It was another volatile week amid mixed economic and corporate earnings reports, as investors continue to digest news in an effort to gain long-term insights into U.S. inflation and growth prospects. While the markets traded down for most of the week, the S&P 500 gapped up in price on Friday, in a move that was marked by relatively high volume (which is positive).

Economic data was one reason for the market's nice gain today; however, the primary driver among some of the day's biggest winners was 2nd quarter earnings reports. Today, eight large-cap companies came out with results and each one traded much higher on well-above-average volume. The average gain was 6%, which is over three times what the market posted.

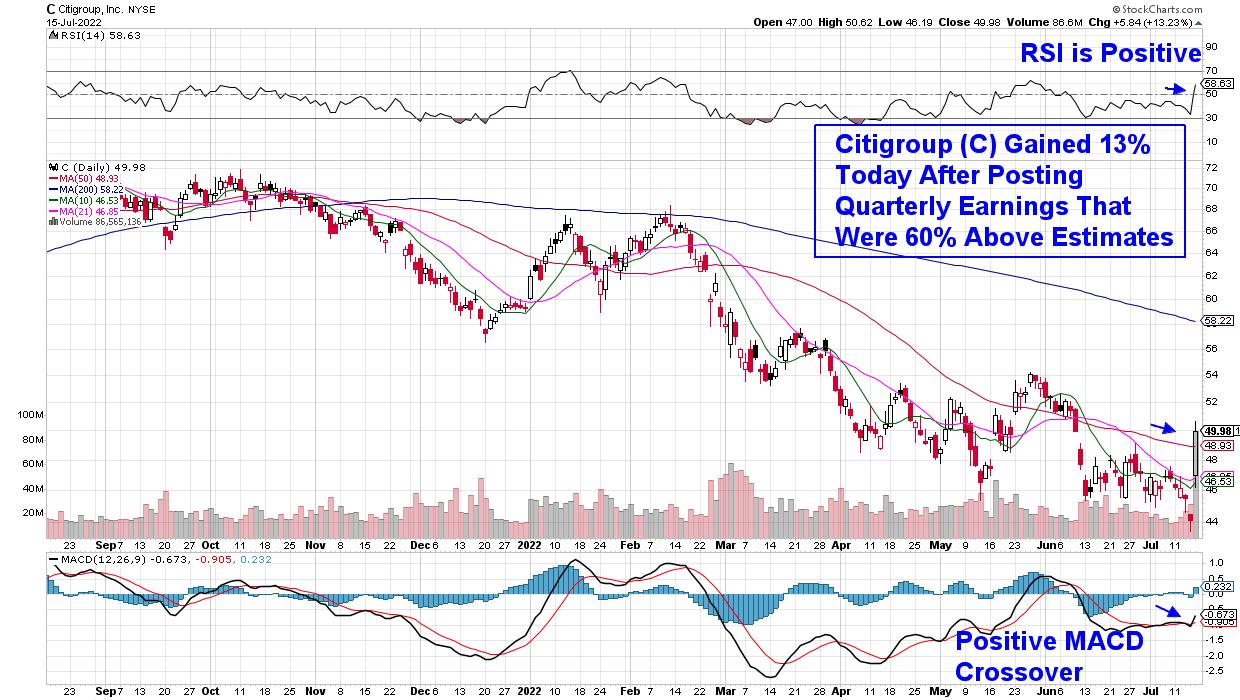

The largest gainer was Citigroup, which was up over 13% today on volume that was 250% above its average. This high volume indicates investors want in and often points to further upside as market conditions allow. The company's pop followed 2nd quarter results that were 61% above estimates.

DAILY CHART OF CITIGROUP (C)

Most of the other companies that reported today were also in the Financial sector and while none reported results that were as strong as Citigroup, each of the Bank stocks that reported, shared 2nd quarter results that came in above estimates. The fact that these stocks were so handsomely rewarded is the common thread, however, and this positive response may carry through into next week and beyond.

To begin, a number of stocks have seen their earnings estimates revised much lower after reporting weak 1st quarter results three months ago. Many Bank stocks, in particular, experienced reduced profits at that time as loan margins were reduced amid a flatter-than-usual yield curve.

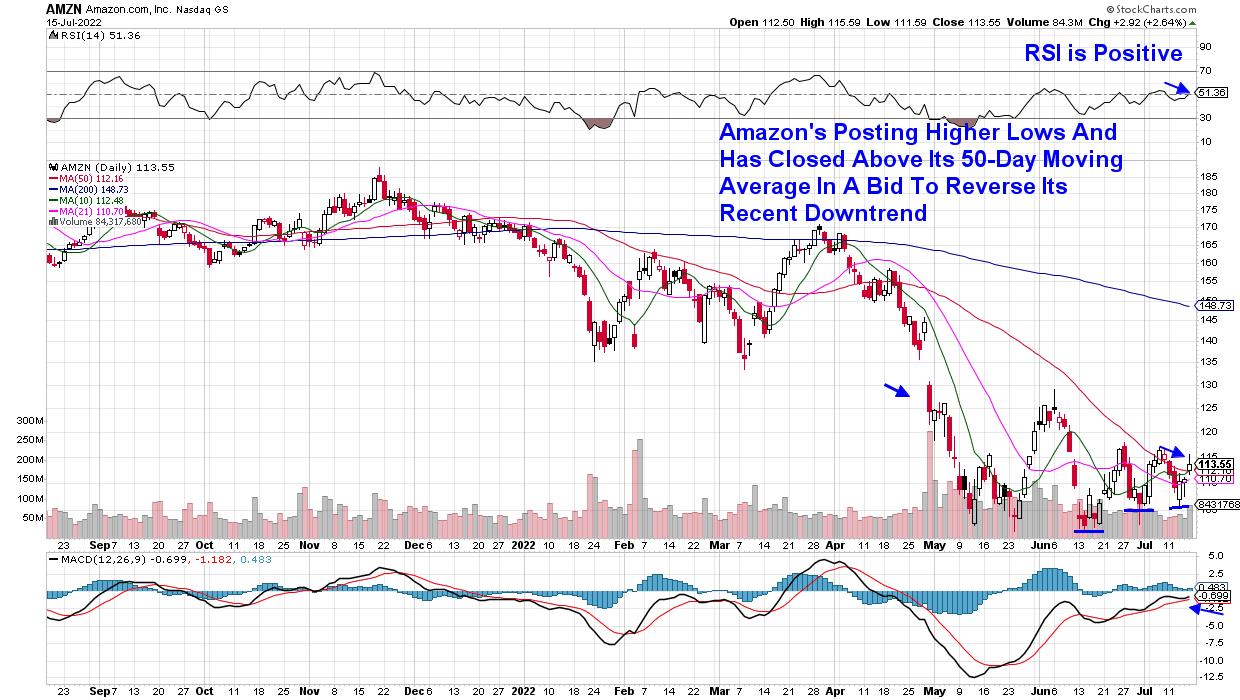

Other stocks also saw their estimates knocked a lot lower on weak Q1 results, with online retailer Amazon (AMZN) being a prime example (pun intended!). Estimates at this time are calling for an 84% decline in earnings for 2022 compared to last year.

DAILY CHART OF AMAZON (AMZN)

Analysts are revisiting their lowered outlook for the company, with Wall Street firm Barclays expecting Amazon to provide better-than-feared guidance for their 3rd quarter due to declining capital spending, among other factors. Barclays has a $195 price target on the stock, which is 75% above the current price.

I expect many other companies to produce earnings above depressed estimates. In addition, as earnings season continues, investors will be closely watching management's outlook for the remainder of this year, and any upgrade in guidance, similar to what's anticipated for Amazon, should help push many beaten down stocks higher.

Next week, 73 companies within the S&P 500 will be reporting their 2nd quarter results, with heavyweight stock Tesla (TSLA) as well as major banking firm Goldman Sachs (GS) expected to garner the most attention. I'll be closely watching Semiconductor firm A S M L (ASML)'s results as well, after a constructive rally in Semis last week that followed positive results from a major firm in this group.

Other areas of the market have already firmed up and are continuing to outperform, with the a few Suggested Holdings stocks from my MEM Edge report outpacing the markets. If you'd like immediate access to these stocks, as well as my in-depth insights into whether the broader markets have bottomed, use this link to trial my twice week report for a nominal fee for 2 weeks.

On this week's edition of StockCharts TV's The MEM Edge, I discuss the rally in QCOM and other Semiconductor stocks as select Technology stocks begin to firm up. I also share insights into top stocks due to report earnings next week.

Warmly,

Mary Ellen McGonagle, MEM Investment Research