Statistics show that December has the highest probability of a positive return over every other month of the year, and by a fair margin. Using data from 1926 to 2020, the odds of a positive return for U.S. large-cap stocks are 77.9%.

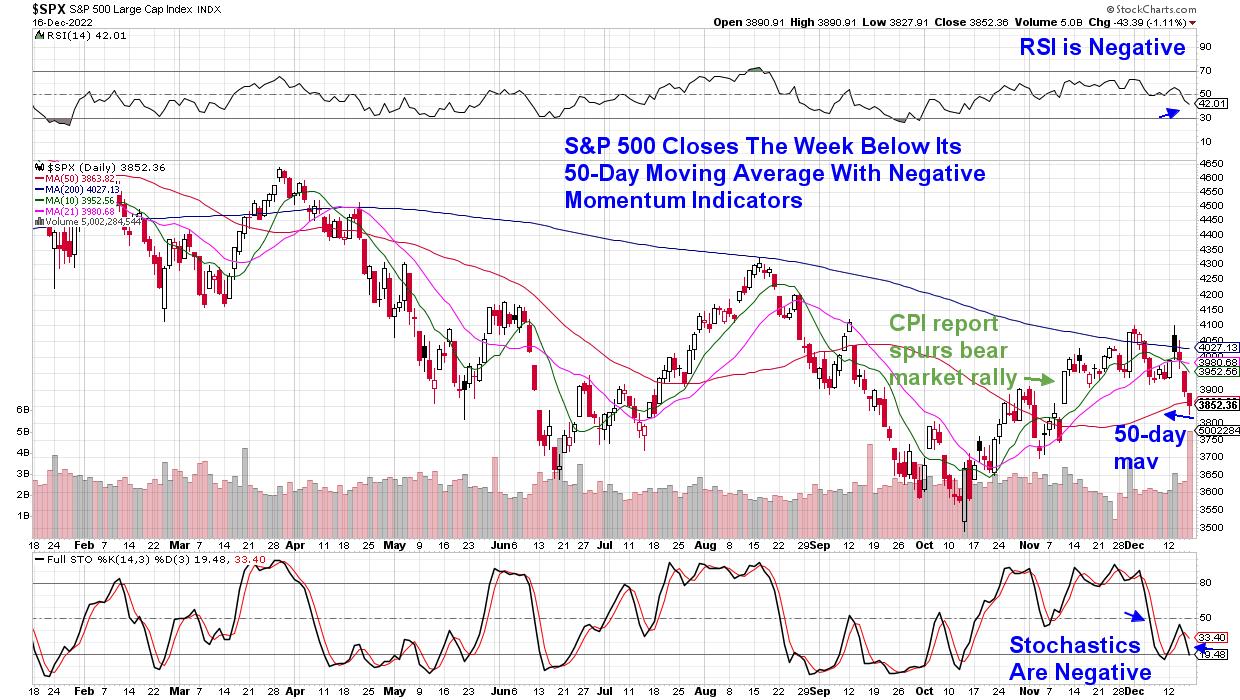

However, the markets will have some work to do this year for this trend to hold true. The S&P 500 Index ($SPX) is down 5.6% over the first two weeks of December. In fact, last week's drubbing pushed $SPX below its key 50-day moving average with both the relative strength index (RSI) and stochastic oscillator now in negative territory. This price action put a halt to the bear market rally that began on November 10 after a positive CPI report showed much lower inflation than expected.

Chart Analysis of S&P 500 Index

CHART 1: DAILY CHART OF S&P 500 INDEX. The index is below its 50-day moving average. The RSI and Full STO are in negative territory. The bear market rally could be coming to an end.Chart source: StockCharts.com. For illustrative purposes only.

Investors have been selling stocks recently due to recession fears, driven by the Federal Reserve's intent to keep interest rates high well into next year in an effort to get inflation levels closer to their 2% target. Just last week, the Fed lowered their forecast for growth in the U.S. next year to 0.5%, and they see the jobless rate rising to 4.6% by year-end.

This fear of a recession among investors has pushed stocks into an oversold position in the near term, and we may see a bounce next week. Keep in mind, however, any bounce is expected to be short-lived as the overall bear market trend remains in place.

Below is a shorter-term, one-hour chart of $SPX that highlights the RSI below 30 and the moving average convergence/divergence oscillator (MACD) below zero during periods of an oversold condition in November as well as earlier this month. To expect any rally, $SPX would need to trade back above its 5 and 13-hour moving averages with the MACD experiencing a bullish crossover of its black line moving up through the red line.

A Shorter-Term View of $SPX

While this shorter-term time frame of investing may not be for everyone, there is potential to make quick profits if you focus on the correct area of the markets. From there, you can select top candidates.

I've been favoring Healthcare stocks longer term, as they have a defensive bias with select areas faring well amid prospects for increased earnings growth. These same stocks stand to fare well in a shorter-term rally period as well.

If you'd like immediate access to my Suggested Holdings List, you can use this link here and access my most recent MEM Edge Report at a nominal cost.

The MEM Edge Report will also keep you on top of the rotation that's taking place away from areas of the market that fare poorly in the face of a possible recession. Be sure and use the link above so you can exit positions that are at the most risk while also being alerted to shifts in the broader market.

Warmly,

Mary Ellen McGonagle, MEM Investment Research