Market Recap for Tuesday, November 10, 2015

Technology and materials shares held back the market on Tuesday. These sectors were down .66% and .73%, respectively. Industrials were flat, while the remaining six sectors finished higher on the session. CreditSuisse lowered its earnings estimates for Apple (AAPL) and Seabreeze Partners Management President Doug Kass reiterated his short position on AAPL, believing that slowing revenue and earnings growth will send shares lower eventually. That combination had AAPL under pressure throughout Tuesday's session and that took a toll on our major indices in general and technology more specifically, especially computer hardware ($DJUSCR) stocks which fell 2.73%. Computer hardware wasn't alone, however. Mobile telecommunications ($DJUSWC), consumer electronics ($DJUSCE) and semiconductors ($DJUSSC) all showed considerable weakness and helped to drag the entire sector lower.

In materials, the weakness was mainly due to the U.S. Dollar index ($USD) which has been on a tear for the past 3-4 weeks. Check it out:

Since consolidating and allowing its stretched weekly MACD to fall back to centerline support for a "reset", the dollar has once again resumed its climb and that's putting tremendous pressure on commodities, especially gold. Here's how gold ($GOLD) has performed of late:

So long as the dollar remains strong and in an uptrend, I'd continue to stay away from gold. There's always been a clear inverse (or negative) correlation between the U.S. dollar and the price of gold. I certainly would not chase rallies in gold as the long-term trend there is lower.

Special Note

Just a quick reminder that I'll be hosting my Trading Places LIVE webinar today from noon to 1pm EST as I always do. John Hopkins, President of EarningsBeats.com, will join me for a quick segment during the show to discuss earnings season thus far. You can register for this webinar by CLICKING HERE.

Then later this evening, we'll flip flop. I'll join John at EarningsBeats.com for a special webinar starting at 7:30pm EST. I plan to discuss my strategies for trading earnings-related gaps. It should be educational so I hope you can join me and John. You can register for tonight's webinar HERE. Please try to arrive early for tonight's webinar as seating will be limited. Hope to see you at both!

Pre-Market Action

Once again, domestic economic news is very light. Traders will continue to follow technical signals and global markets for directional clues while historical trends favor the bulls throughout most of November and December. Both the German DAX and French CAC were up more than 1% at last check while the London FTSE is higher but lags slightly. Overnight, Asian markets were mixed.

U.S. futures are strong this morning, which isn't too surprising as rising 20 day EMAs have held thus far and our major indices rallied most of the day on Tuesday after early weakness.

Current Outlook

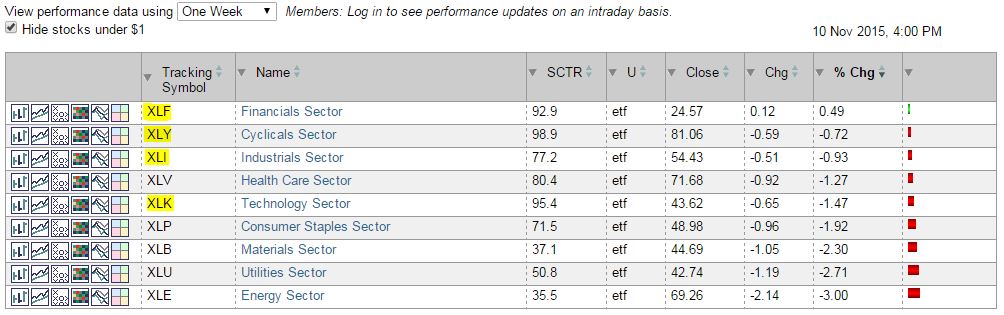

We've seen profit taking over the past week as eight of our nine sectors have moved lower. The selling has mostly taken place in energy (profit taking), utilities, materials and consumer staples, however. This is not a bad sign as it suggests rotation continues to be towards more aggressive areas of the market. This supports the bull market theory. During periods of consolidation, sector rotation is key as it provides clues as to what market participants believe lies ahead. The Fed has been talking about hiking interest rates and the jobs report last Friday supports it. Rates rising from historically low levels during a period of economic expansion is not a bad thing and could very well lead to rapidly rising stock prices.

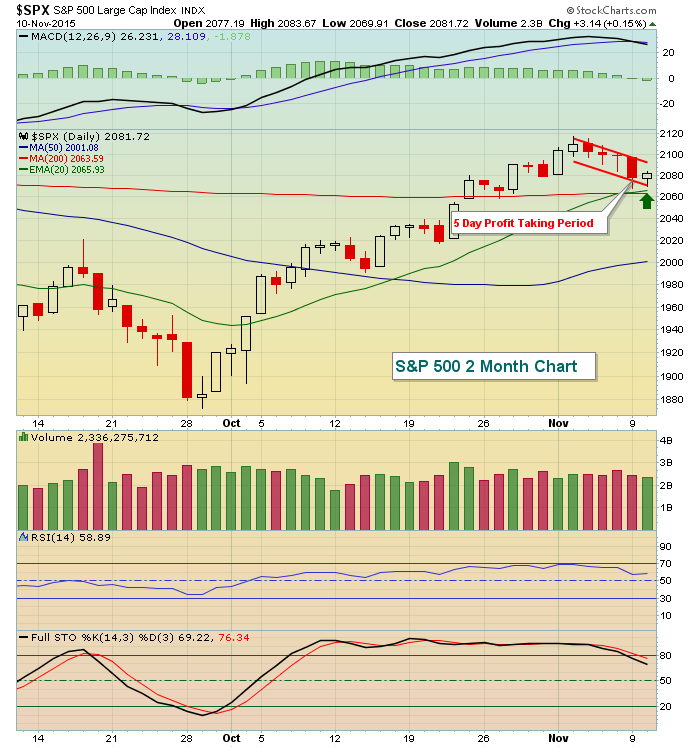

First, take a look at the S&P 500's decline the past several trading days, holding short-term support at the rising 20 day EMA (green arrow):

When a market is rising and money flows into the aggressive sectors - as it's done the past several weeks - I look to sector performance during pullbacks to ensure that key support levels hold and to analyze relative performance of the various sectors. Over the past week, despite the selling, our aggressive sectors - technology, industrials, financials and consumer discretionary - have all remained on the top half of the sector leaderboard. I view this action bullishly. It doesn't guarantee us anything, but I certainly feel better about the selling than if all our aggressive areas were leading the downward action.

Here's the breakdown of sector performance over the past week:

I've highlighted the four aggressive sectors and you can see they performed very well on a relative basis. Pulling back to test support with strong relative performance suggests to me this rally hasn't ended.

Sector/Industry Watch

Given the downside leadership of energy the past week, does this mean the rally there is over? I don't think so. First, let's look at the recent action and the slowing momentum:

To me, the issue with energy right now is slowing momentum. We have a negative divergence present on the most recent price high and notice also that the volume slowed considerably on the last move higher. So we're getting signs of slowing momentum in terms of price (MACD) and volume, not a good combination in the very near-term. But the recent reverse head & shoulders pattern is quite bullish. My guess is that energy will sideways consolidate and allow the rising 50 day SMA to come up and meet price, while at the same time the MACD falls closer to centerline support to reset. Worst case scenario I'd watch the 65.75 area as critical support. Price support resides there along with the 50 day SMA. Breaking below that level would be a bad sign and that's where I'd consider keeping a stop in place. Otherwise, I expect the XLE to push higher in time.

Historical Tendencies

Tendencies over the next several days do favor the bulls, especially on the NASDAQ. Here are annualized returns on the NASDAQ (since 1971) over the next few calendar days:

November 11 (today): +47.26%

November 12 (Thursday): +22.70%

November 13 (Friday): +91.63%

The calendar does turn next week so the bulls will be looking to take advantage of historical tail winds the balance of this week. The Russell 2000 doesn't really enjoy the same strength this week as the NASDAQ so it will be interesting to see if small caps can maintain their recent relative strength.

Key Earnings Reports

(actual vs estimate):

ADT: .51 vs .48

M: vs .53 (awaiting earnings report)

(reports after close today, estimate provided):

NTES: 1.79

Key Economic Reports

None

Happy trading!

Tom