FACT: If you investigate the skill sets of the top tier General Managers of your favorite pro sports league, you'll recognize uncanny parallels to the top tier traders described in the Market Wizard books. This is not a coincidence.

FACT: If you investigate the skill sets of the top tier General Managers of your favorite pro sports league, you'll recognize uncanny parallels to the top tier traders described in the Market Wizard books. This is not a coincidence.

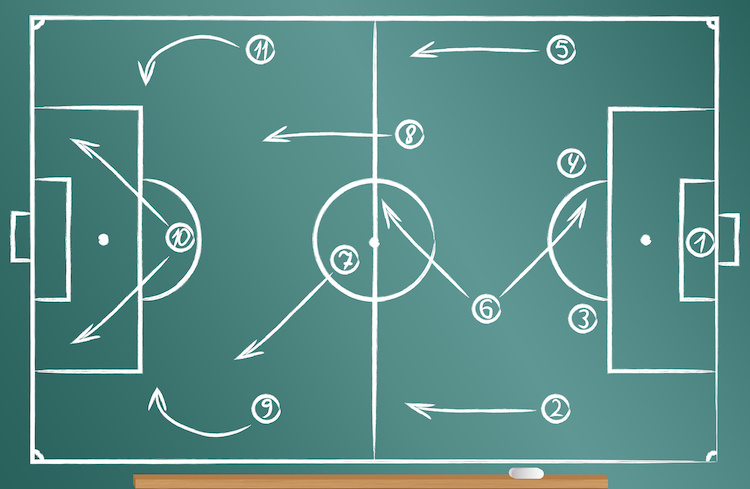

Some 20 years ago, I discovered a breakthrough that sharpened my perspective on individual stocks and has contributed mightily to my long-term consistent profitability. I draft my stock portfolio in much the same way GMs draft players for their teams.

In all sports arenas across the world, a recurring quote one hears is "just because that big name athlete is available, doesn't mean they're a good fit for our team." To reframe it in my own words, "I'll only draft a stock if I deem its personality appropriate for my portfolio." Allow me to explain.

I know — I can hear you saying that stocks aren't athletes. They aren't human, and they don't have a personality. But oh yes they do! And the more you understand this, the more likely you'll be to build a championship-winning portfolio.

This blog probably should have been a stand-alone chapter in our book, Tensile Trading. Nevertheless, I'll try to reduce it down to its essential core. First and foremost, I'm a chartist or technician. Give me any stock chart and I can wax on for an hour describing it's trading history, its unique volume behavior, trading ranges, momentum characteristics, appropriate moving averages, the attributes of its rallies and reactions, etc.

This is similar to a GM sizing up the technical absolutes of athletes — their speed, height and weight, their strength, reaction times, etc. Stocks' chart technicals make up a portion of their personality in the same basic way that a GM might see potential players. With respect to stocks, this first cut for me eliminates many equities immediately because they don't have a technical personality that I'm comfortable with. In other words, they're not a good fit for my team.

For example, a technically-deformed simple case is Bitcoin. For a whole host of reasons, I don't like its personality. Technically speaking, if Bitcoin were a person, it would be an unpredictable drug addict. Fine perhaps for some other trader's team portfolio, but I'll pass.

Next, I look to the stock's fundamentals. I'm an earnings junkie. Have earnings surprises been mostly positive? Have earnings consistently trended higher and are the analysts raising their projections on both growth and earnings? How do earnings per share and financial ratios compare to sister stocks in the same industry?

This is not unlike how our sports General Managers would be researching the personal fundamentals of particular athletes. How does the athlete's sports IQ stack up to the other players? Do they have the emotional discipline, commitment and work ethic to grow into first-tier outperformers? Do they have the personality to fit seamlessly into the team's culture?

Finally , I consider a stock's intangibles. What does my portfolio need metaphorically to fill the specific seats in my symphony orchestra? Do I need more growth stocks, large caps or mid-caps? Do I need more international or domestic ones? What about specific sectors or industries, and so on? It's all about balance.

I once saw a professional hockey scouting report, and the intangibles portion was surprisingly lengthy. It listed details about a players's parents (both of whom had been professional athletes), chronicled all the athlete's injuries and rehabilitation regimes, potential salary estimates and which positions and team needs the player might fill. Not unlike our portfolios, it's all about fit.

After years of investing, my intuition is such that I can become deeply familiar with most any stock within five minutes and can determine if its personality is appropriate for my portfolio or if it's an inappropriate faceless gremlin. Not dissimilar to GMs who have to perform — as do their players — or else they'll be gone. They must never forget that pro sports is a business above all else. Investors would be well served to adopt this same mentality. Investing with a business mindset is the goal.

There's an entirely separate blog I could write about using a stock's "personality changes" as a trigger to exit your position. It's a true "bell ringer" when an equity begins behaving out of character , but that'll be for another day. For now, I'll leave you with one of my favorite Zen proverbs:

"Knowledge is learning something every day. Wisdom is letting go of something every day."

Trade well; trade with discipline!

- Gatis Roze, MBA, CMT

- Author, "Tensile Trading: The 10 Essential Stages of Stock Market Mastery" (Wiley, 2016)

- Presenter of the best-selling "Tensile Trading" DVD seminar

- Presenter of the "How to Master Your Asset Allocation Profile DVD" seminar

- Developer of the Tensile Trading ChartPack for StockCharts members

Trade well; trade with discipline!

Gatis Roze, MBA, CMT

- Author, "Tensile Trading: The 10 Essential Stages of Stock Market Mastery" (Wiley, 2016)

- Developer of the "Stock Market Mastery" ChartPack for StockCharts members

- Presenter of the best-selling "Tensile Trading" DVD seminar

- Presenter of the "How to Master Your Asset Allocation Profile DVD" seminar