Market Recap for Wednesday, May 9, 2018

Was Wednesday the day that marked the resumption of the 9 year bull market? Some might argue it began with the bottom last week, while others might argue it hasn't begun because the Dow Jones and S&P 500 are lagging badly and nowhere near breakouts to all-time highs. I suppose there's a bit of truth in each of these arguments, so let's just say the U.S. stock market had a very bullish day.

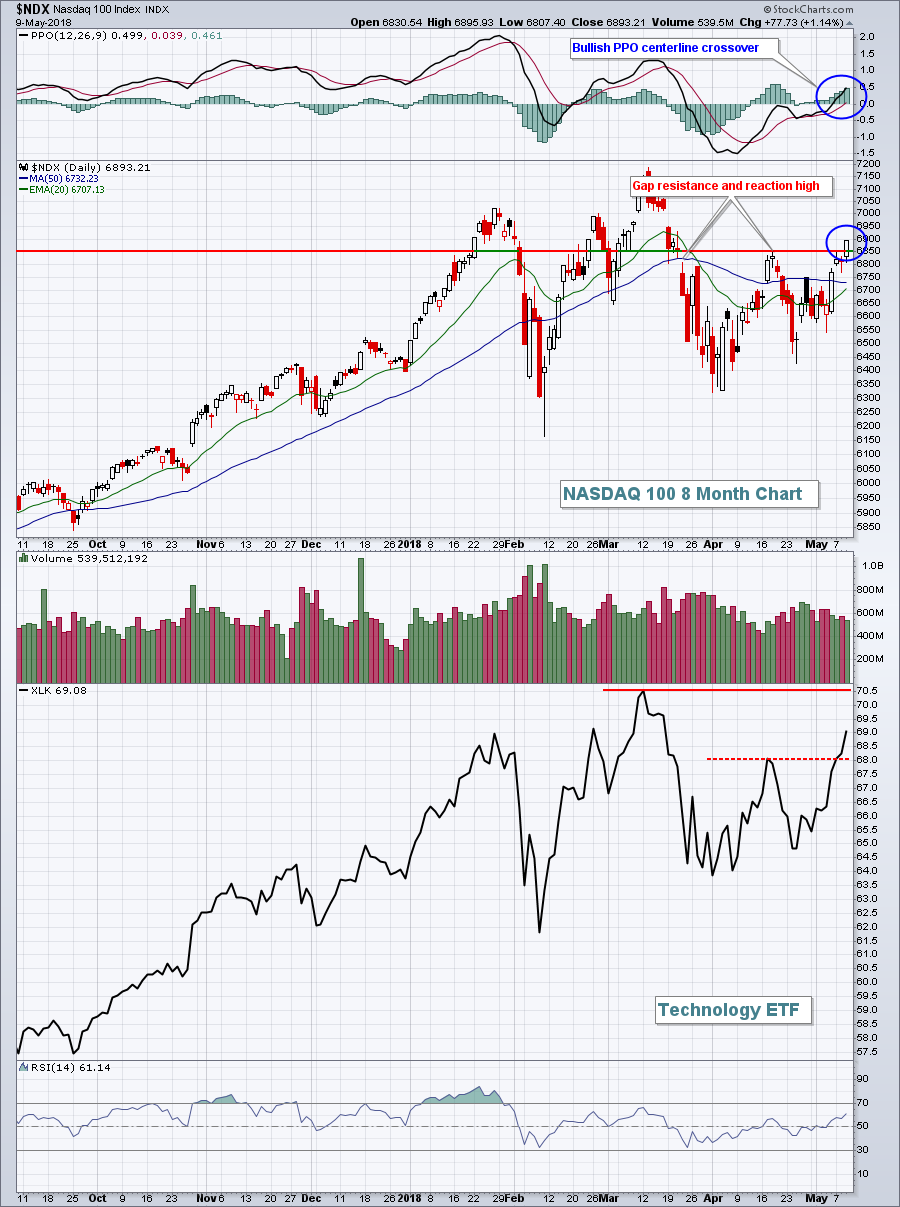

All of our major indices were bid higher, including another very strong day for the NASDAQ 100 ($NDX, +1.14%). The NDX cleared the late-March gap resistance and the April reaction high as it closed at its highest level since March 16th:

A bull market cannot resume with a PPO in negative territory. It needs short-term bullish momentum. And for the first time in several weeks, we're seeing bullish momentum picking up.

A bull market cannot resume with a PPO in negative territory. It needs short-term bullish momentum. And for the first time in several weeks, we're seeing bullish momentum picking up.

Eight of nine sectors advanced on Wednesday as well, providing the wide participation that we want to see on rallies. Energy (XLE, +2.04%) was the clear leader as surging crude oil prices ($WTIC, +3.01%) bolstered this sector. Financials (XLF, +1.48%), materials (XLB, +1.44%), technology (XLK, +1.24%) and consumer discretionary (XLY, +1.08%) all finished higher by more than 1%. That's solid action.

But perhaps the most bullish news of all was the Volatility Index ($VIX, -8.77%) falling beneath its earlier lows in March and April. With the VIX now at 13.42, it is substantially beneath the lowest level of the previous two bear markets. The VIX never fell beneath 16 in either bear market and high volatility represents the fear ingredient necessary to sustain the bears.

Pre-Market Action

Consumer price data was released this morning with no signs of inflation worries. That should help calm the fears of those who believe inflation could be our next problem. Traders are turning to bonds this morning as the 10 year treasury yield ($TNX) has dropped back to 2.96%. Crude oil ($WTIC) is up another 0.50% in early action and that could provide another lift to energy shares.

There was a modest rally in Asian markets overnight with a more modest rally in Europe today. Currently, with nearly an hour to go before the opening bell, Dow Jones futures are fairly flat (+10 points) as traders decide whether to jump in or out after the latest rally.

Current Outlook

When small caps close at an all-time high, it's difficult to be bearish. The S&P 600 Small Cap Index ($SML) represents companies that do the majority, if not all, of their business domestically. They are a solid gauge of the U.S. economic picture and when the dollar is rising, as it is now, they can have explosive upside moves. The SML appears to be in one of those moves now:

Their relative strength is really not up for debate and I'm of the opinion that the U.S. Dollar Index ($USD) is in the midst of a major upside move that's just beginning. I look for small caps to continue to outperform in 2018 - at least as long as the dollar continues to strengthen.

Their relative strength is really not up for debate and I'm of the opinion that the U.S. Dollar Index ($USD) is in the midst of a major upside move that's just beginning. I look for small caps to continue to outperform in 2018 - at least as long as the dollar continues to strengthen.

Sector/Industry Watch

Yesterday, I featured an improving trucker ($DJUSTK) group. Today, let's check out the strength in railroads ($DJUSRR):

The PPO (blue circle) shows that bullish momentum is strengthening. The red-dotted line shows that 1900 was holding as resistance after the late-January gap lower, but it's now been broken. The DJUSRR gained 2.43% to test the mid-January high and key price resistance on Wednesday. We could consolidate a bit just beneath this key price level, but there's no denying the bullish uptrending price action that's been in play for months. I find railroads to be a key signal as well because they only move higher with a strengthening domestic economy so the strength here confirms what we've been seeing in lower bond prices and rising treasury yields.

The PPO (blue circle) shows that bullish momentum is strengthening. The red-dotted line shows that 1900 was holding as resistance after the late-January gap lower, but it's now been broken. The DJUSRR gained 2.43% to test the mid-January high and key price resistance on Wednesday. We could consolidate a bit just beneath this key price level, but there's no denying the bullish uptrending price action that's been in play for months. I find railroads to be a key signal as well because they only move higher with a strengthening domestic economy so the strength here confirms what we've been seeing in lower bond prices and rising treasury yields.

Historical Tendencies

Small caps are clearly outperforming its large cap counterparts now and they've been doing so for the past couple months. But did you know that the majority of gains in the Russell 2000 have been made between the 25th of one calendar month and the 2nd of the next? Check out these annualized returns on the Russell 2000 since 1987:

25th through 2nd: +35.23%

3rd through 24th: +1.22%

Key Earnings Reports

(actual vs. estimate):

DUK: 1.28 vs 1.15

ENB: .82 vs .48

(reports after close, estimate provided):

NKTR: (.52)

NVDA: 1.65

SYMC: .40

Key Economic Reports

April CPI released at 8:30am EST: +0.2% (actual) vs. +0.3% (estimate)

April Core CPI released at 8:30am EST: +0.1% (actual) vs. +0.2% (estimate)

Initial jobless claims released at 8:30am EST: 211,000 (actual) vs. 220,000 (estimate)

Happy trading!

Tom