Market Recap for Monday, June 12, 2017

U.S. indices fell in unison on Monday and the tech-laden NASDAQ led the action, but after Friday's bloodbath, it certainly could have been worse. Based on overall action Friday and Monday, it appears to be a healthy rotation from the aggressive technology sector (XLK, -0.59%) to other aggressive sectors like industrials (XLI, +0.37%) and financials (XLF, +0.21%). The oversold energy sector (XLE, +0.71%) has performed very well the past two sessions and on extremely heavy volume so it's possible that the energy group also benefits from short- to intermediate-term weakness in technology.

The move higher in the XLE is worth discussing as this group recently had a SCTR score of just 3. Recent strength has moved it to 5, but clearly there's still a very long way to go if we see continuing strength. Here's the latest look at the chart:

While the XLE move has been accompanied by heavy volume and the oversold sector needed some much-needed buying relief, it's not out of the woods. It's quite easy to visualize the down channel that's been in play throughout 2017 and if the XLE has any hopes of a leadership role in the second half of 2017, we need to see a breakout above this down channel.

While the XLE move has been accompanied by heavy volume and the oversold sector needed some much-needed buying relief, it's not out of the woods. It's quite easy to visualize the down channel that's been in play throughout 2017 and if the XLE has any hopes of a leadership role in the second half of 2017, we need to see a breakout above this down channel.

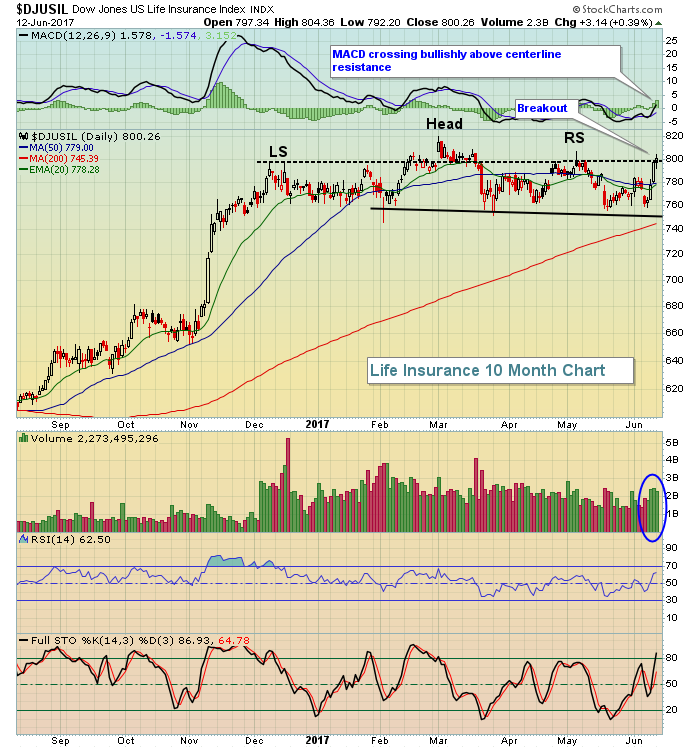

With the Fed meeting today and tomorrow, all eyes are on interest-sensitive areas of the market. Financials have an opportunity to recapture the relative leadership role the group enjoyed late in 2016. Banks ($DJUSBK) were up slightly again yesterday as that industry remains above what was its right shoulder high near 410. The DJUSBK closed above that level for the second consecutive day on Monday. Life insurance ($DJUSIL) also has cleared right shoulder resistance and is featured below in the Sector/Industry Watch section.

Pre-Market Action

We typically see quiet action in our major indices as the Fed meets. The reaction to the FOMC ann0uncement on Wednesday at 2pm EST will be important on several fronts. First and foremost, will the Fed change its language in terms of future rate hikes? Will they become more accommodating as the treasury market seems to think they should. The fact that the 10 year treasury yield ($TNX) is hovering towards the bottom of its six month range lets us know that the bond market is not buying what the Fed has been selling. The bond market is suggesting that economic improvement later in 2017 is not a foregone conclusion. If anything, it's exactly the opposite so the words that the Fed chooses tomorrow will be very important.

With 30 minutes left to the opening bell, Dow Jones futures are higher by 33 points and the NASDAQ is set to rebound as well.

Current Outlook

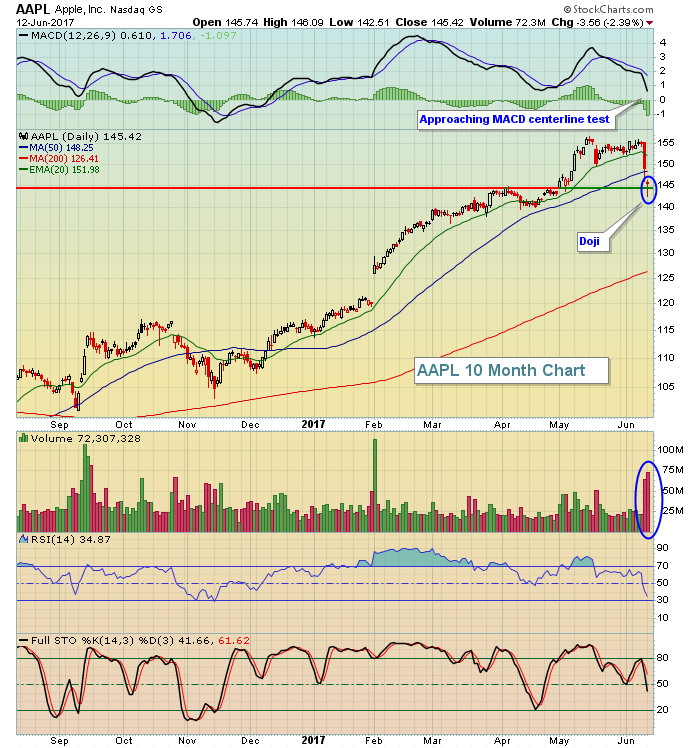

Apple (AAPL) has been the target of downgrades recently and the stock, after climbing consistently for months, has finally surrendered some of its gains - and in rather quick fashion I might add. However, yesterday's doji candlestick (open and close are nearly identical with almost no candle body) off the sudden selling may have established a short-term bottom and, quite possibly, a trading range to consider for the next couple months. Here's the chart:

Apple drives the computer hardware ($DJUSCR) group and yesterday's reversing candle should help the NASDAQ re-establish strength, possibly some relative strength in Tuesday's session. That would help the overall indices regain confidence as well.

Apple drives the computer hardware ($DJUSCR) group and yesterday's reversing candle should help the NASDAQ re-establish strength, possibly some relative strength in Tuesday's session. That would help the overall indices regain confidence as well.

Sector/Industry Watch

Life insurance ($DJUSIL) is one of the industries likely to respond significantly in one direction or the other after the FOMC announcement tomorrow at 2pm EST. Currently, its chart is setting up bullishly after the formation of a bearish head & shoulders topping pattern never was confirmed:

The bullish MACD centerline crossover typically doesn't occur when a stock or index is struggling in a topping pattern. Any MACD reading above zero suggests strengthening and bullish momentum so this bullish crossover adds to my belief that we are not in a topping phase in life insurance. In fact, we could be in the beginning of an explosive move higher. Hopefully, the FOMC announcement tomorrow will confirm that.

The bullish MACD centerline crossover typically doesn't occur when a stock or index is struggling in a topping pattern. Any MACD reading above zero suggests strengthening and bullish momentum so this bullish crossover adds to my belief that we are not in a topping phase in life insurance. In fact, we could be in the beginning of an explosive move higher. Hopefully, the FOMC announcement tomorrow will confirm that.

Historical Tendencies

Since 1971, Mondays and Tuesdays have both produced negative annualized returns on the NASDAQ, while Wednesdays, Thursdays and Fridays have all produced annualized returns well in excess of 20%.

Key Earnings Reports

None

Key Economic Reports

May PPI released at 8:30am EST: +0.0% (actual) vs. +0.1% (estimate)

May Core PPI released at 8:30am EST: +0.3% (actual) vs. +0.2% (estimate)

FOMC meeting begins today with an FOMC announcement due at 2pm EST on Wednesday

Happy trading!

Tom