Have you ever met a famous investor at a cocktail party or event, taken his or her advice on a stock and lost money? You are not alone. It may have been a sensational timely trade and the famous one made a 30% gain in four weeks while you held it an entire year and lost money. Therein lies the crux of the problem. Same equity but two different trading timeframes.

The reality is that we all are comfortable with investing on different time horizons. Ask yourself this question: “How many trades do you generally execute in a day, a week, a month, a year or every decade?” My point is that while a conversation between a day trader, a position trader and a long-term investor may be academically interesting, it will not be profitable for any of the three parties. They are simply not on the same timeframe page.

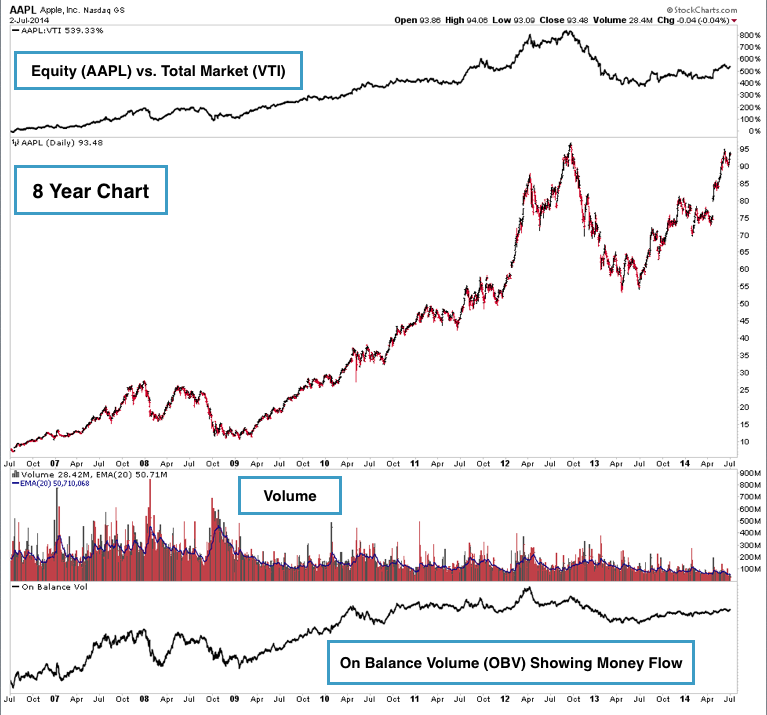

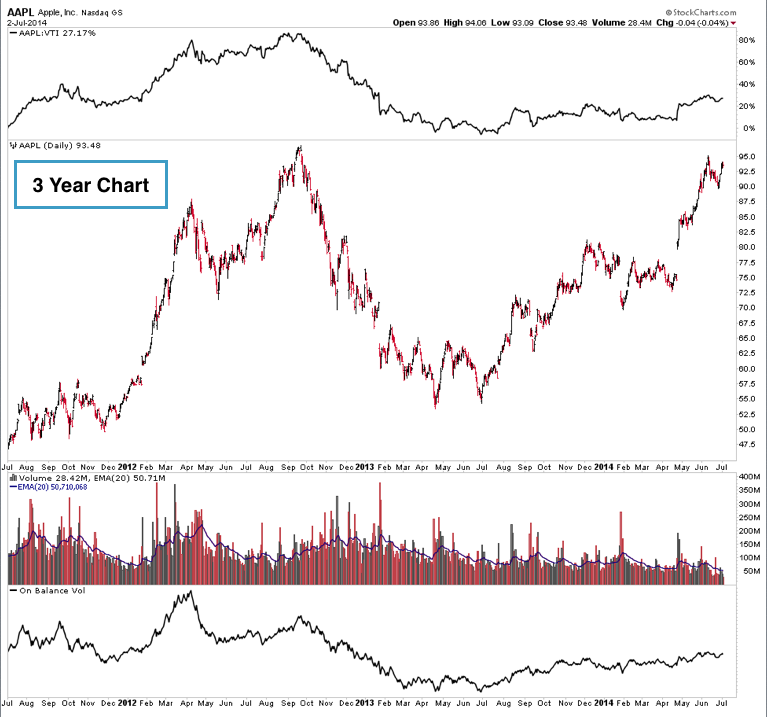

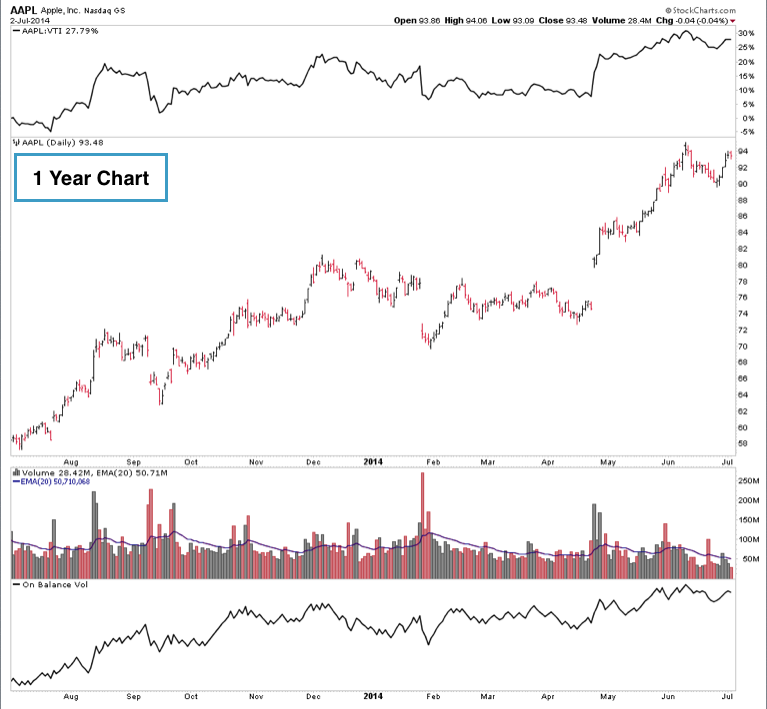

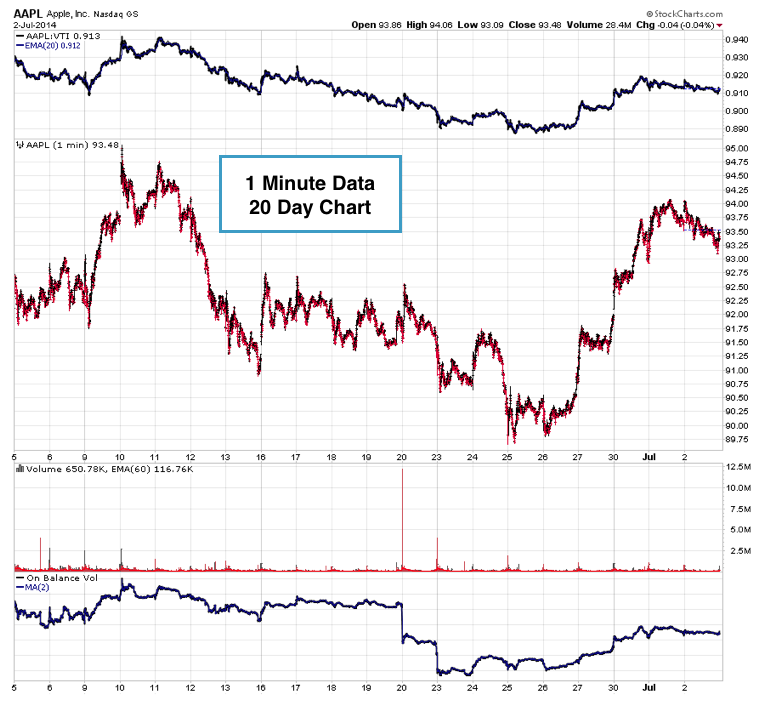

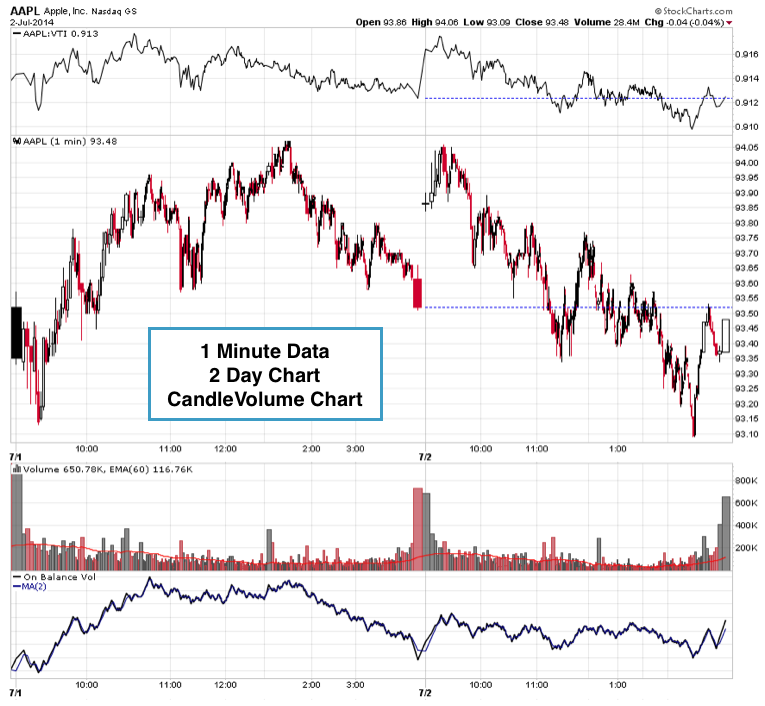

Let me suggest an exercise I did in my investor class with over 100 people. I’ve attached six charts of the same equity but in six different timeframes. Try to role play and trade each of the six as stand-alone independent charts and ask yourself where you would have entered a buy and where you would have exited for each of the different time horizons involved. Once you’ve done that, dig into your archives and generate ten more symbols from your investing portfolio. Repeat the exercise, being acutely aware of the different time frames that each chart represents. Total up the number of trades you did in each of the six time frames. Then step back and ask yourself which timeframe was the most comfortable for you personally to trade. When you answer this question, you’ll be a wiser investor.

Trade well; trade with discipline!

-- Gatis Roze