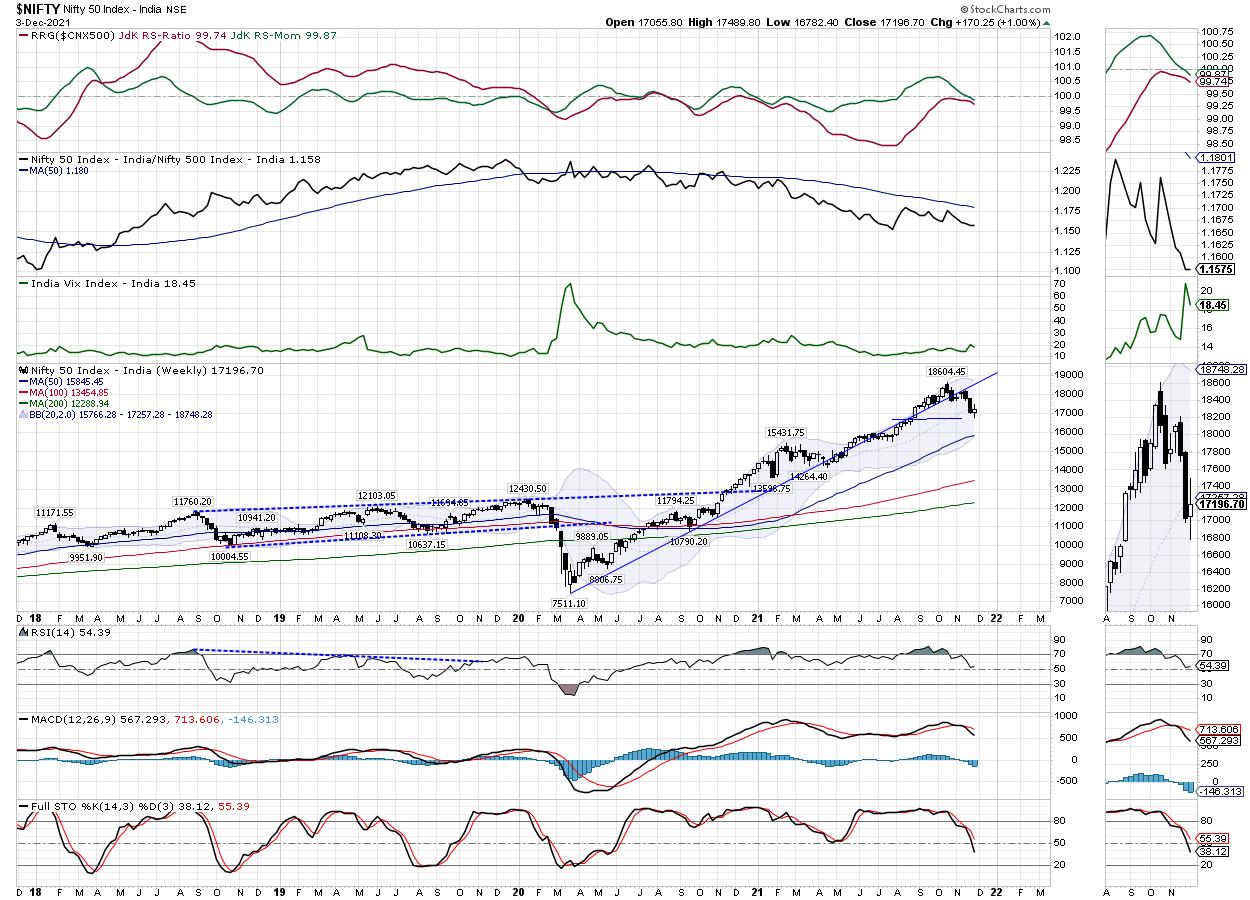

Just like the previous one, this week remained a relatively wide-ranging, with NIFTY oscillating in a 707-point range before ending with modest gains. Over the past five days, the markets struggled hard to find and create a base for themselves, staging a technical pullback and also moving above important levels as they successfully defended a crucial support point. The last trading day of the week also saw a corrective move that erased a major chunk of the weekly gains. Despite the corrective move on Friday, NIFTY ended with a net gain of 170.25 points (+1.00%) on a weekly basis.

There are a few things that need to be noted from a technical perspective. On the daily charts, the NIFTY has just rested again on the 100-DMA, which presently stands at 17168. On the weekly charts, the NIFTY has resisted and ended a notch below the 20-Week MA, which stands at 17261. The index has also resisted and failed to move above a pattern resistance point near 17400. This makes the zone of 17260-17400 a potentially stiff resistance area for the NIFTY. For any technical pullback to continue, the index will have to move past the 17400 levels convincingly. Until this happens, we may see it consolidating once again.

The volatility eased; INDIAVIX came off by 11.28% to 18.45 on a weekly note. Over the coming week, the NIFTY is likely to find resistance at 17300 and 17430 levels. Supports come in at 17100 and 16830. Any slip below 17000 is likely to infuse some incremental weakness in the markets.

The weekly RSI is 54.33; it remains neutral and does not show any divergence against the price. The weekly MACD is bearish and remains below the signal line. A Bullish Harami candle has emerged; this happens when the real body of the current candle is completely engulfed by the body of the previous candle. This may act as a potentially bullish setup, since it has occurred following a downtrend. However, this will need confirmation on the next trading bar.

The pattern analysis of the weekly chart shows that the NIFTY has clearly violated the upward rising trend line pattern support; this upward rising trend line began from the lows formed in March 2020 and, after that, joined the subsequent higher bottoms on the charts. On the way up, NIFTY will find very strong resistance at this line. Over the near term, there is a stiff resistance zone created between 17261-17400; this is made up of a 20-week MA followed by a pattern resistance.

All in all, for the technical pullback to find more strength and fuel, it would be imperative for the NIFTY to move past the 17400 levels convincingly. Until this happens, the markets remain prone to volatile oscillations and consolidation. Looking at sectoral setups, we will see pockets like Consumption, PSE stocks and very select stocks from Pharma, IT and Auto finding favors. However, it is unlikely to see any runaway moves on either side. It is strongly recommended avoiding aggressively leveraged positions on either side. The markets are presently in the process of finding a bottom and a base for themselves; unless this process is done and the markets get some directional bias, all profits should be vigilantly protected.

Sector Analysis for the Coming Week

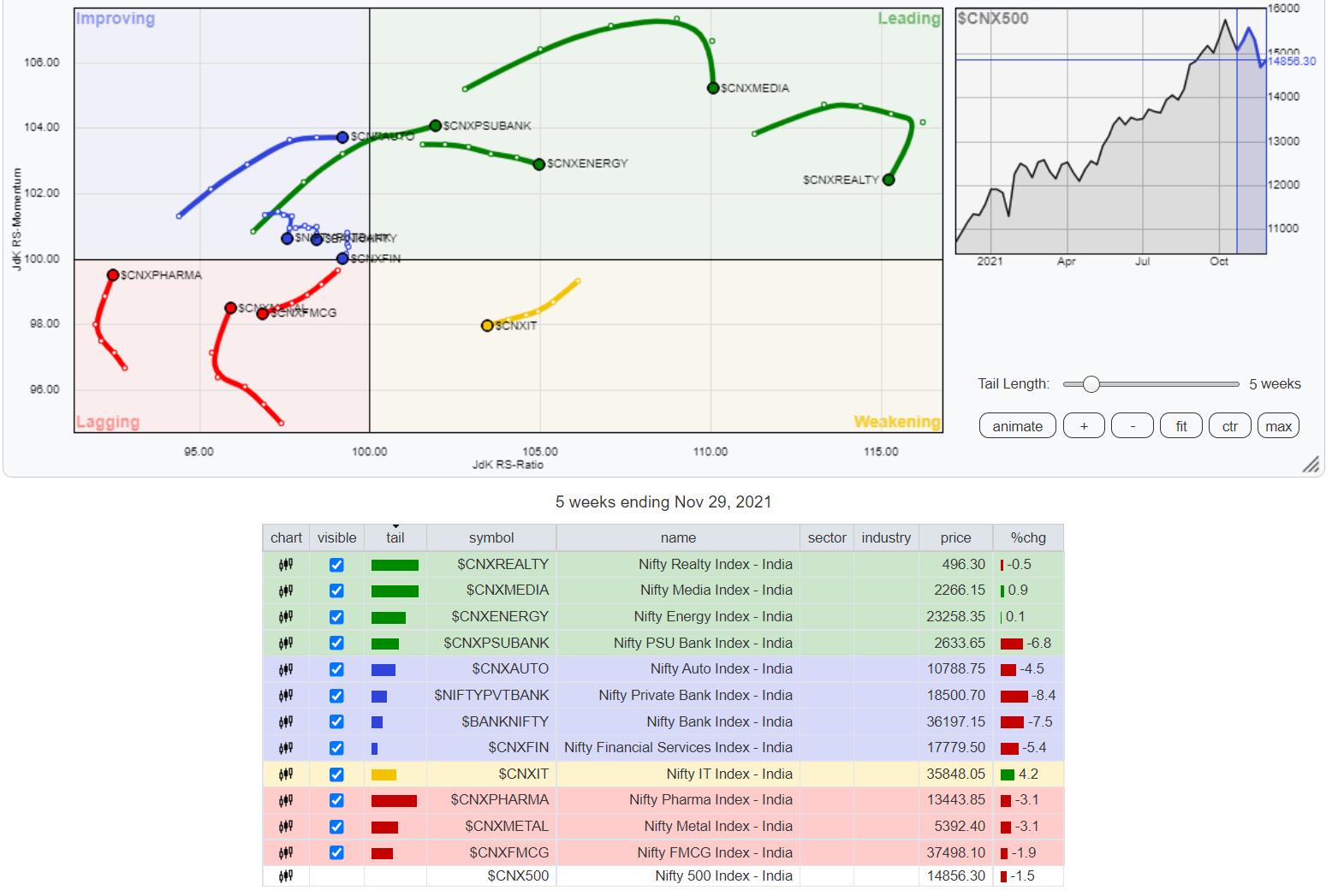

In our look at Relative Rotation Graphs®, we compared various sectors against CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all the stocks listed.

The analysis of Relative Rotation Graphs (RRG) shows that a few sectors are ready to take a breather while the others are readying themselves for some strong moves. The NIFTY Energy, Midcap 100, and PSU Bank index are placed inside the leading quadrant; they appear to be firmly maintaining their relative momentum. The Realty Index and the Media Index are also inside the leading quadrant, but they appear to be getting weaker on their momentum.

The NIFTY Services sector, Commodities, IT and Small-Cap Indices are inside the weakening quadrant.

The NIFTY FMCG Index continues to languish inside the lagging quadrant. NIFTY Pharma and Metal are also inside the lagging quadrant, but they are sharply improving on their relative momentum and are in the process of completing their consolidation and readying themselves for a move.

NIFTY Bank and NIFTY Auto Sectors are placed inside the improving quadrant.

Important Note: RRG™ charts show the relative strength and momentum for a group of stocks. In the above Chart, they show relative performance against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

- For Premium Equity Portfolio Advisory on Indian Stocks, Click Here.

- Alpha-generating actionable investment ideas on the US and UK Equities, Click Here.

- For International Commodities like Gold, Crude Oil and EURUSD/GBPUSD pairs, Click Here.