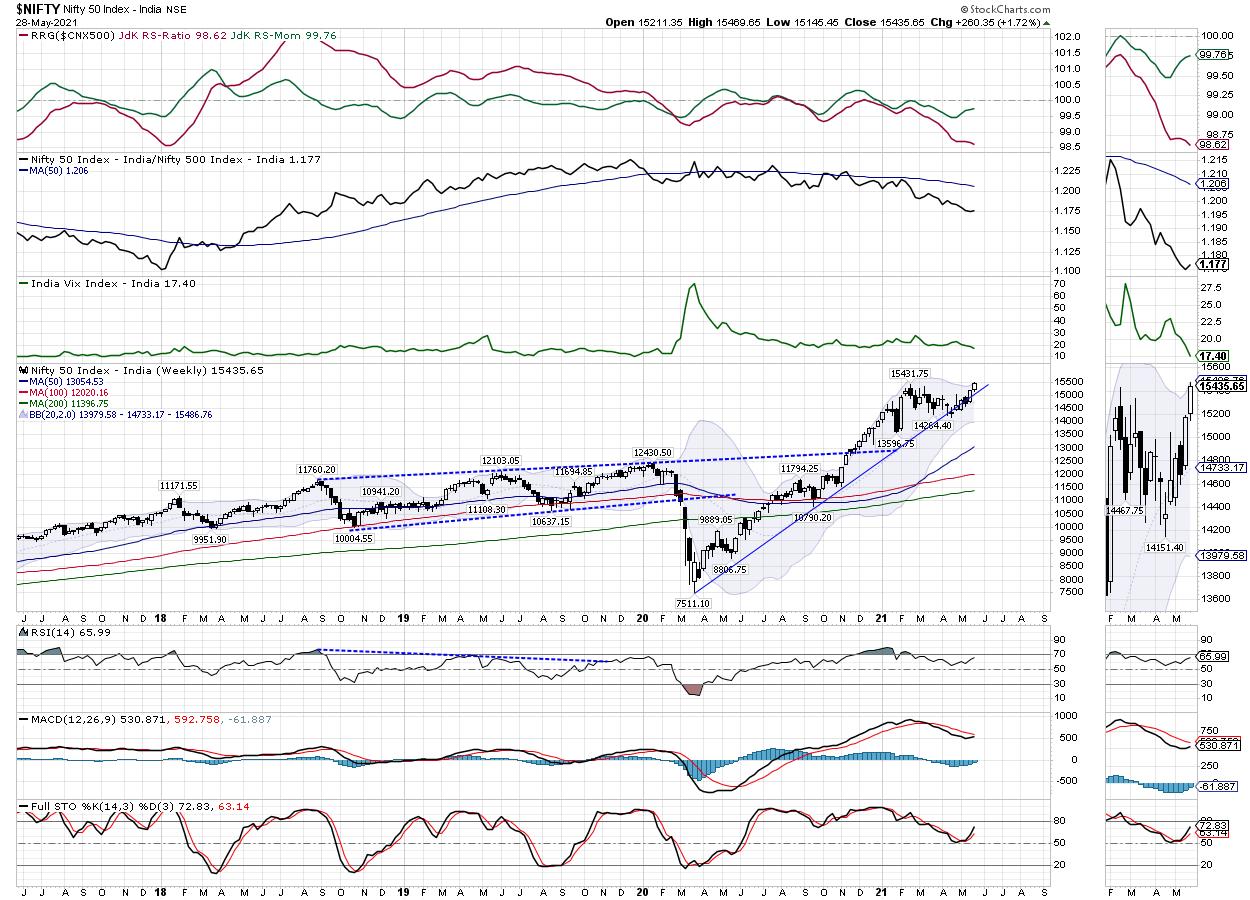

The past week remained a trending one, as the NIFTY attempted to break out of the channel and, in the process, tested and marked a new lifetime high on the last trading day of the week. The trading range during the week remained narrower; the index moved in a 324-point range during the week. However, barring one day inbetween, four of the five days were trending for the headline index. The index marked a fresh lifetime high at 15469. Following some retracement from that point, the headline index finally ended posting net gains of 260.35 points (+1.2%) on a weekly basis. In the last two weeks combined, NIFTY has risen 757.85 points.

All throughout the week, NIFTY staying above the previous high point of 15431 will be extremely crucial. If this does not happen, then the high point of 15469 will just remain an incremental high and no breakout shall occur. In the present technical setup, there are few technical points which are extremely important to keep an eye on. NIFTY has retraced from its high point; its moving past 15469 convincingly will only lead to a breakout. While the NIFTY struggles at its high point, the volatility, measured by INDIAVIX (which lost another 8.79% this week), is at 17.40.

INDIAVIX is at its lowest levels levels of the recent past, seen only in early 2020. Further, the 15350 added heavy Call OI on Friday; this level continues to hold maximum Call OI for the coming week as of now.

The opening of the markets on Monday, and its behavior against the 15430-15470 zone, will be extremely crucial to watch. The levels of 15500 and 15650 will act as resistance points. The supports will come in much lower, at the 15300 and 15160 levels.

The weekly RSI is 65.99; it has marked a new 14-period high, which is bullish. However, RSI is neutral and does not show any divergence against the price. The weekly MACD is bearish and remains below the signal line.

The pattern analysis shows that the NIFTY has tested a double top resistance on the weekly chart that exits at 15431, which also is the previous lifetime high for the markets. The NIFTY tested slightly higher levels, but has closed very near to this point. For a sustainable breakout to occur, NIFTY will have to take this zone out convincingly.

Options data, which shows highest Call OI concentration for next week expiry, may just be indicative and subject to change. However, the more concerning technical factor is the sustained and persistent low levels of volatility, as indicated by INDIAVIX. It is important to note that prolonged periods of low volatility are often followed by highly volatile periods. Such periods of low volatility, just as the present ones, show complacency of the market participants and often lead to the marking of a potential top.

The inverse relationship between the Index and the VIX is an established one, but very low levels of the VIX at the time of any attempted breakout, which is yet to actually take place, brings the sustainability of such breakouts in question when they happen. We recommend continuing to chase the momentum carefully, without getting carried away with the current up moves.

Sector Analysis for the Coming Week

In our look at Relative Rotation Graphs®, we compared various sectors against CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all the stocks listed.

Our review of Relative Rotation Graphs (RRG) does not show any substantial change in the sectoral setup as compared to the previous couple of weeks -- except that a few sectors are showing some effort to take a breather and improve in the relative momentum. The NIFTY IT and Metal Indexes are in the leading quadrant; they appear to be maintaining their relative momentum against the broader markets. The Small Cap and the NIFTY Midcap 100 indices, along with the Commodities index, are also in the leading quadrant. However, they appear to be consolidating and, in the process, paring on their relative momentum against the broader NIFTY500 index.

The NIFTY PSU Banks, Infrastructure and the PSE indexes are in the weakening quadrant. Out of these three, PSU Bank Index is trying to consolidate its performance at the present moment.

The NIFTY Bank, Services Sector Index, Realty, Financial Services and Auto Index all remain in the lagging quadrant. However, these groups are also trying to consolidate their respective moves and arrest their loss of relative momentum. The Energy Index continues to languish in the lagging quadrant.

The Media Index has rolled inside the improving quadrant, hinting at a likely end to its relative underperformance against the broader markets. The Pharma Index remains firmly placed inside the improving quadrant and appears to be maintaining its northeasterly rotation towards the leading quadrant. The FMCG and the Consumption indexes seem to have mildly stalled their move; they appear to be slightly losing their momentum against the broader markets at present.

Important Note: RRG™ charts show the relative strength and momentum for a group of stocks. In the above chart, they show relative performance against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst,