Market Recap for Thursday, January 10, 2019

There was both good and bad action on Thursday. Yes, the bulls should be excited as a short-term price and trendline breakdown did not result in panic or a Volatility Index ($VIX) that surged. Also, all of our major indices remained above their ascending 20 day EMAs. So long as that continues, a tradable uptrend remains in play. By the close, the Dow Jones, S&P 500, NASDAQ and Russell 2000 all finished higher, gaining 0.51%, 0.45%, 0.46%, and 0.42%, respectively. Considering that each started the day 0.75%-1.00% lower and several retailers either warned or reported disappointing holiday sales, it was a clear victory for the bulls as it demonstrated resiliency, something that's been missing for months on Wall Street.

Now for the bad news.

Only 1 of the 5 top sectors were aggressive sectors. Industrials (XLI, +1.36%) had a solid session. Otherwise, it's difficult to feel much comfort in the leaders - real estate (XLRE, +1.59%), utilities (XLU, +1.31%), materials (XLB, +0.88%), and consumer staples (XLP, +0.59%). Consumer discretionary (XLY, -0.29%) was held back by many areas of retail, including clothing & accessories ($DJUSCF, -2.26%), apparel retailers ($DJUSRA, -1.23%), and broadline retailers ($DJUSRB, -0.46%), the latter of which includes Macy's (M, -17.69%), crushed on its 2019 warning.

Defensive sector leadership is typically synonymous with market weakness. That was certainly the case in Q4 2018 as you can see below:

The rally over the past two weeks has been characterized by money rotating away from defensive sectors as the relative ratios for each topped in December and have been moving lower. Yesterday's action, however, managed to hold December relative support. It's difficult to get overly excited by the S&P 500 clearing initial price resistance at 2581 when the groups leading the rally are defensive.

The rally over the past two weeks has been characterized by money rotating away from defensive sectors as the relative ratios for each topped in December and have been moving lower. Yesterday's action, however, managed to hold December relative support. It's difficult to get overly excited by the S&P 500 clearing initial price resistance at 2581 when the groups leading the rally are defensive.

My takeaway from yesterday's action: The bulls showed resiliency, a very important aspect of a bull market, but lacked conviction in terms of what they were buying. That will need to change if the S&P 500 is going to clear its declining 20 week EMA.

Pre-Market Action

The 10 year treasury yield ($TNX) is down 3 basis points this morning to 2.70%, continuation of the rotation to safety that we saw on Thursday - not a great sign. Gold ($GOLD) is up fractionally, while crude oil ($WTIC) is down fractionally. Asian markets were mostly higher overnight, but European markets are currently down across-the-board this morning. There's lots of mixed action.

Dow Jones futures are pointing to another test of the bulls' mettle as they're lower by 73 points as another trading day approaches.

Current Outlook

For me, calling bottoms has always been much easier than calling tops. That's probably why I generally have a bullish bias over the long-term. Still, there are key intermarket relationships that we always need to stay on top of and one of them is the constant rotation between bonds and stocks. What's good for bonds is generally bad for stocks and vice versa, so their prices will normally move inversely. But bond prices and yields move inversely to one another also. Therefore, one relationship to watch is the S&P 500 and the 10 year treasury yield ($TNX), which typically move in the same direction.

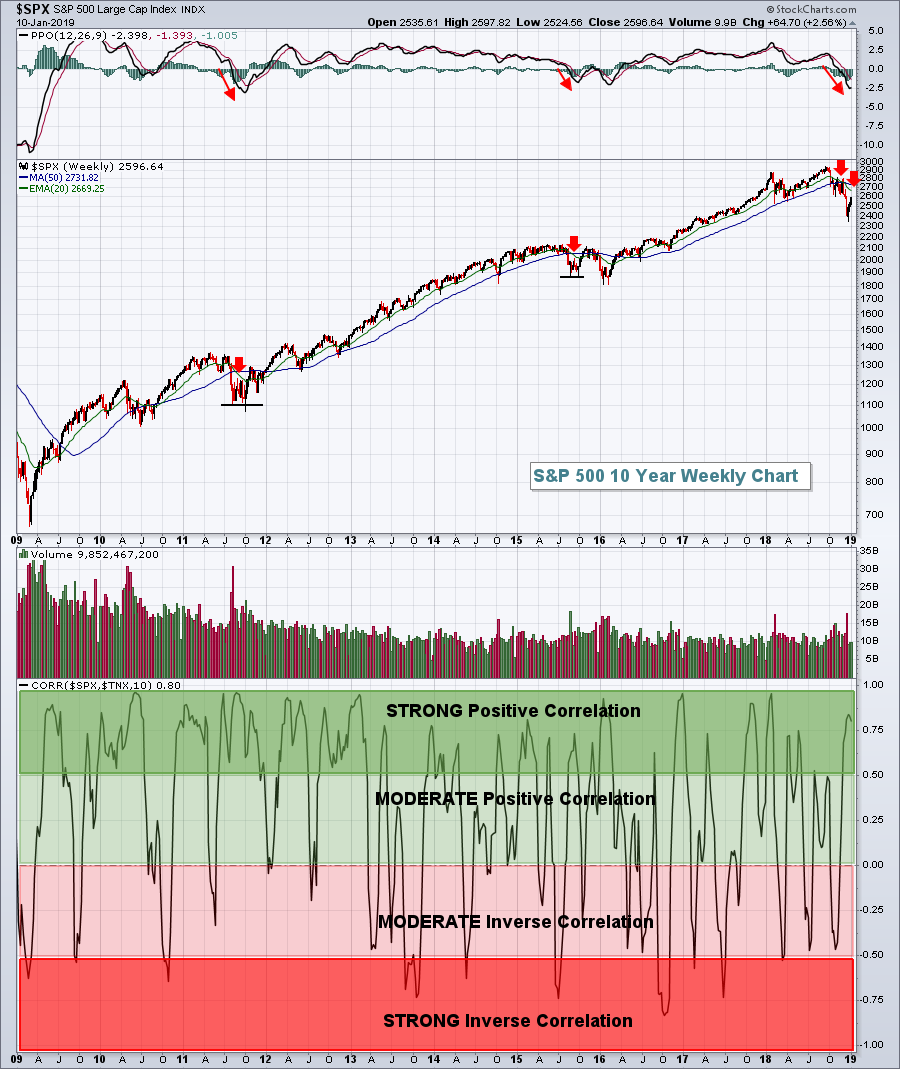

Here's a long-term chart that illustrates this positive correlation:

The color coding simply highlights the degree of correlation. One quick glance at the strong positive correlation and strong inverse correlation areas essentially tells us all we need to know. The S&P 500 and TNX are typically moving together. From my experience over the years, when these two diverge, I tend to believe the bond market signals. Currently, the TNX appears to be rolling over under its 20 day EMA. So while the S&P 500 has broken above its 20 day EMA, I'd be very cautious if it loses this key short-term moving average.

The color coding simply highlights the degree of correlation. One quick glance at the strong positive correlation and strong inverse correlation areas essentially tells us all we need to know. The S&P 500 and TNX are typically moving together. From my experience over the years, when these two diverge, I tend to believe the bond market signals. Currently, the TNX appears to be rolling over under its 20 day EMA. So while the S&P 500 has broken above its 20 day EMA, I'd be very cautious if it loses this key short-term moving average.

Also, on the above chart, I've shown the key PPO centerline breakdowns with red directional lines. In both 2011 and 2015, the initial rally attempt failed prior to clearing the declining 20 week EMA and, in both cases, printed double bottoms. I'm still expecting to see a short-term top on the S&P 500, followed by a move lower to retest the December low just beneath 2350. I'll re-evaluate the market at that point, assuming we see that impending drop.

Sector/Industry Watch

Full line insurers ($DJUSIF) had a positive divergence that printed on their December low and have now completely "reset" their PPO at centerline resistance. The DJUSIF also has reached its price resistance zone and could go either way from here:

The blue arrows highlight what I look for after a positive divergence prints - a 50 day SMA test and/or a PPO centerline test.

The blue arrows highlight what I look for after a positive divergence prints - a 50 day SMA test and/or a PPO centerline test.

Historical Tendencies

American Int'l Group (AIG) has been the worst performer on the S&P 500 over the past two decades during the months of January and February. Its average monthly returns for January and February are -4.7% and -5.1%, respectively.

Key Earnings Reports

(actual vs. estimate):

INFY: .14 vs .13

Key Economic Reports

December CPI released at 8:30am EST: -0.1% (actual) vs. -0.1% (estimate)

December Core CPI released at 8:30am EST: +0.2% (actual) vs. +0.2% (estimate)

Want to stay on top of what REALLY matters? You won't hear it on CNBC. Subscribe to my blog and have my daily Trading Places articles delivered to you every morning the stock market is open. Simply scroll down and provide your email address in the box provided and click the green "Subscribe" button. It's 100% FREE! Thanks for your support!

Happy trading!

Tom