Market Recap for Thursday, March 29, 2018

The energy ETF (XLE, +2.11%) surged off of key price support at 66.00 and there's reason to believe that this rally could last a bit longer. Crude oil prices ($WTIC) outperformed the XLE during the month of March and we could see the XLE play a bit of catch up in April. Here's the chart:

The red arrows highlight the difficulty that the XLE has had negotiating the 69-70 price resistance zone. A close above 69.50 would be bullish as not only would it clear price resistance, but it would also clear its 50 day SMA for the first time since the early-February swoon.

The red arrows highlight the difficulty that the XLE has had negotiating the 69-70 price resistance zone. A close above 69.50 would be bullish as not only would it clear price resistance, but it would also clear its 50 day SMA for the first time since the early-February swoon.

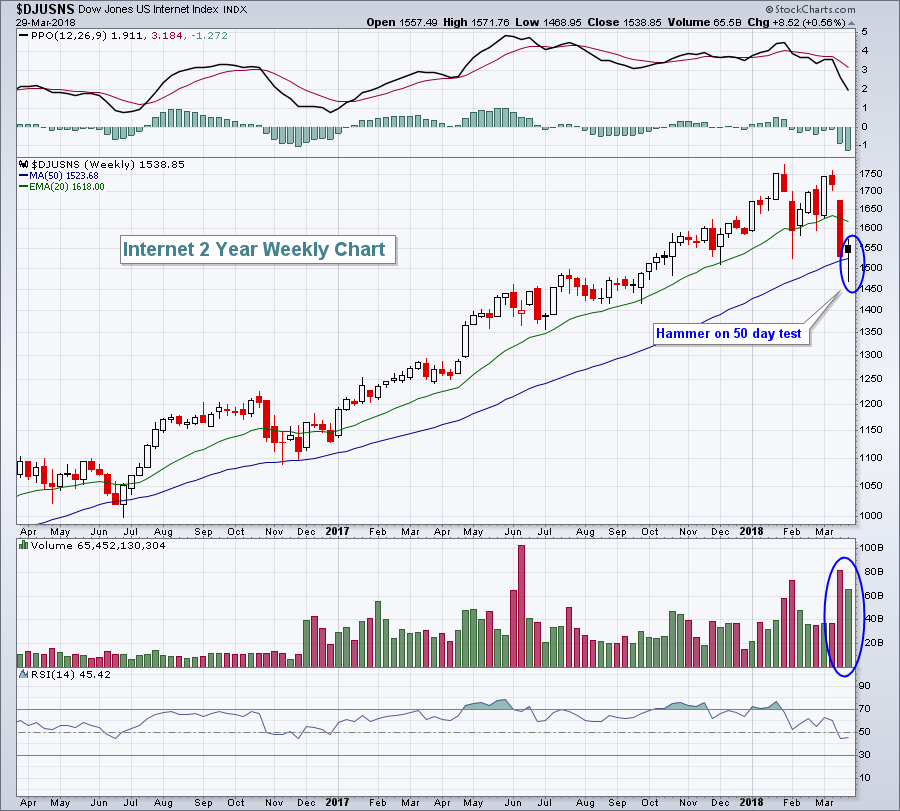

Technology (XLK, +1.98%) was the second best performing sector on Thursday as internet stocks ($DJUSNS) rebounded after closing beneath their early February lows. While the daily chart certainly saw a breakdown, the weekly chart painted a much different, and much more bullish, picture:

It had been more than a year since the DJUSNS had a definitive weekly close beneath its rising 20 week EMA. That changed over the past two weeks and it was bullish to see this influential technology area hammer out a bottom at the rising 50 week SMA. The high volume and reversal suggests we'll see higher prices in the weeks ahead.

It had been more than a year since the DJUSNS had a definitive weekly close beneath its rising 20 week EMA. That changed over the past two weeks and it was bullish to see this influential technology area hammer out a bottom at the rising 50 week SMA. The high volume and reversal suggests we'll see higher prices in the weeks ahead.

Pre-Market Action

U.S. futures are looking to open a new trading day, week, month and quarter on a mostly sour note. Most of the selling pressure appears to be centered on large cap names like Amazon.com (AMZN) and Tesla (TSLA). Dow Jones futures are lower by 137 points, while NASDAQ futures are staring at a 53 point drop with about an hour to go before the opening bell.

While markets are closed in Europe in honor of Easter Monday, there was mixed action overnight in Asia. Key indices did finish fairly close to the flat line after China announced over the weekend that they were slapping tariffs on many U.S. products.

Current Outlook

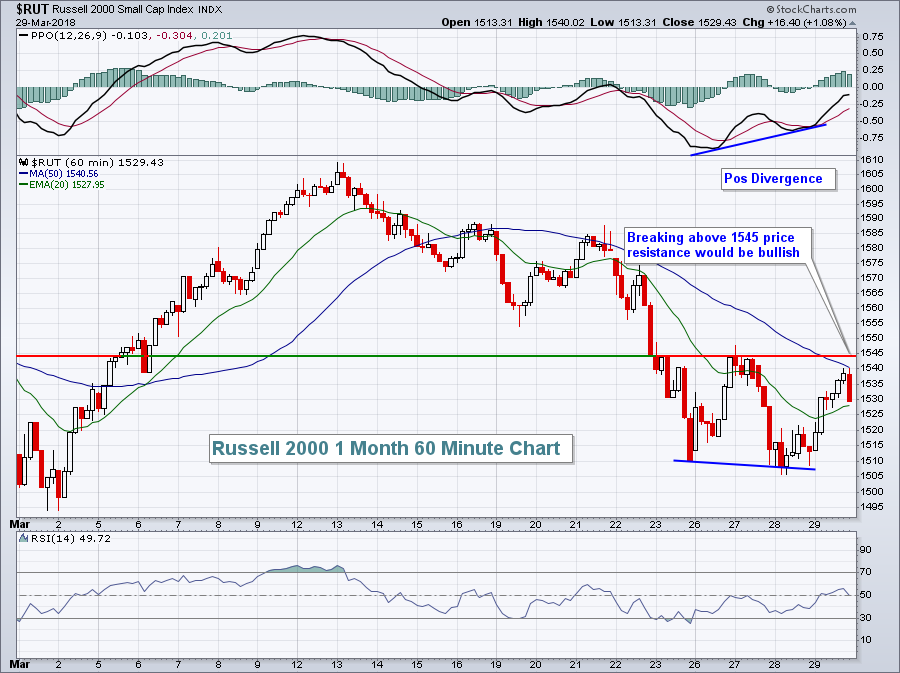

The small cap Russell 2000 ($RUT) performed quite well on a relative basis during March as it was the only major index to post a gain for the month (+1.12%). By contrast, the Dow Jones lost 3.70%. That's nearly a 5% swing between Dow and Russell 2000 performance. A positive divergence on the 60 minute chart aided small caps on Friday and a breakout above the 50 hour SMA would be a bullish short-term signal:

Small caps do tend to perform well through June so continuing strength within a bull market is what I'll be expecting.

Small caps do tend to perform well through June so continuing strength within a bull market is what I'll be expecting.

Sector/Industry Watch

Gold mining ($DJUSPM) was one of the best performing industry groups last week and its PPO is strengthening as it bounced off of 20 day EMA support on Thursday:

Note that when the PPO is strengthening above its centerline, pullbacks to the rising 20 day EMA typically hold. I'd make sure that's the case if I were to trade gold mining stocks on the long side. I'm not a fan of gold and haven't been since 2011 because the group has been so weak vs. the S&P 500. It's hard to outperform the benchmark index if you're constantly owning stocks that have underperformed the benchmark for 7 years. That's why I'd personally keep a very tight stop on the stocks in this area if the DJUSPM's 20 day EMA is violated on a closing basis.

Note that when the PPO is strengthening above its centerline, pullbacks to the rising 20 day EMA typically hold. I'd make sure that's the case if I were to trade gold mining stocks on the long side. I'm not a fan of gold and haven't been since 2011 because the group has been so weak vs. the S&P 500. It's hard to outperform the benchmark index if you're constantly owning stocks that have underperformed the benchmark for 7 years. That's why I'd personally keep a very tight stop on the stocks in this area if the DJUSPM's 20 day EMA is violated on a closing basis.

Monday Setups

Marvell Technology (MRVL) has been under significant selling pressure the past 2-3 weeks, but has reached a key area of support where I'd expect to see a rebound:

Note the huge volume in November when MRVL gapped up from a little above 20. The top and bottom of gap support proved to be excellent support in early February and I'd expect it to provide solid support once again. Accumulating from the current price down to 20.25 would make sense, along with keeping a closing stop beneath 19.75 with a target of 24.50.

Note the huge volume in November when MRVL gapped up from a little above 20. The top and bottom of gap support proved to be excellent support in early February and I'd expect it to provide solid support once again. Accumulating from the current price down to 20.25 would make sense, along with keeping a closing stop beneath 19.75 with a target of 24.50.

Historical Tendencies

Over the past 19 years, MRVL (Monday setup above) has averaged gaining 6.1% in the month of April. That trails only January's 8.7% average monthly gain as MRVL's best calendar month of the year. May is also a solid month, where MRVL has averaged gaining 4.9% over nearly two decades.

Key Earnings Reports

None

Key Economic Reports

March PMI manufacturing index to be released at 9:45am EST: 55.7 (estimate)

March ISM manufacturing index to be released at 10:00am EST: 60.0 (estimate)

February construction spending to be released at 10:00am EST: +0.5% (estimate)

Happy trading!

Tom