Market Recap for Tuesday, July 31, 2018

It was a solid day on Wall Street to close out July. The small cap Russell 2000, weak on a relative basis during July, regained its leadership role, spiking more than 1% and doubling the performance of its other major index counterparts. Industrials (XLI, +2.21%) were quite strong as commercial vehicles & trucks ($DJUSHR, +3.28%) led a robust advance in every industry group in the sector. Diversified industrials ($DJUSID) and industrial machinery ($DJUSFE) both gained nearly 3% as the XLI closed at its highest level since March. The XLI is featured in the Sector/Industry Watch section below.

Healthcare (XLV, +1.05%) also saw a healthy advance with biotechnology stocks ($DJUSBT, +1.89%) leading the way. Amgen (AMGN) was a clear beneficiary as this biotech giant broke out to a fresh new high on increasing volume:

AMGN held its rising 20 day EMA on the recent selling in biotech shares and has now broken out. I'd look for a break above the intraday high just above 198 established in January. That would add to the bullishness here.

AMGN held its rising 20 day EMA on the recent selling in biotech shares and has now broken out. I'd look for a break above the intraday high just above 198 established in January. That would add to the bullishness here.

Financials (XLF, -0.71%) lagged the broader market as banks ($DJUSBK) struggled with the 10 year treasury yield pulling back. Given the strength of this morning's ADP employment report and the reaction in treasuries (the TNX is challenging 3%), banks should be able to reverse their position and lead on a relative basis today.

Pre-Market Action

A strong ADP employment report (219,000 vs 173,000) has prompted selling in treasuries with the 10 year treasury yield ($TNX) rising to test 3.00%, its highest level since mid-June. Overnight, Asian markets were mixed and we're seeing fractional losses in Europe this morning.

Apple (AAPL) delivered a very strong quarterly report and is higher by more than 4% as its market cap pushes closer and closer to $1 trillion. It appears that AAPL will open today with a market cap that's close to $975 billion.

U.S. futures are mixed with Dow Jones futures currently lower by 26 points. NASDAQ futures are higher by 17 points.

Current Outlook

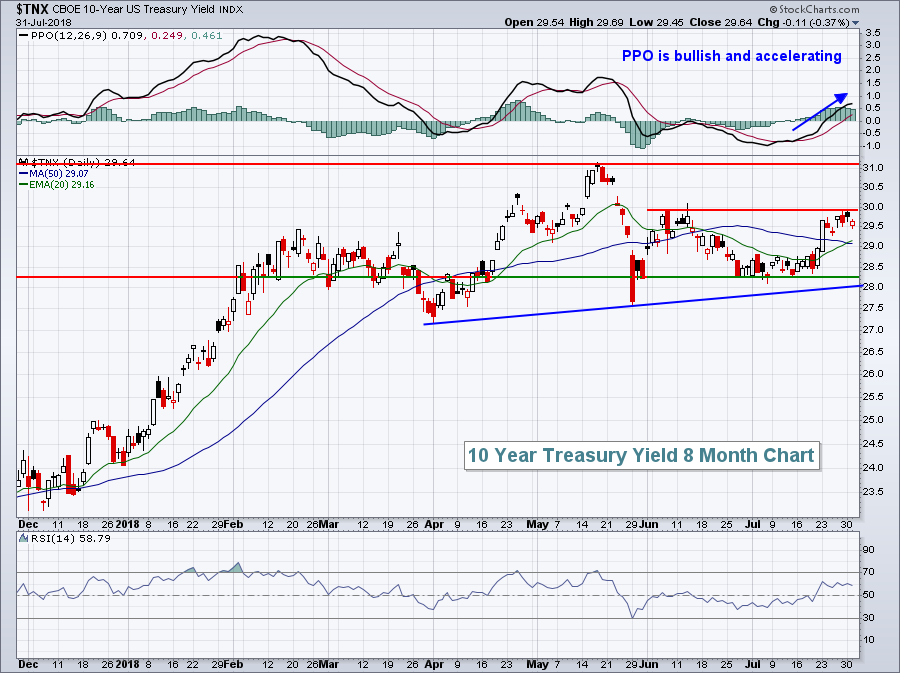

The 10 year treasury yield ($TNX) should be monitored closely in the near-term. A rising TNX signals rotation away from treasuries and that typically accompanies a rise in U.S. equity prices, especially if the rise is due to a strengthening economy. The most recent GDP was the strongest in four years so further rotation from treasuries would likely be bullish for stocks. There is overhead yield resistance that must be negotiated in the short- and intermediate-terms so watch these levels:

Initial yield resistance is being felt at the early June high near 3.00%, but the big level is clearly set at 3.11%. That was the highest TNX reading since 2011 and appeared to break the 37 year downtrend in treasury yields. Another push above 3.11% would confirm it in my opinion. Short-term support is at the rising 20 day EMA, currently at 2.92%. Then there's the recent TNX low and trendline support that range from 2.80%-2.82%.

Initial yield resistance is being felt at the early June high near 3.00%, but the big level is clearly set at 3.11%. That was the highest TNX reading since 2011 and appeared to break the 37 year downtrend in treasury yields. Another push above 3.11% would confirm it in my opinion. Short-term support is at the rising 20 day EMA, currently at 2.92%. Then there's the recent TNX low and trendline support that range from 2.80%-2.82%.

The latest FOMC meeting concludes today with a policy statement being issued at 2pm EST. We'll see if this announcement is a catalyst for a TNX breakout or breakdown.

Sector/Industry Watch

Industrials (XLI) have taken their first step towards renewed leadership. July was kind to industrials and they appear to have broken out of a recent down channel. As a result, we could see continuation of the renewed relative strength that took place over the past month:

The XLI was a leader during the bull market rally that topped in January. As the market has sold off and consolidated, the XLI has underperformed. It's bullish to see the relative strength returning as industrials are one of the four aggressive areas of the market. As the S&P 500 moves higher, we want to see the XLI among the leaders.

The XLI was a leader during the bull market rally that topped in January. As the market has sold off and consolidated, the XLI has underperformed. It's bullish to see the relative strength returning as industrials are one of the four aggressive areas of the market. As the S&P 500 moves higher, we want to see the XLI among the leaders.

Historical Tendencies

The Dow Jones U.S. Toys Index ($DJUSTY) historically performs better during the first half of the year rather than the second half. An exception, however, is August where the DJUSTY has averaged gaining 1.9% over the past two decades. Within the toys group, Activision Blizzard (ATVI) and Electronic Arts (EA) have posted average August gains of 5.7% and 5.6%, respectively, this century. Of the two, ATVI appears to have the better relative strength currently and also has a 5 year August winning streak, posting average August gains of 6.3% during this stretch.

Key Earnings Reports

(actual vs. estimate):

ADP: .92 vs .90

D: .86 vs .78

EPD: .46 vs .39

HUM: 3.96 vs 3.79

IDXX: 1.23 vs 1.18

PEG: .64 vs .62

S: .04 vs (.01)

(reports after close, estimate provided):

ALL: 1.45

APA: .35

CXO: .92

ESRX: 2.20

MET: 1.17

MRO: .21

NTR: 1.39

PRU: 3.08

PSA: 2.61

SQ: 1.11

TMUS: .86

TS: .29

TSLA: (2.76)

WMB: .16

WPZ: .40

WYNN: 2.03

Key Economic Reports

July ADP employment report released at 8:15am EST: 219,000 (actual) vs. 173,000 (estimate)

July PMI manufacturing index to be released at 9:45am EST: 55.5 (estimate)

July ISM manufacturing index to be released at 10:00am EST: 59.5 (estimate)

June construction spending to be released at 10:00am EST: +0.3% (estimate)

FOMC meeting announcement at 2pm EST

Happy trading!

Tom