Market Recap for Thursday, January 11, 2018

The small cap Russell 2000 ($RUT) led U.S. indices higher on Thursday with more across-the-board record highs being set. The RUT gained 1.73%, more than doubling the advance on any of the other major indices. There were plenty of reasons, but leadership from energy (XLE, +2.05%) and consumer discretionary (XLY, +1.63%) played a huge role. The candle that printed on yesterday was the most bullish kind - the marubozu candle where prices open on the low, we see buying throughout the day, and we finish on the high. Check out Thursday's candle on this short-term RUT chart:

It's always a bullish signal to see the Russell 2000 perform well and for two primary reasons. First and foremost, the RUT is widely recognized as a volatile and aggressive area of the market where both gains and losses can be much greater than we see on the benchmark S&P 500. Any time that money seeks out more aggressive areas of the market, it suggests traders are willing to take on more risk and that typically coincides with very bullish market action. Second, the RUT is comprised of companies that do nearly all of their business in the U.S. so it's a great indication of what the market thinks of the U.S. economy ahead, relative to other parts of the world.

It's always a bullish signal to see the Russell 2000 perform well and for two primary reasons. First and foremost, the RUT is widely recognized as a volatile and aggressive area of the market where both gains and losses can be much greater than we see on the benchmark S&P 500. Any time that money seeks out more aggressive areas of the market, it suggests traders are willing to take on more risk and that typically coincides with very bullish market action. Second, the RUT is comprised of companies that do nearly all of their business in the U.S. so it's a great indication of what the market thinks of the U.S. economy ahead, relative to other parts of the world.

Once again, the defensive-oriented sectors were ignored during Thursday's rally with utilities (XLU, -0.37%) and consumer staples (XLP, -0.14%) the only two sectors that lost ground.

Pre-Market Action

Earnings are beginning to kick into gear and we're already seeing nice quarterly earnings reports from large banks this morning as JP Morgan Chase (JPM) and PNC Financial (PNC) both topped estimates and their stock price has been rising to anticipate these results. The question now becomes what type of market reaction do these stocks receive. In other words, are these strong quarterly results already built into the current price? We'll know more later today.

The Hang Seng Index ($HSI) had a strong overnight session, leading Asia to mostly higher prices. In Europe this morning, action has been mixed.

The Dow Jones looks to open higher with futures up 71 points with 30 minutes left to the opening bell.

Current Outlook

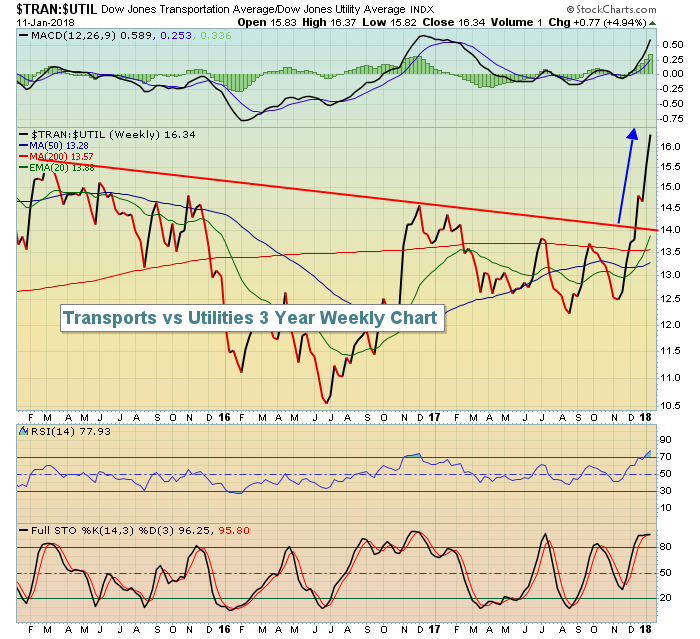

One key ratio that I follow to determine the sustainability of an S&P 500 rally is the relationship of the transportation index vs. the utilities index ($TRAN:$UTIL). Transportation stocks perform well as the economy expands or as the market anticipates such expansion. That typically results in higher treasury yields to keep the economic engine from overheating. Those rising yields, however, typically play havoc on utilities stocks as income investors decide to bail as the dividend yields on utilities don't look nearly as attractive when treasury yields are rising. So for me, it's important to see a rising TRAN:UTIL ratio to support a market rally. That wasn't always the case in 2017, so I find the recent acceleration particularly bullish:

It's hard to misinterpret this chart.

It's hard to misinterpret this chart.

Sector/Industry Watch

Airlines ($DJUSAR) saw their highest level ever at Thursday's intraday high and this comes on the heels of a very significant long-term base that began forming at the beginning of 2015:

Multi-year downtrends or sideways-type action can result in very strong rallies once they're broken. We saw it in many areas in 2017, most notably in renewable energy ($DWCREE) and home construction ($DJUSHB) shares. Airlines will be a group to watch closely in 2018 to see if rising 20 week EMAs hold on pullbacks. If so, the odds of a strong rally increase significantly.

Multi-year downtrends or sideways-type action can result in very strong rallies once they're broken. We saw it in many areas in 2017, most notably in renewable energy ($DWCREE) and home construction ($DJUSHB) shares. Airlines will be a group to watch closely in 2018 to see if rising 20 week EMAs hold on pullbacks. If so, the odds of a strong rally increase significantly.

Historical Tendencies

Over the past two decades, the Russell 2000 has outperformed the S&P 500 in eight of the twelve calendar months. During the first half of the year, the Russell 2000 has averaged outperforming by 2.5%. During the second half, that outperformance drops to just 0.9%, with particular relative weakness from July through October where it's underperformed by an average of 1.4%. January's outperformance is just 0.1%, but February's spikes to 0.7% so we very well could see more of what we saw yesterday.

Key Earnings Reports

(actual vs. estimate)

BLK: 6.24 vs 6.07

INFY: .25 vs .25

JPM: 1.76 vs 1.69

PNC: 2.29 vs 2.20

WFC: 1.16 vs 1.07

Key Economic Reports

December CPI released at 8:30am EST: +0.1% (actual) vs +0.1% (estimate)

December Core CPI released at 8:30am EST: +0.3% (actual) vs. +0.2% (estimate)

December retail sales released at 8:30am EST: +0.4% (actual) vs. +0.5% (estimate)

December retail sales excluding autos released at 8:30am EST: +0.4% (actual) vs. +0.4% (estimate)

November business inventories to be released at 10:00am EST: +0.3% (estimate)

Happy trading!

Tom