One reminder: You can subscribe to my blog and receive all of my blog posts via e-mail each morning by simply clicking on the "Yes" button below and providing your e-mail address. This applies to all of the blogs here at StockCharts.com so stay ahead of the masses and don't miss your favorite articles!

Market Recap for Friday, October 2, 2015

It's difficult to argue with price action, but I'm going to give it a try. First, congratulations to the bulls. A couple weeks ago, the Federal Reserve expressed concern about global economic uncertainty and the market fizzled. If there's one thing I've learned over decades of following the stock market, it's that traders absolutely LOATHE uncertainty. And Fed Chair Yellen gave the bears plenty of ammo after the latest FOMC announcement. So it only made sense that when Friday's weak jobs report showed that the uncertainty should be directed at the U.S. stock market, traders panicked. Futures were higher on Friday prior to the report, but the Dow Jones immediately sank 200 points after the bad report.

But the good news for the bulls is that there was very little selling after the opening bell. The bears tried to take prices lower in the first 30 minutes, but then one of the strongest reversals of 2015 took place and stocks finished on their highs on another day of solid volume. For the third consecutive session, buying was strong heading into the close. So everything is wonderful again in bull market land, right? Well.....

Energy, materials and healthcare were all up more than 2%. The XLE (energy ETF) was higher by 4.13% - a huge day! Energy is in the process of bottoming, if it hasn't already. It's still volatile and there's certainly still a lot of risk in the group, but they've taken a beating over the past 15 months and a few positive technicals have developed. Check this out:

Energy closed above its 20 day EMA with its strongest day of buying throughout its recent downtrend (big hollow candle provides evidence of that). Also note that the relative downtrend since May was broken. That suggests to me that the worst is probably behind the group. The downside to Friday's huge reversal, however, was the performance of financials - the XLF fell near 0.50% - and technology. The latter was only fractionally higher.

Pre-Market Action

U.S. futures are very strong right out of the chute this morning as global markets are moving in unison to the upside. The German DAX, at last check, was higher by roughly 2.7% and challenging key resistance. Strength overseas is carrying into the U.S. market and given Friday's solid reversal the bulls are definitely in charge in the near-term.

There's little in the way of corporate earnings and news, but that will change soon as earnings season approaches. Alcoa (AA) is generally seen as the company that kicks off quarterly earnings season and they're set to report on Thursday after the close. This is more of a ceremonial opening of earnings season than anything else as AA's results will likely have little impact on overall market performance.

Current Outlook

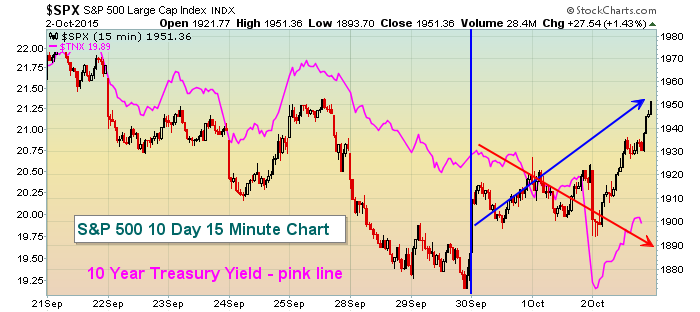

There's no doubt that the picture has improved with the action in the second half of last week. The bears received the fundamental news they wanted on Friday morning as the Federal Reserve's concern about economic conditions rang true. But I follow the market reaction much more than I do the actual news. The reason is simple. Fundamental announcements tell us what happened yesterday while technical price action tries to predict what's going to happen. Therefore, Friday's positive action after horrible news should not be overlooked. It could simply be that a lot of bad news was already priced in as our major indices had tumbled following the September 17th FOMC announcement. So perhaps this was just a much-needed technical bounce. Action this week will help us determine if that's the case and this morning's futures are making a strong argument that the high volatility, panicked August selloff marked a significant bottom in the ongoing bull market. I would like to see more participation from the key aggressive sectors like financials and technology to feel more bullish about this action. Also, it will be important to see the selling of treasuries (with a corresponding spike in the 10 year treasury yield) to help fuel a continuing stock market rally. Below is the divergence between the direction of the S&P 500 and the direction of the 10 year treasury yield ($TNX) the past few trading sessions:

If we begin to see a major push higher in the TNX, that would support the ongoing bull market. But the only way that lower yields and a rising S&P 500 make sense is if the market is anticipating another round of quantitative easing (QE) and few have even discussed that possibility. At this point, I wouldn't bank on such a development. In other words, if you're bullish stocks, you want to see higher yields support this move, not further accommodation by the Federal Reserve - just my opinion.

Sector/Industry Watch

I discussed the nice technical move in energy earlier. One industry group that I'd watch closely if you're a fan of this sector is U.S. exploration and production ($DJUSOS). A double bottom is currently in place so now I'm simply awaiting a breakout above 675 to clear both trendline and price resistance. Such a move would confirm that a bottom is in place and I'd begin trading the group as if a new uptrend has emerged. Take a look at the current technical picture:

It would seem this rally has legs to the 670-675 level, then we'll see what the bulls are made of. Several recent rally attempts have failed near 675 (red arrows) and you can see that 675 had previously held as price support during the downtrend (green arrows). Throw in the 50 day SMA at 656 and the downtrend line closer to 675 and I'd imagine the bears will try to make a stand at that level. We may find out today if pre-market strength holds into Monday's regular hours of trading.

Historical Tendencies

Early October carries bullish implications as does the first week of trading just about every calendar month. The Russell 2000 is the big exception as it shows mostly negative historical action through the first week of October. Watching the relative action of small caps will be worthwhile. Of course, I like to see relative strength in small caps as this suggests that traders are willing to take on more risk. Taking risks is what bull markets are all about. A strong Russell 2000 also provides a solid outlook on U.S. companies as most of the smaller companies rely much more heavily on a vibrant U.S. economy.

One word of caution: October is home to the worst week of the year historically and it's rapidly approaching, just a couple short weeks away. I'll be providing more details on this upcoming bearish week in future morning reports.

Key Earnings Reports

None

Key Economic Reports

September PMI services to be released at 9:45am EST: 55.8 (estimate)

September ISM manufacturing to be released at 10:00am EST: 58.0 (estimate)

Happy trading!

Tom