Market Recap for Friday, May 17, 2019

Friday offered up a mixed bag. Our major indices were either higher or near the flat line with an hour left in the trading day. Then more discussion surfaced that US-China trade talks had stalled. That sent U.S. equities spiraling lower, especially areas that have been hit hard previously by trade talk failures like semiconductors ($DJUSSC, -1.88%). That group has seen a steady push lower for the last 3-4 months and it likely won't get any better this morning with U.S. futures pointing to a weak open:

The down channel on the DJUSSC is firmly established and should be respected. It seems to be setting us up for a test of the March low and lower channel line near 3200. The bulls will be hoping that level holds. While the DJUSSC can be extremely volatile, it's also typically a bullish catalyst during bull markets. Seeing a key group like that break below March lows would be a burden no doubt.

The down channel on the DJUSSC is firmly established and should be respected. It seems to be setting us up for a test of the March low and lower channel line near 3200. The bulls will be hoping that level holds. While the DJUSSC can be extremely volatile, it's also typically a bullish catalyst during bull markets. Seeing a key group like that break below March lows would be a burden no doubt.

The weak final hour on Friday resulted in all of our major indices finishing in negative territory. The Russell 2000 and NASDAQ lost 1.38% and 1.04%, respectively, leading to the downside, but the S&P 500 and Dow Jones also dropped 0.58% and 0.38%, respectively. Industrials (XLI, -1.11%) and energy (XLE, -1.01%) were the hardest hit sectors. Deere & Co (DE, -7.65%) posted underwhelming results and cited China weakness as a drag on its bottom line, only adding to the trade war fears and recent losses in the commercial vehicles & trucks industry ($DJUSHR, -3.55%). The absolute and relative weakness in this space has been obvious for quite awhile:

While the S&P 500 set a fresh all-time record high earlier in 2019, you can see that the DJUSHR was nowhere close to doing so. In fact, there's a clear downtrend in place on both an absolute and relative basis with the DJUSHR's relative strength approaching a multi-year low.

While the S&P 500 set a fresh all-time record high earlier in 2019, you can see that the DJUSHR was nowhere close to doing so. In fact, there's a clear downtrend in place on both an absolute and relative basis with the DJUSHR's relative strength approaching a multi-year low.

Pre-Market Action

Crude oil ($WTIC), gold ($GOLD) and treasury prices are all relatively flat this morning. U.S. equities wish they could say the same as stocks will be under pressure once again at the opening bell. With 30 minutes left to the opening bell, Dow Jones futures are lower by 170 points and the NASDAQ appears to be set to lose more on a percentage basis.

Asian markets were mixed overnight, but there's clear weakness in Europe with the German DAX ($DAX) down more than 200 points, or 1.65%.

Let's also keep in mind that the S&P 500's worst period of all calendar months runs from the 19th through the 25th. Today is May 20th. Also, Mondays are the worst calendar day of the week. Better opportunities lie ahead, it might not hurt to be a little cautious until later in the week.

Current Outlook

The S&P 500 printed a top in early May and now is in consolidation mode. The short-term price resistance to watch is the 2890-2900 range. A break above that level would likely lead to fresh all-time highs in my opinion. But....until we make that breakout, we need to consider possible continuation patterns forming on the 60 minute chart. As I pointed out on an hourly NASDAQ chart last week, I believe we could be watching an inverse head & shoulders pattern develop, one that would likely result in a bullish breakout:

A recognizable pattern does not need to print. We could continue to consolidate in a fairly wide range from 2790 to 2850. After all, the 2019 advance thus far has been powerful and basing for awhile wouldn't be bad technically. It could provide a launching pad for the bulls later in the year.

A recognizable pattern does not need to print. We could continue to consolidate in a fairly wide range from 2790 to 2850. After all, the 2019 advance thus far has been powerful and basing for awhile wouldn't be bad technically. It could provide a launching pad for the bulls later in the year.

Sector/Industry Watch

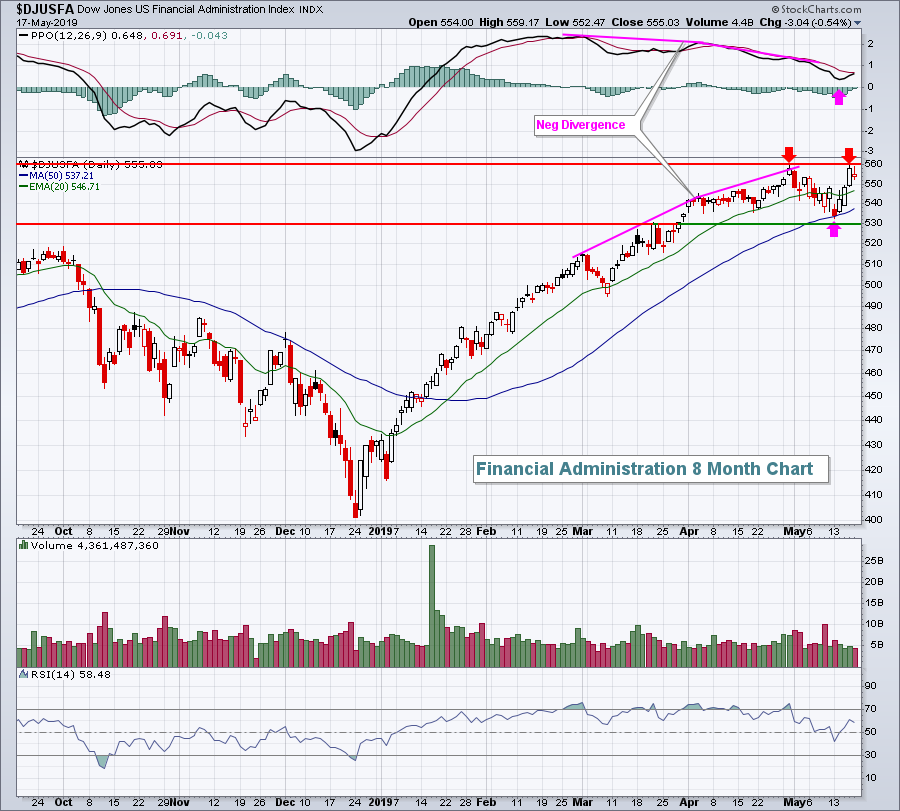

Below I provide historical reasons (see Historical Tendencies section) to consider taking profits in financial administration stocks ($DJUSFA, -0.54%). Technically, we could be at a level that suggests at least consolidation as well:

A persistent negative divergence had been in place since breaking out in March. We finally saw a 50 day SMA test and we nearly had a PPO reset at its centerline. On Thursday and Friday, the DJUSFA tested overhead price resistance at 560 and failed, setting up a possible period of consolidation. The late-March breakout above 530 has yet to be tested, although the 50 day SMA test was close to that level. Keep in mind that the rising 20 week EMA (not pictured above) is at 520. Bulls will likely be lined up at these levels to buy, so I'd use any short-term weakness as an entry opportunity for another push higher back to the 560 level.

A persistent negative divergence had been in place since breaking out in March. We finally saw a 50 day SMA test and we nearly had a PPO reset at its centerline. On Thursday and Friday, the DJUSFA tested overhead price resistance at 560 and failed, setting up a possible period of consolidation. The late-March breakout above 530 has yet to be tested, although the 50 day SMA test was close to that level. Keep in mind that the rising 20 week EMA (not pictured above) is at 520. Bulls will likely be lined up at these levels to buy, so I'd use any short-term weakness as an entry opportunity for another push higher back to the 560 level.

Monday Setups

Timken Co (TKR) recently posted excellent quarterly results and was humming along and testing all-time highs set in early 2018....and then the bottom dropped out in the industrial machinery group ($DJUSFE). TKR fell in sympathy, but on Friday closed at its 50 day SMA. While further weakness in the group could result in a test of key price support close to 44, I believe a bounce is right around the corner for TKR:

The 10% drop is likely a solid opportunity for short-term entry. I expect to see 52 again in the near-term, setting up a nice reward to risk entry, especially if two entries are considered - one at the current price and a second entry closer to 44. I'd keep a stop beneath the gap support just above 43.50. If you like giving a bit more room, then consider the multiple lows that held 41. A close below 41 would clearly be a bearish development for the stock.

The 10% drop is likely a solid opportunity for short-term entry. I expect to see 52 again in the near-term, setting up a nice reward to risk entry, especially if two entries are considered - one at the current price and a second entry closer to 44. I'd keep a stop beneath the gap support just above 43.50. If you like giving a bit more room, then consider the multiple lows that held 41. A close below 41 would clearly be a bearish development for the stock.

Historical Tendencies

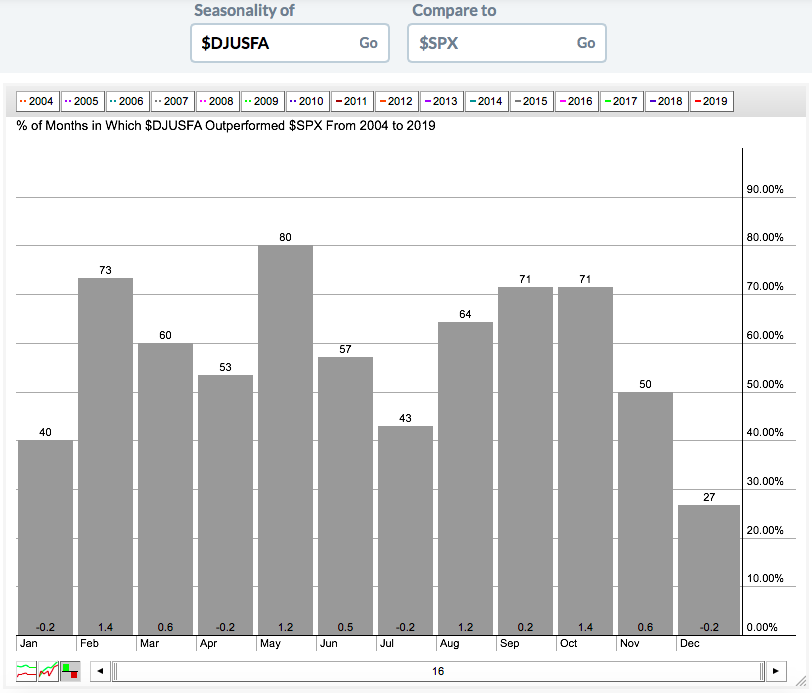

Financial administration ($DJUSFA) has been a very strong area of the market, but one of it's best calendar months for relative performance is quickly coming to an end:

The group has outperformed the benchmark S&P 500 80% of Mays over the last 16 years. May 2019 has been no exception. Perhaps we'll see a bit of "relative" profit taking over the summer months.

The group has outperformed the benchmark S&P 500 80% of Mays over the last 16 years. May 2019 has been no exception. Perhaps we'll see a bit of "relative" profit taking over the summer months.

Key Earnings Reports

(reports after close, estimate provided):

NDSN: 1.59

Key Economic Reports

None

Happy trading!

Tom