Market Recap for Friday, December 28, 2018

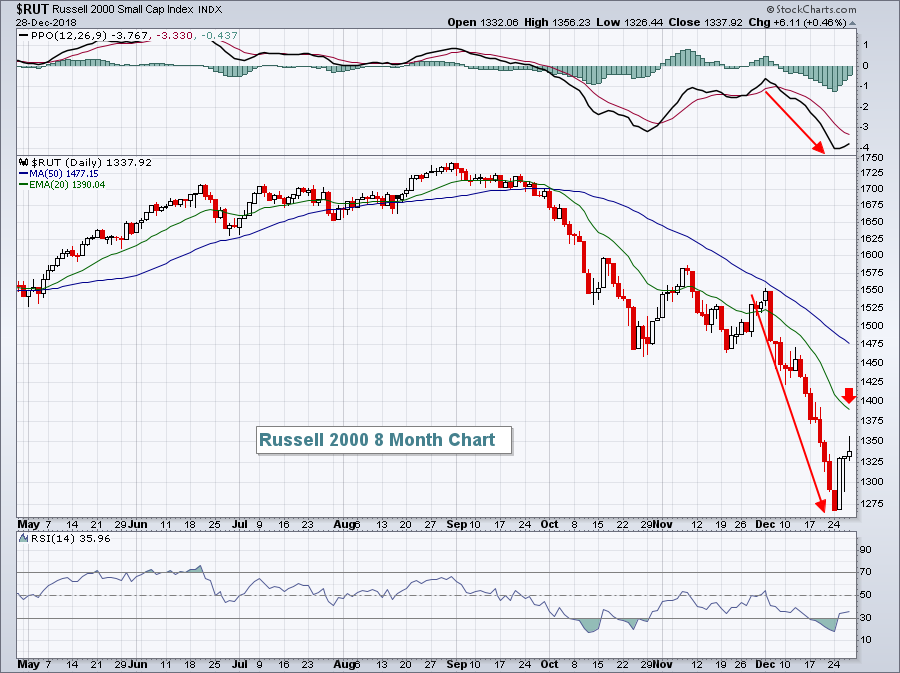

Let's start with the bright spots from Friday's market action. The more aggressive NASDAQ and Russell 2000 ended the session in positive territory, gaining 0.08% and 0.46%, respectively. They both closed higher for the third consecutive day after a drubbing throughout December. As a result, the month-to-date losses have shrunk, but they haven't changed the 2019 outlook much. Most market participants consider a 20% drop to be a "bear market". The small cap Russell 2000 nearly dropped 20% in December alone, prior to last week's winning streak. It's still down more than 13% for the month, which is extremely unusual for the Russell 2000. Prior to 2018, the Russell 2000 had advanced during Decembers in 26 of the last 31 years. December has been a "safe month" for small caps. But we know that historical tendencies are just that - tendencies. They never provide us a guarantee of future performance and this year's December performance underscores that fact. The Russell 2000 is very weak technically and still has much to overcome as we begin 2019:

Obviously, anything can happen, but technical analysis provides us probabilities. I believe the Russell 2000 will struggle with its overhead declining 20 day EMA.

Obviously, anything can happen, but technical analysis provides us probabilities. I believe the Russell 2000 will struggle with its overhead declining 20 day EMA.

The big problem with Friday's bifurcated action (the Dow Jones and S&P 500 both finished with fractional losses) was the final hour selling when the S&P 500 lost 1.7% to give up all of its gains. It also didn't help that defensive groups were all over the top of the sector leaderboard as real estate (XLRE, +0.36%) and utilities (XLU, +0.25%) were fan favorites. Money was rotating back towards safety on Friday and that was further driven home by the treasury market as the 10 year treasury yield ($TNX) fell below 2.74% at Friday's close, its lowest level since the beginning of April.

Pre-Market Action

Crude oil ($WTIC) is up 1.68% this morning to just above $46 per barrel, but the 10 year treasury yield continues to hover around 2.74%. If the stock market is to sustain its recent trend higher, it'll likely need to see the TNX jump so that money rotation supports that move higher. Asian markets were mixed overnight and Europe is as well.

The Dow Jones is set for a nice open as futures are higher by 202 points with 30 minutes left to the opening bell.

Current Outlook

During bull market rallies, it's typical to see the aggressive technology sector (XLK) outperform the S&P 500. It's a signal of "risk on", where traders are willing to take additional risks in order to generate higher returns. In a bear market, this flips to a "risk off" mode as traders want less exposure to riskier, high-growth areas of the stock market. The following chart illustrates what this "risk on" vs. "risk off" looks like:

The red circles above really highlight the change of character that's taken place in the U.S. stock market in Q4. The black circle at the bottom highlights the "rate of change" of this ratio, which began slowing in Q3 and turned decidedly negative in Q4. I don't think there's any question that traders have moved into risk off mode. The question that remains is when will they return?

The red circles above really highlight the change of character that's taken place in the U.S. stock market in Q4. The black circle at the bottom highlights the "rate of change" of this ratio, which began slowing in Q3 and turned decidedly negative in Q4. I don't think there's any question that traders have moved into risk off mode. The question that remains is when will they return?

Sector/Industry Watch

Utilities (XLU) is the only sector that currently shows a trend of higher highs and higher lows. All sectors will trend lower during a bear market, so it's likely just a matter of time before utilities joins the other 10 sectors that have broken their previous short-term price low. Here's the chart:

Last week's performance was pretty solid in that aggressive sectors led the rally. Friday's performance, however, highlighted the fact that traders were cautious in terms of where they put their money. It's difficult to be bullish currently. There's definitely still room to the upside, but the further we bounce, the more risk there will be back to the downside.

Last week's performance was pretty solid in that aggressive sectors led the rally. Friday's performance, however, highlighted the fact that traders were cautious in terms of where they put their money. It's difficult to be bullish currently. There's definitely still room to the upside, but the further we bounce, the more risk there will be back to the downside.

Monday Setups

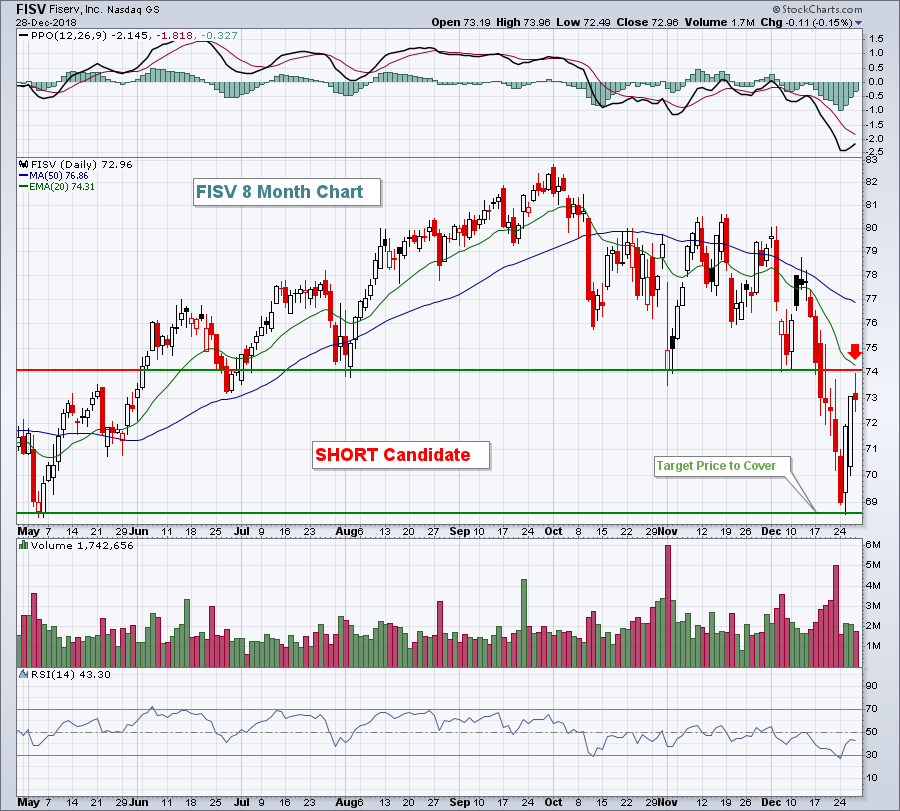

Fiserv, Inc. (FISV) looks like a solid reward to risk short setup. After posting dismal quarterly earnings results, I would expect to see FISV fail at its declining 20 day EMA. Volume trends have been quite bearish. A test of its 20 day, especially an intraday move above that level with a failure into the close, would be the best setup:

Shorting at or near price resistance and the declining 20 day EMA provides solid reward down to price support (5 bucks) with risk of perhaps $1.00 or $1.50 to the upside.

Shorting at or near price resistance and the declining 20 day EMA provides solid reward down to price support (5 bucks) with risk of perhaps $1.00 or $1.50 to the upside.

For all Monday setups this week (all short candidates), you can CLICK HERE.

Historical Tendencies

Here's a breakdown of the S&P 500's annualized performance during January since 1950:

January 2-6: +40.53%

January 7-13: -18.79%

January 14-18: +30.14%

January 19-20: -46.48%

January 21-31: +21.97%

Key Earnings Reports

None

Key Economic Reports

None

Happy trading!

Tom