading Places LIVE show that starts today at 9:00am EST. In addition, I'll break down the two groups, identifying the stocks that I'll be watching closest for signals to jump in.

If you'd like to join me, the room typically opens around 8:30am EST. Just click on the following link and I'll see you at 9:00am!

Happy trading!

Tom