Fish swim in schools. Birds fly in flocks. Humans follow grouping principles too. Gestalt psychologists describe these as the Laws of Grouping and the stock market most definitely acknowledges these laws at its core.

Fish swim in schools. Birds fly in flocks. Humans follow grouping principles too. Gestalt psychologists describe these as the Laws of Grouping and the stock market most definitely acknowledges these laws at its core.

My own trading methodology leans heavily on these principles to such an extent that I actually named my version the “sisters strategy”. In the most elemental form, it endorses and embraces the fact that equities tend to move together on four legs:

Group 1: We’ve all heard the cliché “a rising tide lifts all boats.” When markets trend up, the majority of equities participate in the uptrend.

Group 2: The market is divided into nine large sectors. Up-trending markets are lead by a number of these strong sectors.

Group 3: The strongest sector is composed of a basket of similar industry groups that are fueling its rise.

Group 4: Finally, a cluster of similar and robust individual equities, which are all part of the same strongly trending industry group, in the leading sector are driving the total market in a significant fashion.

The last group of this paradigm is comprised of the market’s highest probability stocks, and it’s here that I deploy my “Sisters Strategy”.

I say highest probability stocks because they have the winds at their backs due to an overall rising market, being part of the sector most in favor and being in the industry group that is presently most popular. I see these as the winds of probability blowing nicely on my behalf.

As investors, we want to harness these market principles of groupings and profit from this knowledge. My “Sisters Strategy” merely states that “when you buy an equity, the whole family moves in too.” For example, if you bought Johnson & Johnson (JNJ), you are now also married to its Mother Sector, (Health Care – XLV), its Father Industry (Pharmaceuticals – $DJUSPR), and its three sisters, sister Abbott (ABT), sister Merck (MRK) and sister Pfizer (PFE). If you think you are simply married to an only child named Johnson & Johnson, then you are delusional and naïve.

You must therefore keep your eye on the entire family and stay vigilant for any changes. Do not think for a second that you can live blissfully with sister JNJ while the other sisters catch the flu or when Father Industry breaks his leg and Mother Sector gets cancer.

I constantly gauge the health of each family in these 5 ways:

1. My favorite way – and the most powerful, I believe – is what I’ve written about a number of times before. http://stockcharts.com/articles/journal/2014/06/the-probability-buster-chart-improved--strengthened.html

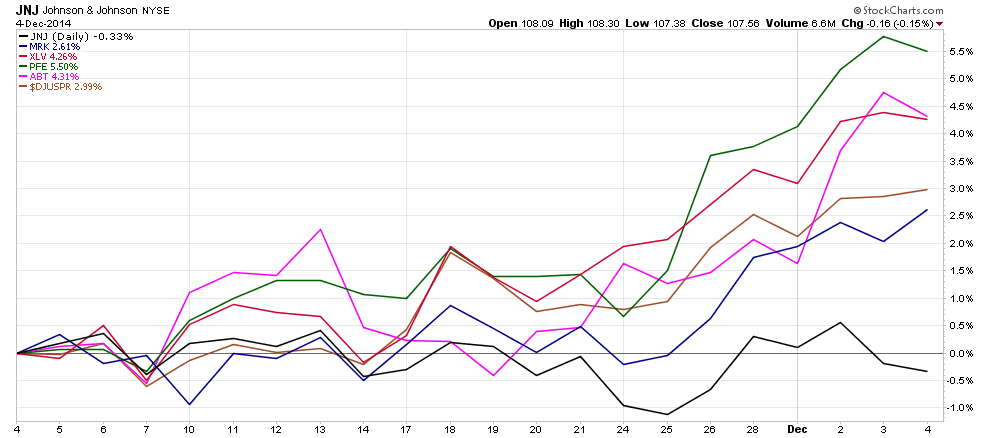

2. Plot JNJ and all three sister stocks on one performance chart, along with the sector ETF (XLV) and the industry group ($DJUSPR).

3. You should have a Chartlist with the entire family’s symbols contained in it. Pull down the Market Carpet format to see how each is behaving over various timeframes.

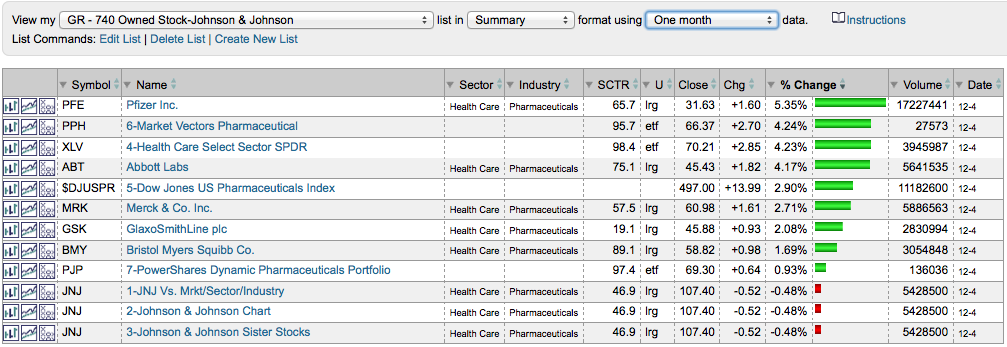

4. The same chartlist can be viewed in the Summary format using different timeframes.

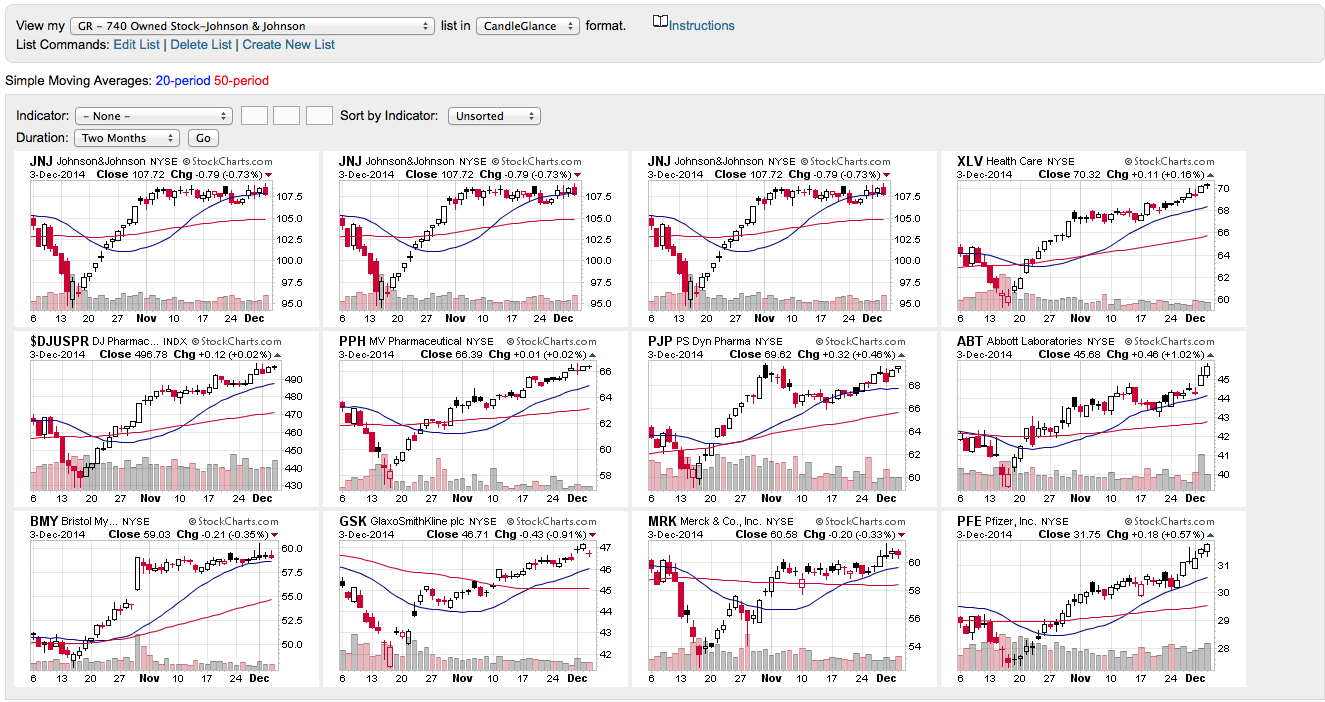

5. Finally, the Candle Glance format allows you to see all the family charts side-by-side.

The real money is made by falling in love and marrying into the right family, but staying married only as long as the family loves you back. The “Sisters Strategy” is all about knowing whether you are getting that loving from the whole family. When the loving starts to taper off, it’s time for a divorce.

Trade well; trade with discipline!

-- Gatis Roze