Market Recap for Monday, May 21, 2018

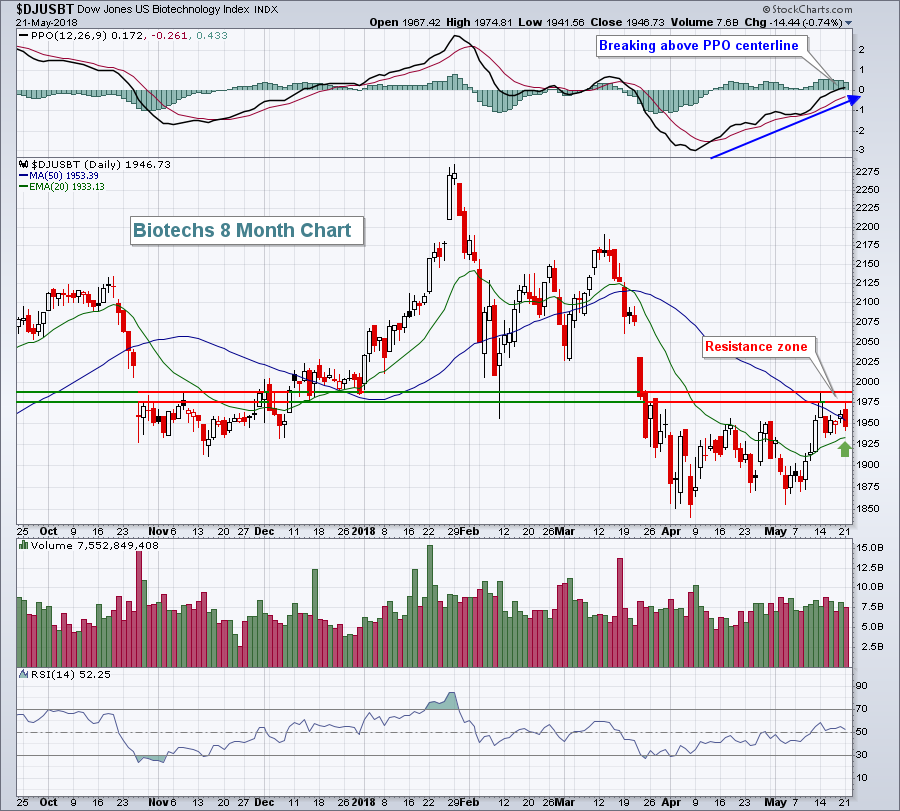

Until recently, the industrials (XLI, +1.51%) had been lagging its aggressive sector counterparts rather badly. That has definitely changed in May and we now have all key sectors with buy signals. Relative weakness remains in the defensive healthcare (XLV, +0.10%), consumer staples (XLP, +0.42%) and utilities (XLU, +0.51%) sectors, but that's exactly what we should expect to see during bull markets. They'll participate, but they'll likely underperform. Of these three laggards, I would like to see better performance from biotechnology stocks ($DJUSBT) within the healthcare space. They've begun to show technical strength, but a breakout above the 1975-1985 area is critical. There's a recent uptrend in place, so if the DJUSBT can hold its rising 20 day EMA and clear this resistance zone, they'd be well on their way to a better technical outlook:

A close above 1985 would likely trigger a quick surge to gap resistance closer to 2030.

A close above 1985 would likely trigger a quick surge to gap resistance closer to 2030.

Transportation stocks ($TRAN) made a huge breakout yesterday and this group is featured below in the Current Outlook section. Aerospace stocks ($DJUSAS), however, were the best performing industry group within the industrials as Boeing (BA) surged to an all-time high close:

Since its bottom in early May, the DJUSAS has climbed more than 10% and are a big reason why industrials are strengthening.

Since its bottom in early May, the DJUSAS has climbed more than 10% and are a big reason why industrials are strengthening.

Pre-Market Action

Crude oil ($WTIC) is on the move higher again this morning after closing above $72 per barrel yesterday for the first time since late-2014. Equity markets were mixed in Asia overnight, but are mostly higher this morning in Europe.

Dow Jones futures are set to advance again, up 48 points with a little more than 30 minutes to the opening bell.

Current Outlook

It's difficult to be 100% behind a bullish outlook when transportation stocks ($TRAN), as a whole, fail to participate in a rally. Well, that failure was rectified on Monday. We had already seen a very strong railroad group ($DJUSRR) and a strengthening trucking group ($DJUSTK), but the TRAN itself had struggled. Take one look at the chart below, however, and you'll see a decisive breakout in the overall transportation area:

I've been discussing this chart a ton over the past few weeks, awaiting a breakout to add further confirmation that the 9 year old bull market is resuming. We saw that confirmation yesterday and it was resounding.

I've been discussing this chart a ton over the past few weeks, awaiting a breakout to add further confirmation that the 9 year old bull market is resuming. We saw that confirmation yesterday and it was resounding.

Sector/Industry Watch

Industrials (XLI) have been very slow to participate in this latest market advance, but it looks as if they've finally made a critical breakout:

Monday's leadership from industrials was bullish on several fronts, but most notably due to its bullish wedge breakout and its clearing of price and gap resistance near 76. Momentum is now bullish and accelerating, as evidenced by the PPO, which has crossed its centerline and is strengthening. It had been below its centerline since the early February swoon.

Monday's leadership from industrials was bullish on several fronts, but most notably due to its bullish wedge breakout and its clearing of price and gap resistance near 76. Momentum is now bullish and accelerating, as evidenced by the PPO, which has crossed its centerline and is strengthening. It had been below its centerline since the early February swoon.

Historical Tendencies

We're rapidly approaching a very bullish period of the calendar year. The May 26th through June 5th period has produced the following annualized returns:

S&P 500 (since 1950): +28.59% (the bullish period actually runs through June 6th on the S&P 500)

NASDAQ (since 1971): +50.66%

Russell 2000 (since 1987): +64.49%

Key Earnings Reports

(actual vs. estimate):

AAP: 2.10 vs 1.98

AZO: 13.42 vs 12.99

KSS: .64 vs .49

TJX: .96 vs 1.02

(reports after close, estimate provided):

CTRP: .15

HPE: .31

INTU: 4.67

Key Economic Reports

None

Happy trading!

Tom