The markets remain in a tight trading range amid mixed inflation data and a slowdown in the number of earnings being reported last week. With the bulls looking for a soft landing as the Fed pauses their rate hike campaign, the bears are fearing a more harsh recession due to sticky inflation and the recent tightening of credit.

As you can see in the chart below, we've been in a trading range for the past six weeks and, with April's critical inflation reports now behind us and earnings season tapering off, we may well remain in this range until at least the Federal Reserve's next rate decision on June 14th and, more possibly, well into the 2nd half of the year.

DAILY CHART OF S&P 500 INDEX

At this time, the Fed has forecasted a mild recession; however, major CEOs such as JPMorgan (JPM) head Jamie Dimon and billionaire Stan Druckenmiller are on the lookout for something much more harsh. Their reasons for an imminent economic downturn? Higher interest rates and tightening of credit. Last week, N.Y. Fed President Daly relayed that there are already signs of reduced lending among regional banks.

One way to guard against the possibility of a downturn in the economy, and hence the markets, is to expand your portfolio to include dividend-paying stocks. In addition to providing a stable--mostly quarterly--cash flow, these stocks often prove to outperform peers that don't offer a payout.

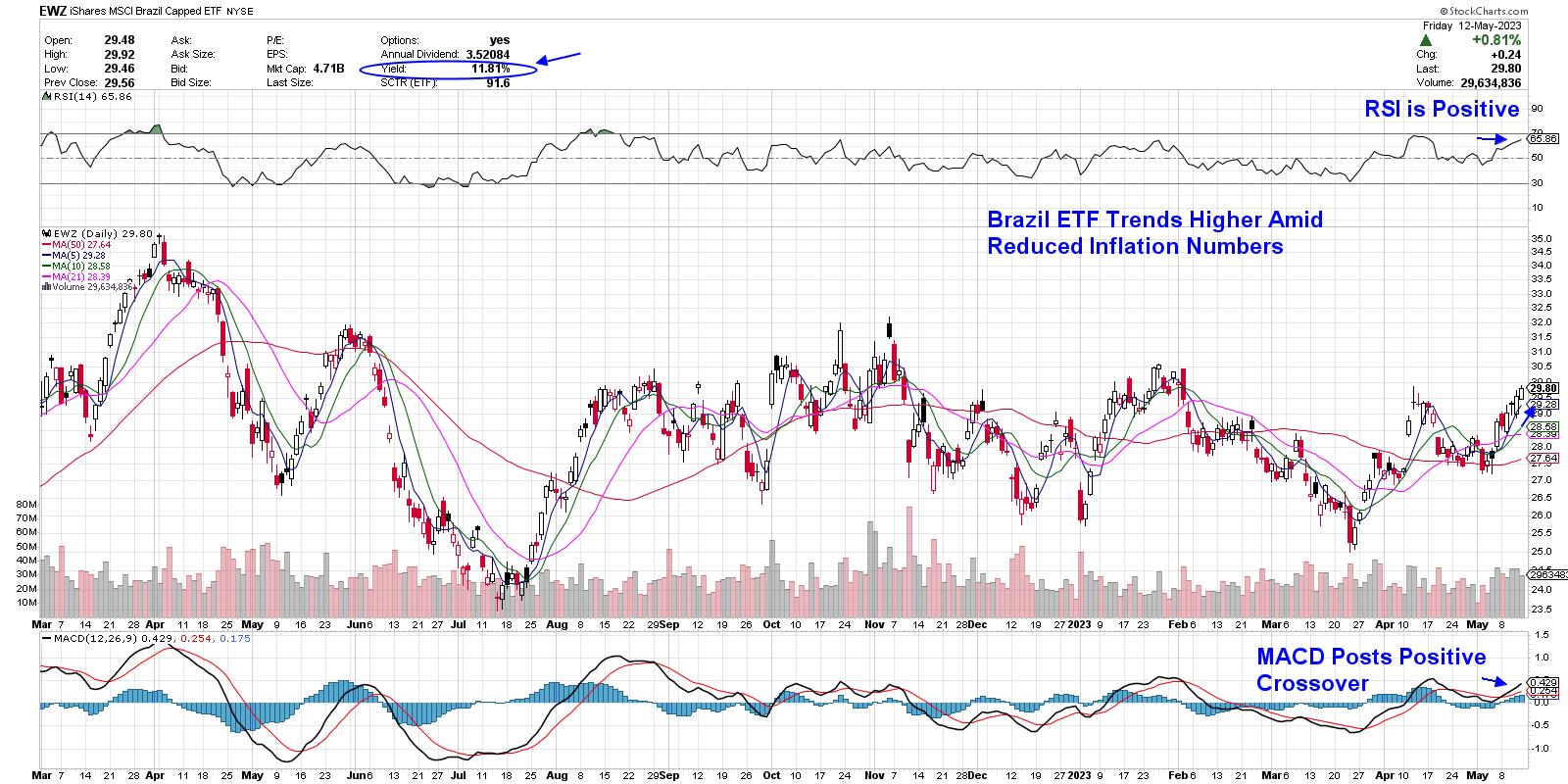

Here is one high dividend producing stock and one ETF that can help counterbalance any downturn due to a weaker-than-expected economy. First up is iShares MSCI Brazil ETF (EWZ), which entered an uptrend late last week after the country reported that inflation dropped to 4.7% in March, which puts the rate within 1.5% of their target rate. In addition, it's forecasted that Brazil's central bank may begin cutting interest rates in the second half of this year. And while a rising dollar may hurt the prospects for this commodity-rich country, last week's uptick in the U.S. dollar did not have an impact.

DAILY CHART OF ISHARES BRAZIL ETF (EWZ)

EWZ offers a 11.85% yield and this ETF broke out of a 1-month base on heavy volume last week, with the MACD posting a positive crossover. While EWZ is in an uptrend, the ETF is extended following last week's gains and buyers may want to wait for a pullback to the $29.3 range as an entry.

Next up is fast food franchise company Wendy's (WEN) which broke out of a 5-month base last week after reporting earnings that were ahead of estimates. The stock offers a 4.3% annualized yield, which is far higher than the S&P's average yield of 1.6%. The company also reaffirmed forward guidance of growth going into the remainder of this year as well as next year.

DAILY CHART OF WENDY'S CO. (WEN)

In addition to growing sales, the company is rapidly accelerating their investment into its digital business after entering into an agreement with Alphabet (GOOG) to use artificial intelligence to take customer drive through orders. This move will reduce costs for Wendy's while improving their efficiency.

There are other ways to combat the currently lackluster market, such as investing in stocks that are in defensive areas of the market but that also offer a growth component. Subscribers to my MEM Edge Report will be familiar with this strategy, as we've been employing it over the past several months with a move into select Healthcare and other stocks.

If you'd like immediate access to this list of stocks, use this link here so you can be granted a 4-week trial at a nominal fee. You'll also receive twice weekly updates on the broader markets as well as in depth sector and stock analysis.

Have a great weekend!

Mary Ellen McGonagle, MEM Investment Research