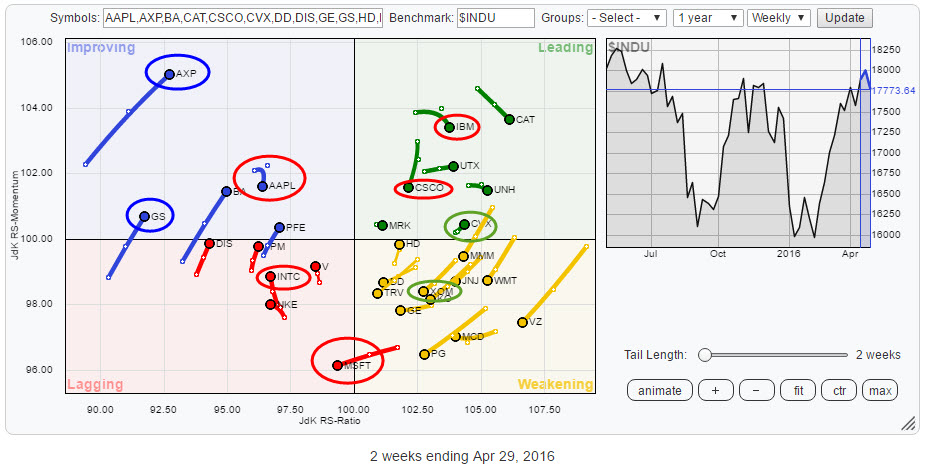

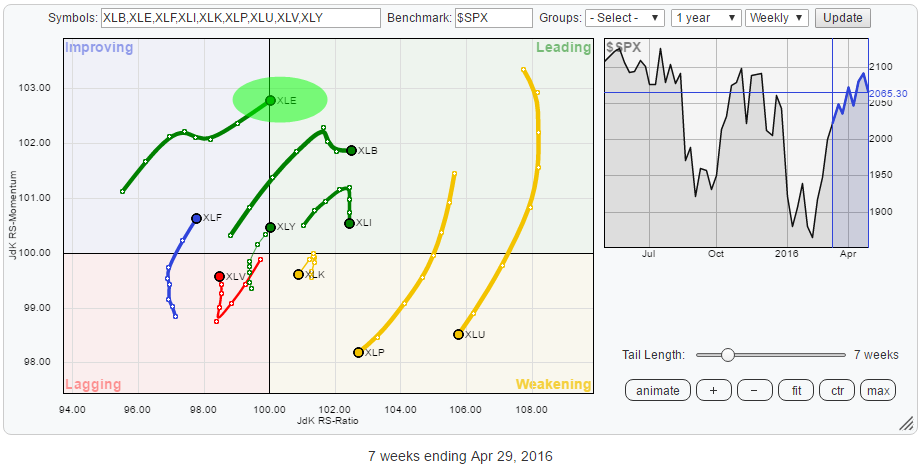

This Relative Rotation Graph holds the constituents of the Dow Jones Industrials Average ($INDU) and shows the position and movement of their relative trends against $INDU and each other.

In this article, I will focus on the movements in the technology- and the energy sectors and briefly touch on financials.

Summary

- Financials showing weakest relative trend on a sector level

- AXP running into resistance making further rise difficult

- Other financials (GS, JPM, V, TRV) showing similar patterns.

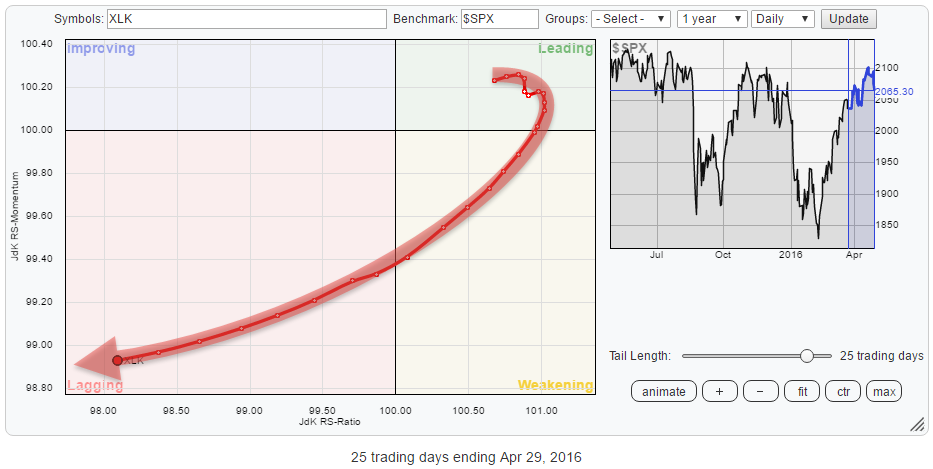

- Technology sector ETF (XLK) rotating into lagging quadrant on daily RRG

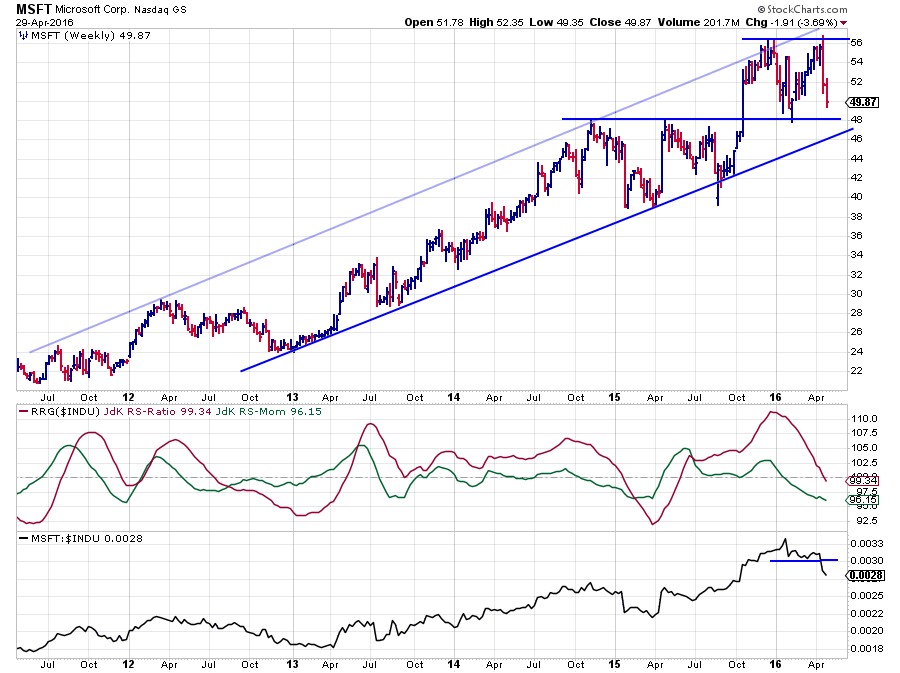

- MSFT about to complete a double top pattern

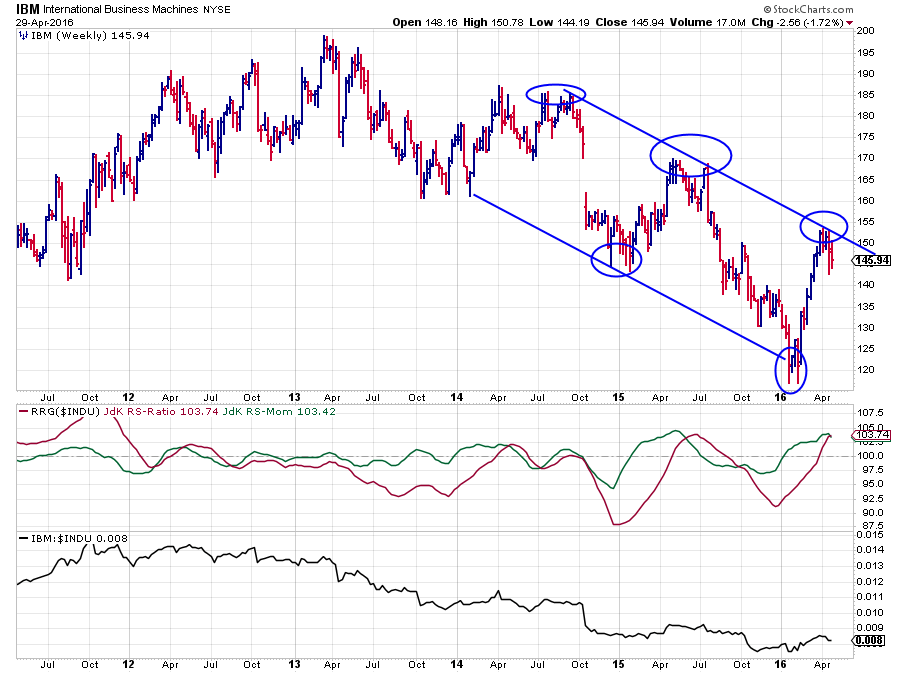

- IBM stalling against resistance

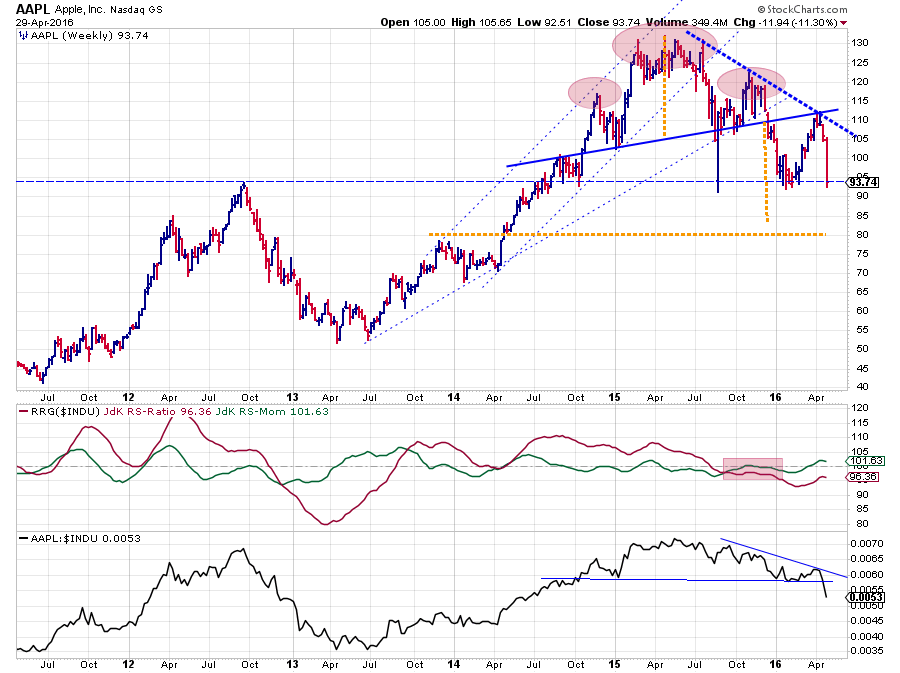

- AAPL ready to rotate back towards lagging quadrant

- XLE crossing over into leading quadrant

- CVX and XOM ready to push higher on strong relative strength and after breaking resistance

Quick Scan

A quick scan of the Relative Rotation Graph at hand shows interesting rotations for AXP and MSFT. AXP catches my attention as it is powering ahead inside the improving quadrant at the highest JdK RS-Momentum level within this universe. However, it is the second weakest stock measured on the JdK RS-Ratio scale.

When I look for other stocks in the financial sector, I find GS, JPM, and V all going through fairly similar rotations on the left-hand side of the RRG, albeit not as strong as AXP. And, still, inside the weakening quadrant we see TRV heading towards the lagging quadrant. Not the strongest rotations inside this sector, therefore. All these financials are circled in blue.

The other stock that draws attention is MSFT. It is crossing over into the lagging quadrant at the lowest, or most negative, JdK RS-Momentum level. Again, scanning the RRG for other technology stocks we find AAPL inside the improving quadrant but sharply turning back towards lagging and we find IBM and CSCO inside the leading quadrant but also, already, heading lower on the RS-Momentum scale. A mixed picture. I have highlighted these tech stocks in red.

Knowing that the Energy sector is about to cross over into the leading quadrant from improving, I was interested to see the rotation of the energy stocks within this universe. Inside $INDU there are only two energy stocks, these are CVX and XOM. Looking for those two on the RRG reveals that XOM is inside the weakening quadrant, heading lower on both scales while CVX is inside the leading quadrant with a very short tail and moving (only slightly) higher on both scales.

Financials

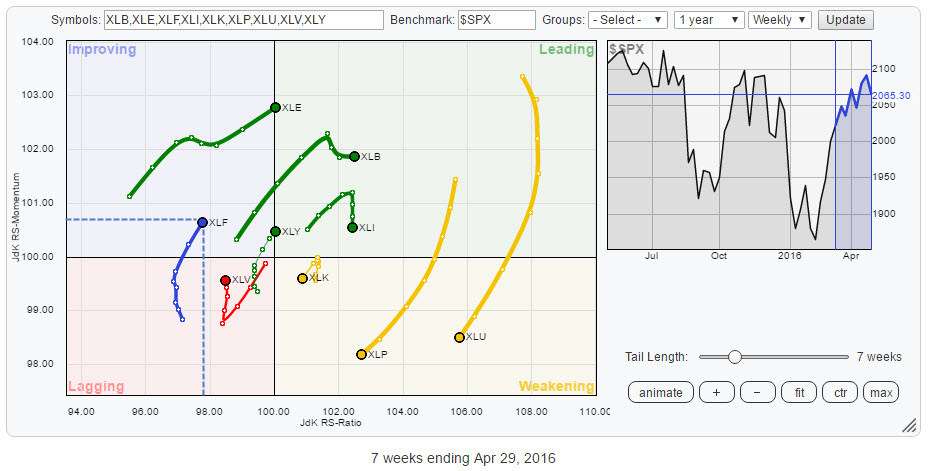

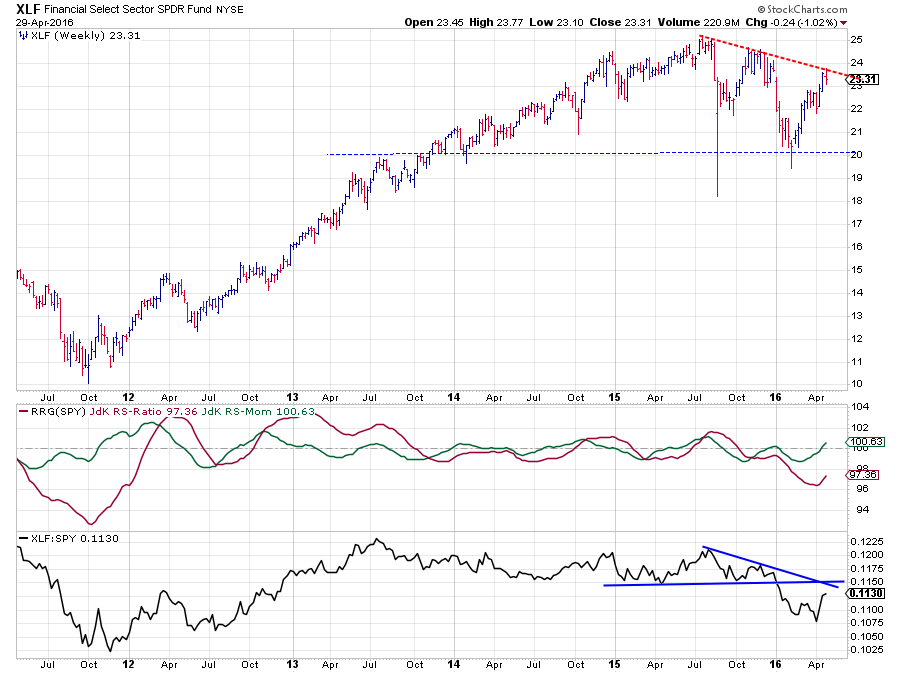

On the sector RRG, using the sector ETFs that make up the S&P 500 index, XLF (financials) shows up as the sector with the weakest relative trend in this universe. The tail is gaining strongly on the JdK RS-Momentum axis but much less on the RS-Ratio axis. Despite this improvement, XLF is still a sector to approach with caution, especially as it seems to be running into resistance on the weekly price chart now which will likely put a cap on the current up-move.

On the sector RRG, using the sector ETFs that make up the S&P 500 index, XLF (financials) shows up as the sector with the weakest relative trend in this universe. The tail is gaining strongly on the JdK RS-Momentum axis but much less on the RS-Ratio axis. Despite this improvement, XLF is still a sector to approach with caution, especially as it seems to be running into resistance on the weekly price chart now which will likely put a cap on the current up-move.

American Express - AXP

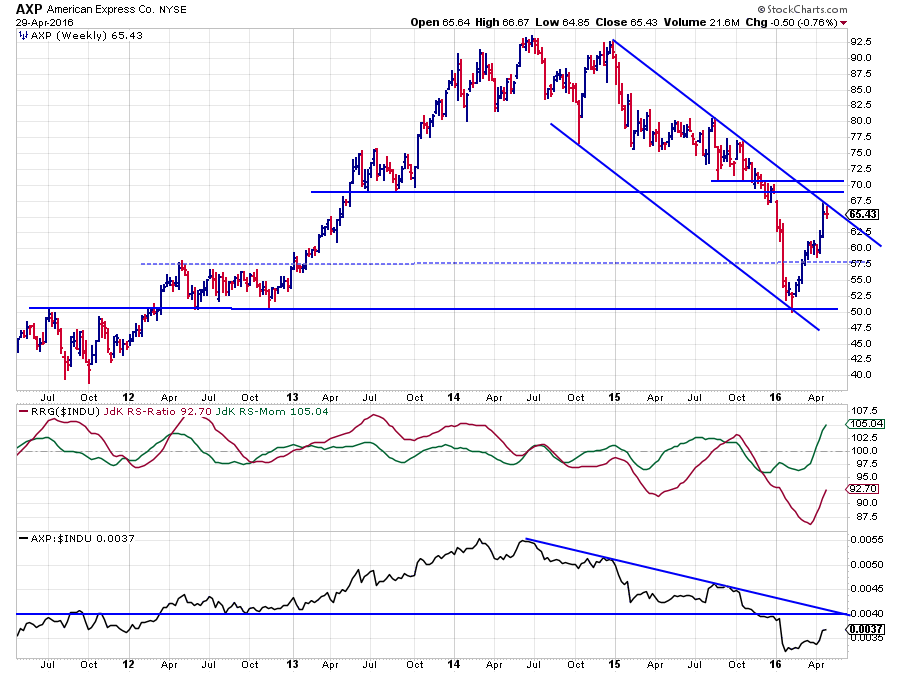

A similar pattern seems to be developing on the chart of AXP. After a steep drop to support near $ 50, the stock recovered rapidly, causing the rotation into the improving quadrant on the Relative Rotation Graph. At the moment, however, AXP is running into resistance coming off the resistance line that connects the major 2015 peaks. Even a push beyond that falling resistance line will not improve the picture in a major way as there are still a few serious overhead, horizontal, resistance levels waiting just beyond the trendline.

A similar pattern seems to be developing on the chart of AXP. After a steep drop to support near $ 50, the stock recovered rapidly, causing the rotation into the improving quadrant on the Relative Rotation Graph. At the moment, however, AXP is running into resistance coming off the resistance line that connects the major 2015 peaks. Even a push beyond that falling resistance line will not improve the picture in a major way as there are still a few serious overhead, horizontal, resistance levels waiting just beyond the trendline.

All in all, there seems to be little upside potential left for AXP while the relative strength line (lowest pane) is still clearly in a downtrend. This combination of observations leads to the belief that AXP is in for a rotation back down towards the lagging quadrant again, without reaching the leading quadrant.

The other financials components inside $INDU (GS, JPM, V, and TRV) are showing somewhat similar patterns. This makes a leading role for the financial sector unlikely in coming weeks.

Technology

On the weekly sector RRG, as shown above, the financials sector makes a sharp turn left, more or less counter-clockwise. To get a better handle on such moves it is often a good idea to zoom in on a daily RRG like below.

This chart reveals that the sudden move of XLK on the weekly chart is actually a very clear rotational move, into the lagging quadrant, on the daily RRG.

This chart reveals that the sudden move of XLK on the weekly chart is actually a very clear rotational move, into the lagging quadrant, on the daily RRG.

Microsoft - MSFT

On the price chart, MSFT is still within the boundaries of a rising channel that started at the transition of 2012 into 2013. The first sign of weakness occurred when the last rally did not manage to break beyond its previous high and a second top was formed around $ 56. With the decline from that last peak now underway towards support around $ 48 a potential double top formation is unfolding.

On the price chart, MSFT is still within the boundaries of a rising channel that started at the transition of 2012 into 2013. The first sign of weakness occurred when the last rally did not manage to break beyond its previous high and a second top was formed around $ 56. With the decline from that last peak now underway towards support around $ 48 a potential double top formation is unfolding.

As this is a pretty major double top on a weekly chart, its impact, if and when support around $ 48, is broken, can be expected to significant. Based on the height of the formation a target can be calculated around $ 40.

From a relative point of view things also are starting to deteriorate. The JdK RS-Ratio is now crossing below the 100-mark, indicating that a new relative downtrend is starting. This is confirmed in the RS-Line where the recent low was taken out and a new series of lower highs and lower lows seems to be getting underway.

All in all not a lot of good signals for MSFT which justifies the expectation for a further rotation into the lagging quadrant and more underperformance against $INDU ahead.

International Business Machines - IBM

Another important technology stock inside $INDU is IBM. On the Relative Rotation Graph, IBM is actually inside the leading quadrant but already started to move lower on the RS-Momentum scale after only a few weeks into it.

Another important technology stock inside $INDU is IBM. On the Relative Rotation Graph, IBM is actually inside the leading quadrant but already started to move lower on the RS-Momentum scale after only a few weeks into it.

On the price chart, IBM looks quite different from MSFT. Where we saw a rising channel for MSFT. IBM is in a downtrend already for roughly three years. The recent rally was sharp and steep and almost without any corrective movement. AT the moment, however, this rally looks to stall against the falling resistance line.

A look at the daily price chart of IBM reveals that the market tried to attack the resistance area between $ 150-152.50 three times over the past few weeks with no success. The low at $ 142.50 should now offer some support but when it gives way an acceleration of the decline will very likely kill the very young relative uptrend.

Apple Inc. - AAPL

The third technology stock that is sending signs of weakness is AAPL. As you can see on the chart above a series of lower highs and lower lows is well underway on a weekly basis, and a Head & Shoulders top formation was completed at the end of last year when price broke below the neckline. After the initial decline, which resulted in a low near $ 90, a recovery move took price back up to the level of the former neckline, now acting as resistance. Last week's sharp decline is now challenging support offered by the previous low. A break lower will very likely lead to a further decline targeting the horizontal level around $ 80, which is just below the target that can be calculated based on the H&S formation.

The third technology stock that is sending signs of weakness is AAPL. As you can see on the chart above a series of lower highs and lower lows is well underway on a weekly basis, and a Head & Shoulders top formation was completed at the end of last year when price broke below the neckline. After the initial decline, which resulted in a low near $ 90, a recovery move took price back up to the level of the former neckline, now acting as resistance. Last week's sharp decline is now challenging support offered by the previous low. A break lower will very likely lead to a further decline targeting the horizontal level around $ 80, which is just below the target that can be calculated based on the H&S formation.

The JdK RS-Ratio line already picked up a downtrend in relative strength, back in 2015. This weakness got confirmed last week when the raw RS-Line broke below a horizontal support level which opened up more relative downside potential.

With three major tech stocks sending negative and/or warning signs caution is advised for this sector.

Energy

On the sector RRG, XLE (energy sector) is crossing over into the leading quadrant from improving on still rising relative momentum. At the moment, this is the sector with the highest relative momentum and about to start a new relative uptrend. Reason enough to take a closer look at the energy stocks inside the Dow Jones Industrials universe, CVX and XOM.

On the sector RRG, XLE (energy sector) is crossing over into the leading quadrant from improving on still rising relative momentum. At the moment, this is the sector with the highest relative momentum and about to start a new relative uptrend. Reason enough to take a closer look at the energy stocks inside the Dow Jones Industrials universe, CVX and XOM.

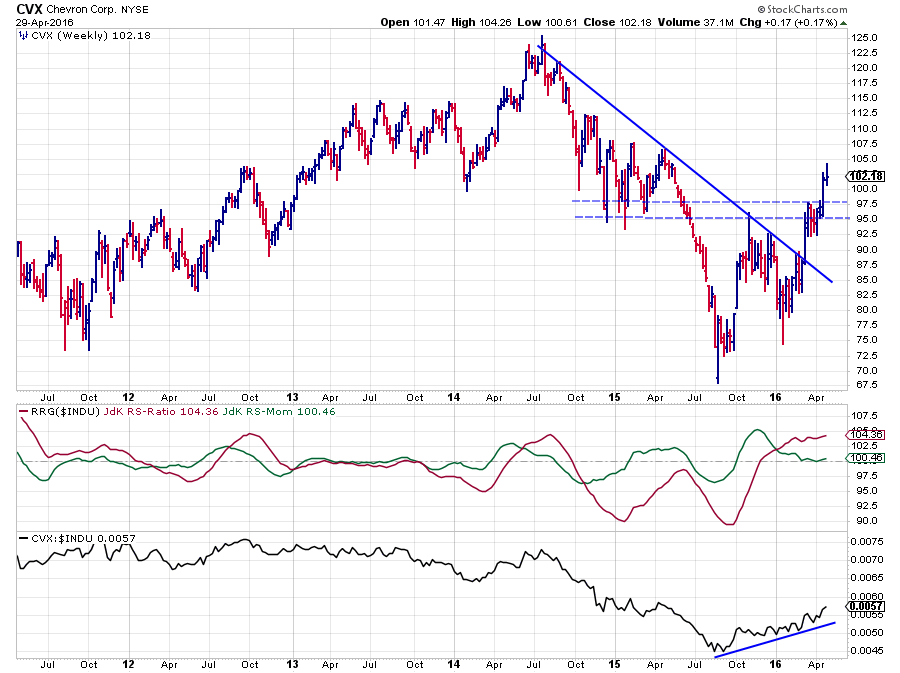

Chevron Corp. - CVX

On a relative basis, CVX already started to improve at the end of 2015 when the JdK RS-Ratio rose above 100 and indicated the start of a new relative uptrend. This new relative strength for CVX became clearly visible when the general market fell sharply in the first few weeks of this year but the CVX:$INDU ratio steadily continued to rise.

On a relative basis, CVX already started to improve at the end of 2015 when the JdK RS-Ratio rose above 100 and indicated the start of a new relative uptrend. This new relative strength for CVX became clearly visible when the general market fell sharply in the first few weeks of this year but the CVX:$INDU ratio steadily continued to rise.

This situation has not changed until today and in the relative strength graph, we can see a steady uptrend underway. As said this uptrend was picked up by the RS-Ratio line late last year. The loss of momentum of this relative rally caused the RS-Momentum line to dip but it seems to be bottoming out at or just above the 100-level and positioning itself for a new move higher. Such a move will push CVX deeper into the leading quadrant on the RRG and confirm the relative strength for this stock at the moment.

The positive RS charts are currently backed by a strong price chart, in which just recently an important horizontal resistance level near $ 97.50 was taken out to the upside which opened up more upside potential for the stock price in absolute terms as well.

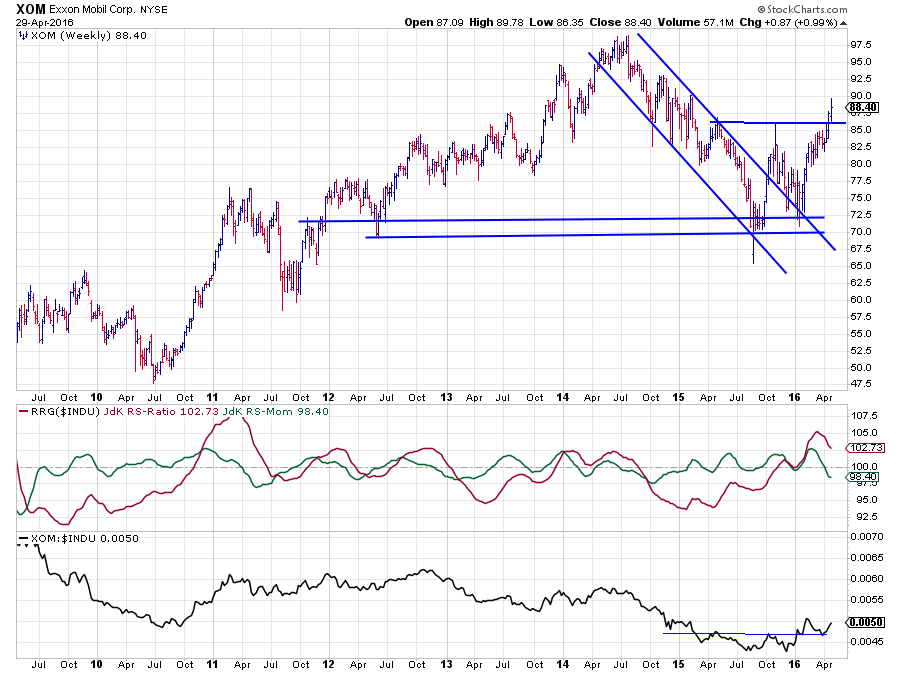

Exxon Mobile Corp - XOM

XOM is showing a similar picture to CVX but slightly lagging on a relative basis. On the relative charts, it can be seen that the downtrend in the RS-line has turned around in the beginning of this year when the XOM:$INDU ratio broke above its previous high for the first time since late 2012. This turn was strong enough for the RS-Ratio line to break above 100 and pick up on the new relative uptrend.

XOM is showing a similar picture to CVX but slightly lagging on a relative basis. On the relative charts, it can be seen that the downtrend in the RS-line has turned around in the beginning of this year when the XOM:$INDU ratio broke above its previous high for the first time since late 2012. This turn was strong enough for the RS-Ratio line to break above 100 and pick up on the new relative uptrend.

The corrective move in relative strength in XOM was a bit stronger than for CVX causing the RS-Momentum line to drop below 100 and cause a rotation for CVX into the weakening quadrant.

The recent strength in the rice chart, where XOM, just like CVX, has broken above an important previous high, will very likely cause the relative momentum to pick up again and push XOM back up again towards the leading quadrant.

Zooming in on the rotation for both energy stocks on a daily basis shows that they are both well inside the leading quadrant and pushing higher on both axes.

Zooming in on the rotation for both energy stocks on a daily basis shows that they are both well inside the leading quadrant and pushing higher on both axes.

The dip in XOM therefore, looks to be a good opportunity to get (back) onboard of this relative uptrend.

Julius de Kempenaer | RRG Research

RRG, Relative Rotation Graphs, JdK RS-Ratio and JdK RS-Momentum are registered TradeMarks by RRG Research

Follow RRG Research on social media:

LinkedIn Facebook Twitter