Market Recap for Friday, September 7, 2018

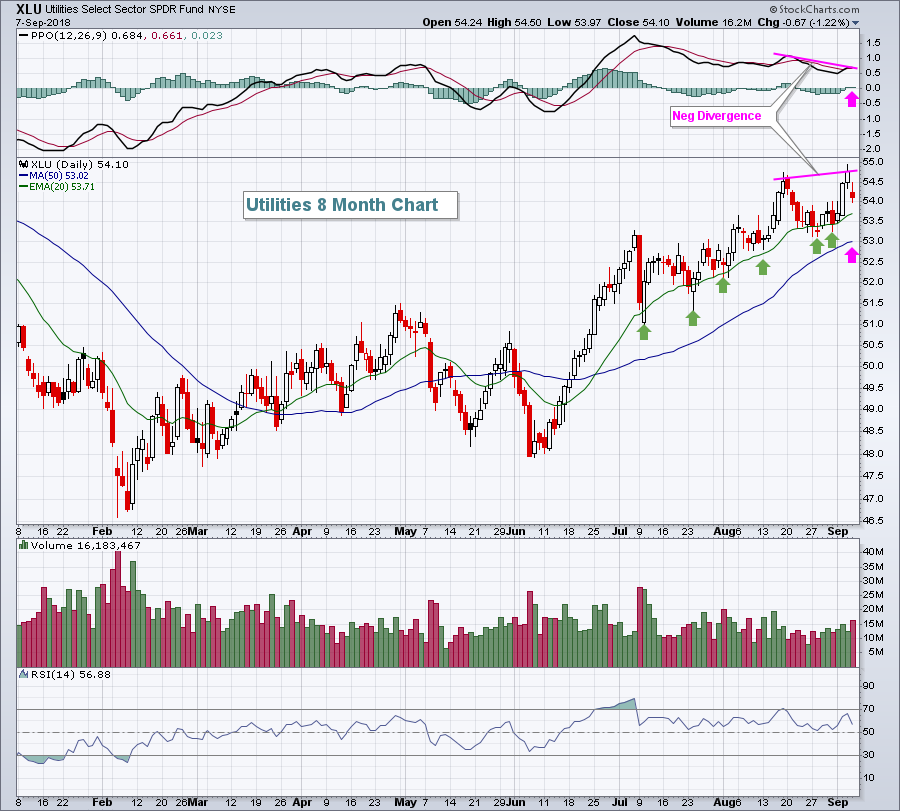

U.S. stock indices and most sectors were flat to slightly lower to close out last week. The small cap Russell 2000 was down just 0.08%, while the Dow Jones was the biggest loser, dropping 0.30%. Among sectors, utilities (XLU, -1.22%) was hit the hardest as the 10 year treasury yield ($TNX) surged six basis points to 2.94% after a solid August nonfarm payrolls report was released Friday morning. The XLU appears poised to undergo further selling or consolidation:

The XLU has spent the past several weeks mostly bouncing off 20 day EMA support (green arrows). But volume slowed on its most recent move higher and price momentum has clearly slowed (negative divergence). Many times after negative divergences print, we see a PPO "reset", the point at which the 12 day EMA and 26 day EMA equal one another, resulting in a PPO centerline test. Also coinciding with this period of selling/consolidation, we'll see a 50 day SMA test. These are both noted above with pink arrows.

The XLU has spent the past several weeks mostly bouncing off 20 day EMA support (green arrows). But volume slowed on its most recent move higher and price momentum has clearly slowed (negative divergence). Many times after negative divergences print, we see a PPO "reset", the point at which the 12 day EMA and 26 day EMA equal one another, resulting in a PPO centerline test. Also coinciding with this period of selling/consolidation, we'll see a 50 day SMA test. These are both noted above with pink arrows.

Another downside of that surge in treasury yields was the performance of home construction stocks ($DJUSHB), which fell 3.28% and closed at their lowest level of 2018:

I do believe we're getting closer to an intermediate-term bottom in home construction, but it's difficult to take the plunge there until that down channel is broken and the PPO turns positive.

I do believe we're getting closer to an intermediate-term bottom in home construction, but it's difficult to take the plunge there until that down channel is broken and the PPO turns positive.

Healthcare (XLV, +0.15%) was the best performing sector, but it's beginning to look a little short-term toppy. More on that in the Sector/Industry Watch section below.

Pre-Market Action

Asia was mostly lower overnight and Europe is mixed. As we start a new week, there are no significant economic or earnings reports due out today. So we'll trade mostly off technical conditions and signals, which should bode fairly well for U.S. stocks.

With roughly 15 minutes left to the opening bell, Dow Jones futures are higher by 91 points.

Current Outlook

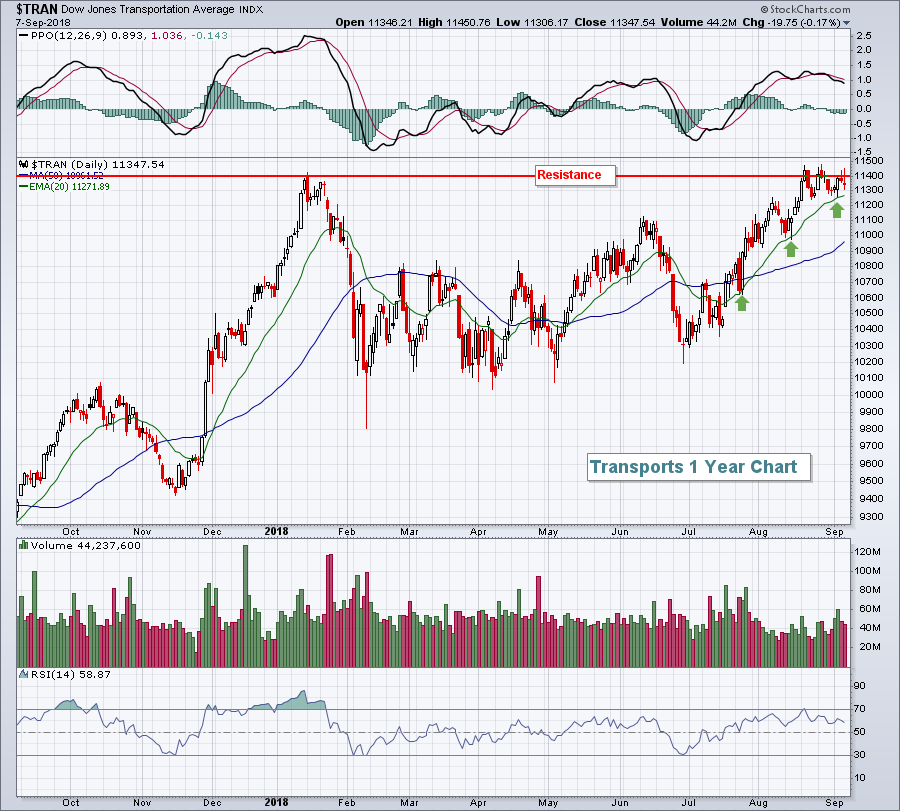

Performance of transportation stocks ($TRAN) is a proxy for the U.S. economy, so it's always a good idea to follow the strength of this group. Currently, the TRAN is challenging significant overhead price resistance as it attempts to break into record high territory:

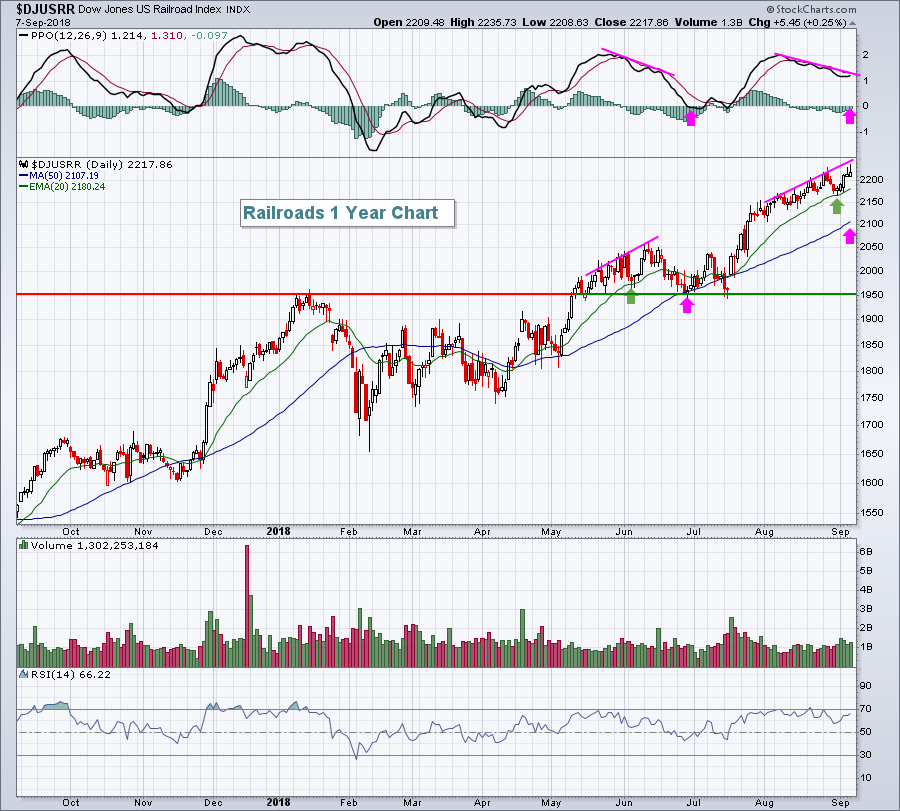

An eventual breakout here would be quite bullish for U.S. equities in general, but the key railroad industry ($DJUSRR) is looking a little vulnerable to short-term selling, similar to June:

An eventual breakout here would be quite bullish for U.S. equities in general, but the key railroad industry ($DJUSRR) is looking a little vulnerable to short-term selling, similar to June:

Slowing price momentum (negative divergence) was an issue back in June and it appears that it could be problematic once again. The pink arrows in late June marked 50 day SMA and PPO centerline tests. We could be in for something similar now. If railroads do struggle in the near-term, it will be difficult for the TRAN to make the aforementioned breakout.

Slowing price momentum (negative divergence) was an issue back in June and it appears that it could be problematic once again. The pink arrows in late June marked 50 day SMA and PPO centerline tests. We could be in for something similar now. If railroads do struggle in the near-term, it will be difficult for the TRAN to make the aforementioned breakout.

Sector/Industry Watch

Healthcare (XLV) has been on a tear for the past 10 weeks or so, without once closing beneath its rapidly-rising 20 day EMA. The strength has been highlighted by the resurgence of pharmaceuticals ($DJUSPR) and health care providers ($DJUSHP), which have gained roughly 15% and 13%, respectively, over that time frame:

I still am a big fan of healthcare stocks, but don't be shocked if the group goes through a deeper period of consolidation as the recent bullish price action is not accompanied by strengthening price momentum. That could lead to more sideways action, or perhaps even short-term selling and relative underperformance. From a trading perspective, it wouldn't be a bad idea to consider taking profits on stocks within this space as the risks are rising. It doesn't mean the price can't go higher, it simply means there's more risk in holding for now.

I still am a big fan of healthcare stocks, but don't be shocked if the group goes through a deeper period of consolidation as the recent bullish price action is not accompanied by strengthening price momentum. That could lead to more sideways action, or perhaps even short-term selling and relative underperformance. From a trading perspective, it wouldn't be a bad idea to consider taking profits on stocks within this space as the risks are rising. It doesn't mean the price can't go higher, it simply means there's more risk in holding for now.

Monday Setups

I tend to favor companies that have beaten its revenue and EPS estimates, gapped higher, and then fallen back as the earnings-related euphoria settles down. NeoPhotonics, Inc (NPTN) certainly fits the bill. After producing revenue numbers that beat Wall Street estimates by approximately 10% and posting EPS of (.14) vs. a much larger anticipated loss of (.20), NPTN deservedly jumped from 6.86 to 9.00 in three trading days. It was a huge move that suggested NPTN could use some consolidation or selling to unwind the quickly overbought conditions. Last week did the trick. NPTN closed at 7.65 on Friday and now has an RSI of 41 (vs. well above 70 just a couple weeks ago). Volume on the selling has been light and I'd begin to look for a price turnaround here:

As NPTN moves lower, the reward to risk grows further and further. I would consider my target to be 9.25, while looking at support in the 7.25-7.75 area. It's certainly possible that we'll see a gap fill down to 6.86, but I'd be surprised if the selling takes NPTN that far down.

As NPTN moves lower, the reward to risk grows further and further. I would consider my target to be 9.25, while looking at support in the 7.25-7.75 area. It's certainly possible that we'll see a gap fill down to 6.86, but I'd be surprised if the selling takes NPTN that far down.

For all of my Monday Setups, CLICK HERE.

Historical Tendencies

While September is a difficult month for U.S. equities historically, the upcoming September 20th through 26th period is easily the worst time of the month for the S&P 500. Since 1950, the annualized return for that week is -39.41%, nearly 50 percentage points below the 9% average annual return that the S&P 500 has enjoyed the past seven decades.

Key Earnings Reports

None

Key Economic Reports

None

Happy trading!

Tom