It's been quite a year for leading Semiconductor stocks, as demand for their chip technologies has been instrumental in pushing them higher. Today, Bank of America gave a "double notch" upgrade to Skyworks (SWKS), which means they moved the stock from Underperform to a Buy and upped their price target.

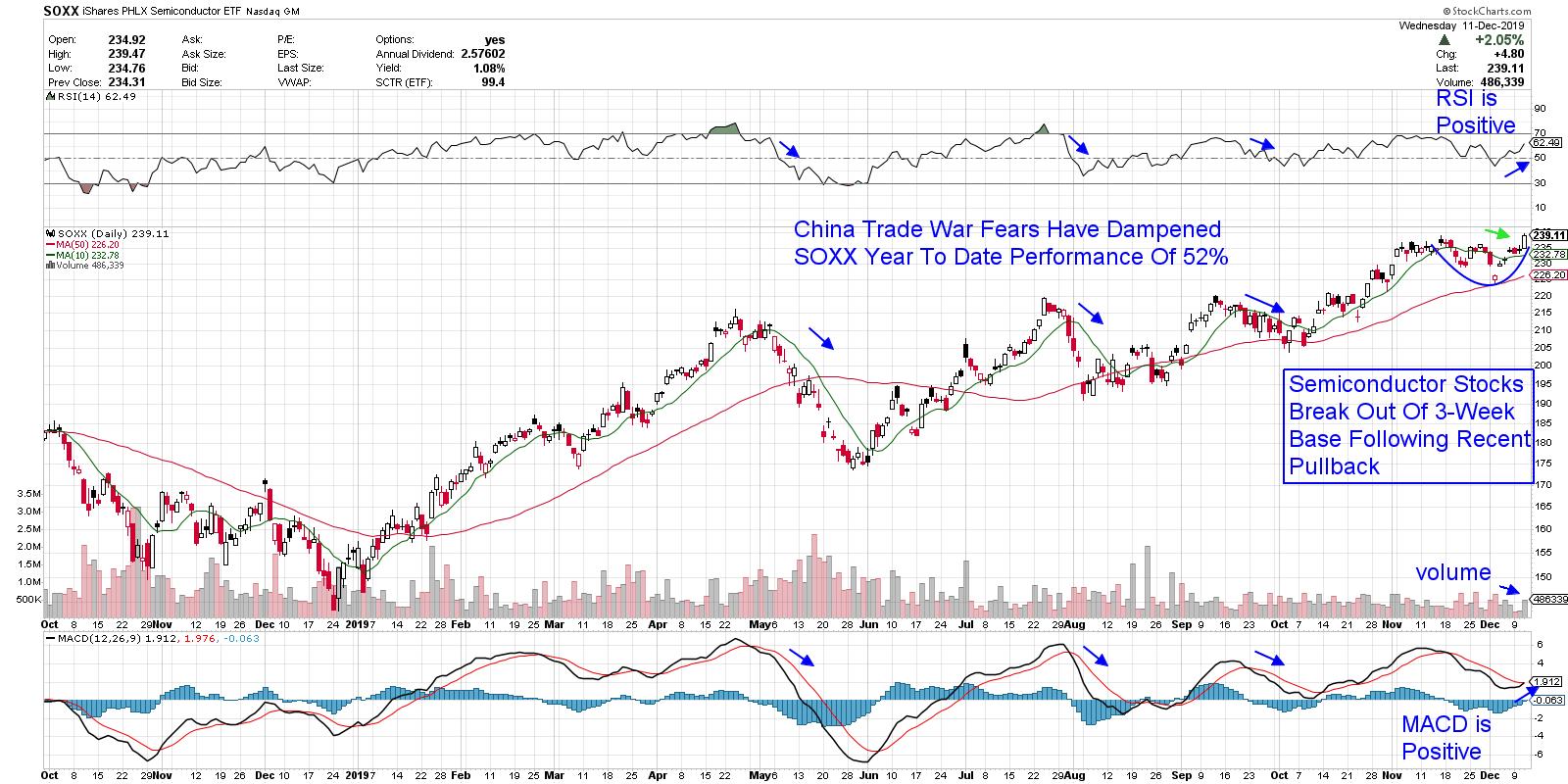

While analysts provide upgrades and downgrades every day, today's remarks were particularly impactful as they pushed the Semiconductor group out of a bullish base, following a pullback over the past several weeks that occurred despite a promising outlook.

DAILY CHART OF SKYWORKS SOLUTIONS, INC. (SWKS)

More than a few Semi stocks rallied on the upgrade; however, there was a select group that outperformed the most. I'm talking about those companies, such as Skyworks, that supply chips to the 5G marketplace. And while you may have been reading about this developing network for some time, major Semi companies in this space are expecting demand to grow faster than expected for next year and beyond as this new technology is taking hold.

As you can see in the chart above, SWKS is extended and can be bought on any pullback - ideally close to its 1o-day moving average. One important note about Semiconductor stocks is the fact that they respond negatively to any trade war angst, as these companies derive at least a part of their revenues from China.

DAILY CHART OF SEMICONDUCTOR ETF (SOXX)

There are other leading stocks that provide chips to the burgeoning 5G space, which I've identified in my MEM Edge Report. For those who'd like to uncover those stocks, as well as other high-quality growth stocks that are poised to outpace the markets, I urge you to take a trial. This biweekly report also provides insights into the markets and is delivered on Sundays and Wednesdays. If you act over the next day, we'll provide you with this week's most recent reports.

Warmly,

Mary Ellen McGonagle,