Sometimes less is more. When things are messy and there are a lot of things that are moving markets I usually like to take a step back and look at some of the very basic stuff to get rid of all the noise and clutter.

On this occasion, I thought to have a quick look at what we can potentially learn from the Dow Theory, or what takes we can get from it with regard to the current situation in the market.

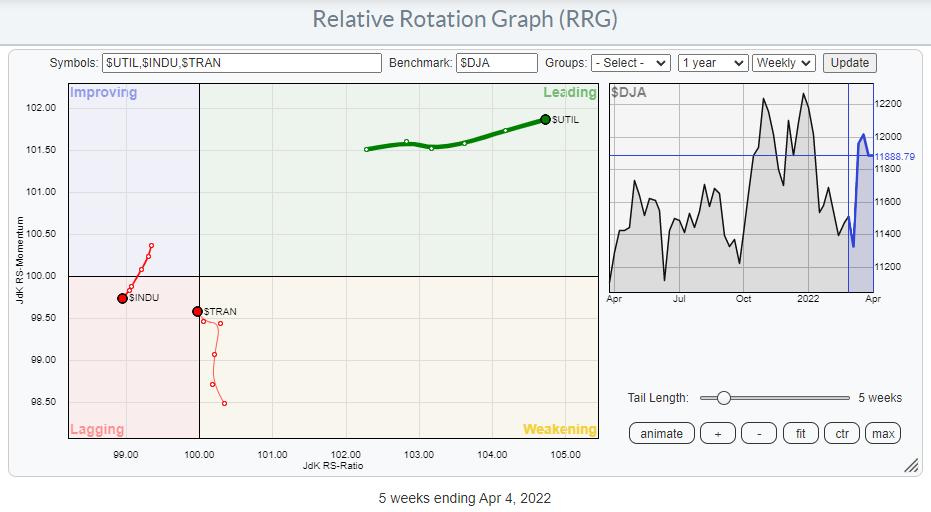

The RRG above shows the three indexes that make up the Dow Jones Composite Average. The DJ Industrials (30 stocks), the DJ Transportation (20 stocks), and the DJ Utilities (15 stocks).

The rotational picture as shown in that RRG is pretty clear. Utilities are leading the pack. Deep inside the leading quadrant, continuing to gain on the JdK RS-Ratio axis and stable to slightly higher on the Jdk RS-Momentum scale. Clearly the strongest segment in this universe.

The opposite goes for the Industrials. This tail has just rotated back down towards the lagging quadrant over the past weeks and is now once again moving deeper into it at a negative RRG-Heading, meaning that this segment is losing on both scales.

The Transportation segment is somewhat in between. Just inside lagging but picking up in terms of relative momentum. But more importantly, the classic Dow theory states that the indexes must confirm each other. And that we can clearly see, is NOT the case at the moment.

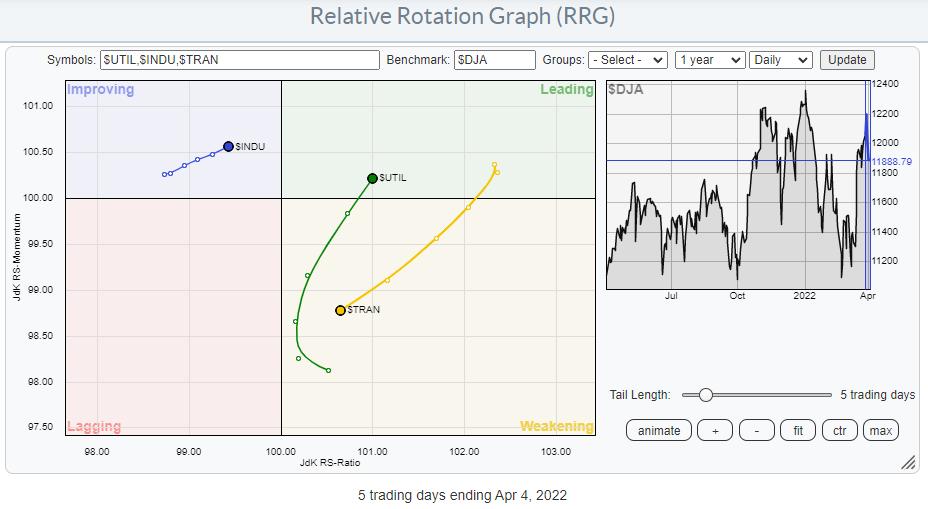

Even when we plot the same universe on a daily RRG we can see the mixed image where Industrials and Transportation are moving in opposite directions and here also Utilities rotating back into the leading quadrant after a short stint through weakening.

So my main takeaway from these RRGs is that Industrials and Transportation are not in sync which basically means that there is no meaningful primary trend. And Utilities are clearly leading. We all know utes are a defensive play.

So the lack of a clear primary trend and a preference for defensive stocks by the market makes me very cautious at the moment.

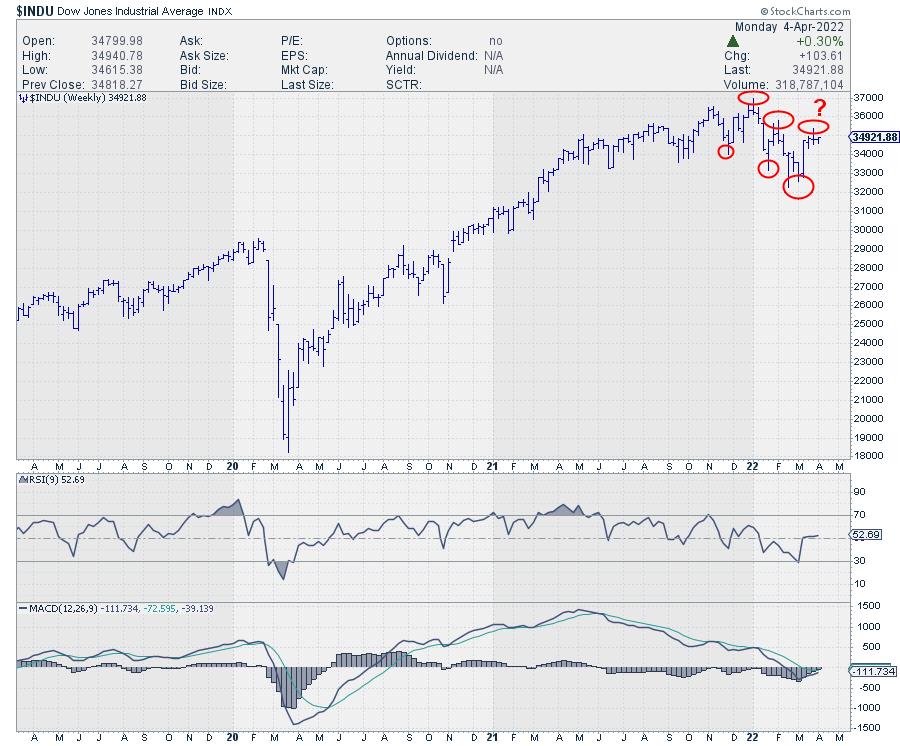

A quick look at the weekly chart of the Dj Industrials shows that a series of lower highs and lower lows seems to be underway since the start of this year. The three lower lows are confirmed, the third lower high not yet. It is still possible that the current rally will take out the previous high at 36k and violate this series.

But even when that would happen it does not mean that we have a full-fledged uptrend back in our hands. At best some more consolidation.

Please note that I am in no way "predicting" a crash or a major turnaround, I am just trying to take guidance from information that the market is sending us. And at the moment I do see a lot of "things" that are not supportive of a broad-based (continuation of the) up-trend.

As usual, there are certainly pockets of opportunities, like utilities at the moment, but my overall takeaway is that caution is still needed and the market will very likely need more time to digest the two-year rally that was in play since early 2020.

#StaySafe, --Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Research

Host of: Sector Spotlight

Please find my handles for social media channels under the Bio below.

Feedback, comments or questions are welcome at Juliusdk@stockcharts.com. I cannot promise to respond to each and every message, but I will certainly read them and, where reasonably possible, use the feedback and comments or answer questions.

To discuss RRG with me on S.C.A.N., tag me using the handle Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.