Market Recap for Monday, September 25, 2017

Technology (XLK, -1.18%) was the only real problem on Monday, but it was a big problem. Mobile telecommunications ($DJUSWC) and internet stocks ($DJUSNS) were the big losers with the latter slammed by Facebook (FB), which dropped nearly 5% on extremely heavy volume. There's an interesting weekly chart on FB below in the Sector/Industry Watch section. Here's the current look at the XLK:

Technology stocks were up more than 20% year to date and in need of some relief. The negative divergence is evidence of slowing momentum. However, the bulls have been stubborn on 20 week EMA tests throughout this uptrend so that would be a very significant test. Currently, the 20 week EMA is at 56.58. What's interesting is that the 56.50 area is solid support on the daily chart as well. Check it out:

Technology stocks were up more than 20% year to date and in need of some relief. The negative divergence is evidence of slowing momentum. However, the bulls have been stubborn on 20 week EMA tests throughout this uptrend so that would be a very significant test. Currently, the 20 week EMA is at 56.58. What's interesting is that the 56.50 area is solid support on the daily chart as well. Check it out:

Monday's close on the XLK was just above its 50 day SMA. If we see more short-term weakness and lose that moving average support, I'd look for that next major test near 56.50. That level would need to hold to set up technology for its typical 4th quarter advance.

Monday's close on the XLK was just above its 50 day SMA. If we see more short-term weakness and lose that moving average support, I'd look for that next major test near 56.50. That level would need to hold to set up technology for its typical 4th quarter advance.

Strength in energy (XLE, +1.44%) enabled the S&P 500 to minimize its losses, despite the weak technology sector. The XLE has been on a tear, rising 17 of the last 18 trading days. While this renewed enthusiasm has resulted in a very overbought group short-term, make no mistake about it, the downtrend has been broken and energy is an area to consider entry on any pullback to test its now-rising 20 day EMA.

Pre-Market Action

U.S. futures are pointing to a slightly higher open with 30 minutes left to the opening bell. Technology, which was slammed on Monday, appears poised to rebound this morning. I'll be watching to see if that rebound sticks throughout the day or if it simply encourages more selling this afternoon.

Crude oil ($WTIC) has dipped back below $52 per barrel this morning after closing above that level on Monday. Gold ($GOLD) is trading very near its important $1300 support.

Current Outlook

Yesterday, the S&P 500 weakened and tested its rising 20 day EMA. Price support resides at 2481. We didn't quite reach that level, but that's where I'd consider short-term price support because that was the prior price high before breaking out above that level in mid-September. In the very near-term, the S&P 500 is struggling to recapture its 20 hour EMA. Here's the chart:

The red parallel downtrend lines mark the current channel for S&P 500 prices. The bulls would like to see that channel broken today. Otherwise, it could lead to another test of gap support where the recent tails occurred near 2490. Ultimately, this downtrend could lead to a more significant price support test at 2481.

The red parallel downtrend lines mark the current channel for S&P 500 prices. The bulls would like to see that channel broken today. Otherwise, it could lead to another test of gap support where the recent tails occurred near 2490. Ultimately, this downtrend could lead to a more significant price support test at 2481.

Sector/Industry Watch

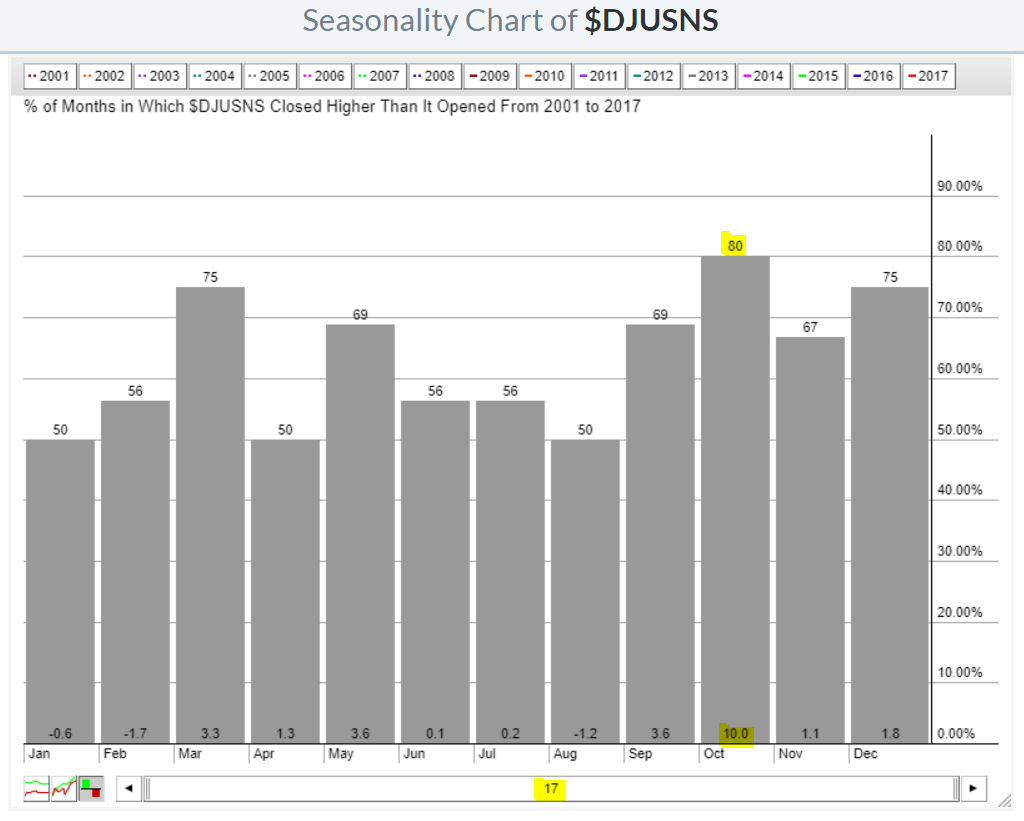

Internet stocks ($DJUSNS) normally perform very well from September through December. The seasonality chart of this index is shown below under Historical Tendencies. Therefore, there's a fairly good chance that Facebook's (FB) current 20 week EMA test could be a great short-term trading opportunity. Check this out:

Volume was extremely heavy yesterday and you can see, with four trading days left this week, that volume is already approaching weekly levels the past several weeks. So whatever FB does this week, it'll be technically significant. A test of price support intraweek with a close above the 20 week EMA would be very bullish in my view, especially given internet stocks' propensity to trade much higher during October.

Volume was extremely heavy yesterday and you can see, with four trading days left this week, that volume is already approaching weekly levels the past several weeks. So whatever FB does this week, it'll be technically significant. A test of price support intraweek with a close above the 20 week EMA would be very bullish in my view, especially given internet stocks' propensity to trade much higher during October.

Historical Tendencies

It's pretty obvious from the seasonal chart below that the DJUSNS loves the month of October:

So while Facebook has some technical challenges ahead, seasonality tells us to give the social media giant the benefit of the doubt as it tests its 20 week EMA for the first time in 2017.

So while Facebook has some technical challenges ahead, seasonality tells us to give the social media giant the benefit of the doubt as it tests its 20 week EMA for the first time in 2017.

Key Earnings Reports

(actual vs. estimate):

DRI: .99 vs .98

(reports after close, estimate provided):

CTAS: 1.25

NKE: .48

Key Economic Reports

July Case Shiller home price index to be released at 9:00am EST: +0.3% (estimate)

August new home sales to be released at 10:00am EST: 583,000 (estimate)

September consumer confidence to be released at 10:00am EST: 120.2 (estimate)

Happy trading!

Tom