Long ago, I was blessed with some powerful advice by an elderly investor of note. The best investors understand in the very beginning that learning to trade the markets is an endurance event. The lucky beginner investor who happens to hit a home run or others who try to take short cuts seldom reap significant ongoing profits.

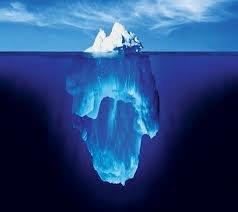

The market is a demanding teacher. She teaches you in the same way a goldsmith refines with fire. Time and time again, academic studies have proven that it is not necessarily the smartest who succeed as investors for it is less about brain power and much more about managing the investor self. The market tests you and smelts your innermost parts so that you become pure all the way through – even to the hidden core of your body, soul and ego. If you refuse to be humbled, the smelting will continue.

At a recent holiday party, I crossed paths with a famous industrial scion and philanthropist. His wife shared with me that he’d been recently diagnosed with diabetes at 77 years of age. She lamented that he was a very stubborn patient who refused to acknowledge the realities of his new condition. This stubbornness likely contributed to his immense success as an empire builder, but this same stubborn denial is proving detrimental to his personal health – much like similar behavior that is detrimental to many accomplished individuals’ financial health. What makes a person successful in one arena isn’t automatically transferable to the investing arena. Some hopeful investors never do embrace this fact and pay for it dearly.

Not until you’ve populated your library with a broad selection of experience, aligned your body, mind and most importantly, your ego with the market, will you be able to deploy your “intestinal computer” – or in other words, your gut and intuition – before you achieve stock market mastery.

The bottom line is that you always have to give up something to achieve success. Everything comes at a cost. Experience takes time. Ego control requires humility. Intuition demands that you blend experience and ego so you can cash the stock market checks you write.

Trade well; trade with discipline!

-- Gatis Roze