RRG Charts September 27, 2022 at 12:41 PM

In this week's edition of StockCharts TV's Sector Spotlight, I review the current rotations for asset classes, where we find continuing strength for the US dollar and fixed-income-related asset classes, while stocks are rotating back to the lagging quadrant... Read More

RRG Charts September 23, 2022 at 05:36 PM

When markets across the world and all asset classes are dropping, it's time to put things into (international) perspective and see if any alternatives to US stocks are available... Read More

RRG Charts September 20, 2022 at 11:59 AM

In this week's edition of StockCharts TV's Sector Spotlight, at asset class level, I highlight the strength of the USD, which also plays a role in the weakness of BTC. Stocks and bonds did not move much last week, while commodities seem to be turning... Read More

RRG Charts September 16, 2022 at 04:37 PM

I seriously hope that I was able to make clear in last Tuesday's Sector Spotlight that the market ($SPX) is still on shaky grounds and certainly not (back) in an uptrend. Sure, I mentioned the short-term improvement, which was undeniably there... Read More

RRG Charts September 13, 2022 at 05:09 PM

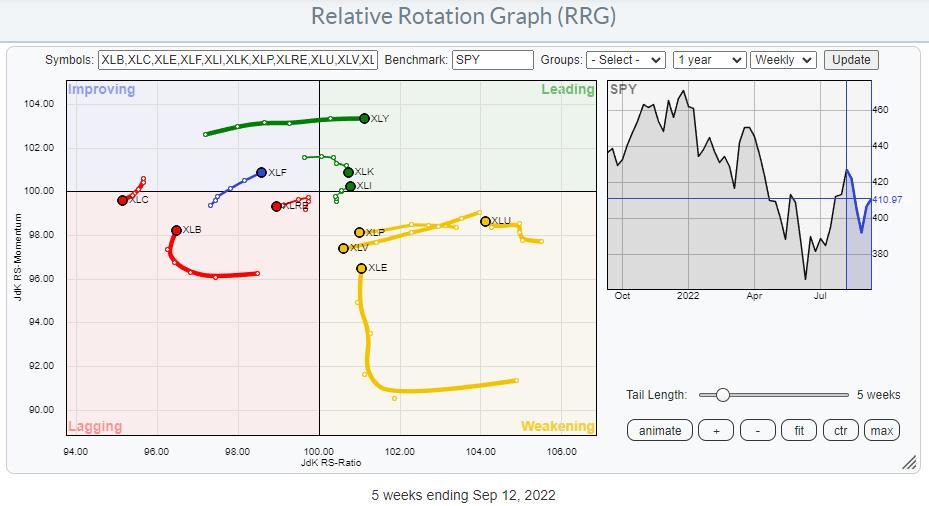

On the weekly Relative Rotation Graph, the consumer discretionary sector continues to improve and is now pushing further into the leading quadrant. It is now the sector with the highest JdK RS-Momentum reading... Read More

RRG Charts September 13, 2022 at 12:30 PM

In this week's edition of StockCharts TV's Sector Spotlight, I start with an overview of the current asset class rotation, using daily and weekly Relative Rotation Graphs... Read More

RRG Charts September 06, 2022 at 12:10 PM

In this week's edition of StockCharts TV's Sector Spotlight, for the first Tuesday of September, I dive into the monthly chart, which was completed last Thursday... Read More

RRG Charts September 02, 2022 at 09:53 AM

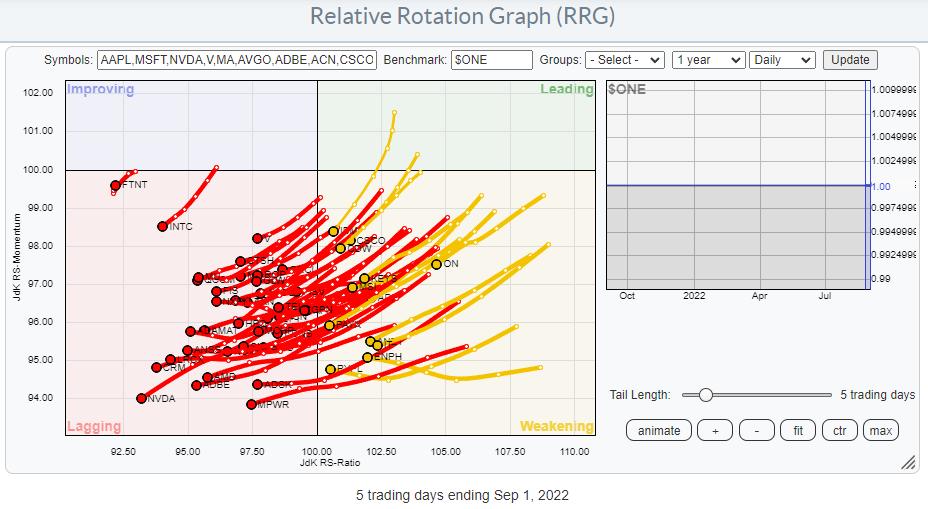

Plotting the components of the Information Technology Sector against $ONE provides us with a sobering picture. Pretty much every single stock in that index is in a downtrend, inside lagging, and/or inside weakening (and very close to entering lagging)... Read More