The first quarter of this CY 2020 was quite a disaster for the equity markets. The month of February saw the onset of the COVID-19 pandemic and the spread of coronavirus saw equity markets the world over witnessing a vertical crash everywhere, in the range of 35% to 45% across the globe. The US and the Indian equities also met a similar fate; the Indian headline index NIFTY50 saw a decline of ~38% in just a matter of a couple of weeks before it found its bottom in the middle of March 2020.

Since the middle of the March through the week ending October 23, 2020, the Indian stocks have seen a literal V-Shaped recovery, with the headline NIFTY50 index rising as much as ~59% from the lows of March.

We have attributed this rally to many factors. The rally across the Emerging Markets has been attributed to the severe weakness in the Dollar index during this time. The sharp surge in the markets and a mad chase of momentum was due to the risk-on environment, where the rally was fueled by the dollar deluge and a large amount of global liquidity chasing the equities.

Are we looking at a very early signs of the end of such a risk-on environment? These three charts answer this question. Let us begin with understanding what a "risk-on" environment actually means.

Whenever the investors show strong preference towards riskier assets, we are said to be typically in an "risk-on" environment. During such times, the riskier assets, like equities, see liquidity-driven rush, and they tend to outperform the safer assets like the Dollar, Debt, Treasury and High Yield Bonds.

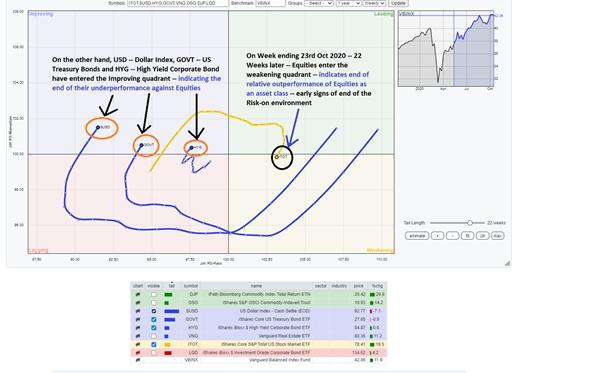

In the above Relative Rotation Graph, we compare the relative performance of various asset classes against a benchmark. The Equities is represented by ITOT (iShares Core S&P Total US Stock Market ETF), US Treasury Bonds are represented by GOVT (the iShares Core US Treasury Bond ETF) and the High Yield Corporate Bonds are represented by HYG (iShares iBoxx $ High Yield Corporate Bond ETF), among other asset classes. The benchmark is VBINX (Vanguard Balanced Index Fund), which typically has an asset allocation of 60% Equities and 40% Debt/Bonds.

On the week ending May 29, 2020, Equities (ITOT) entered the improving quadrant on the RRG. This signaled a likely end of the relative underperformance of Equities as an asset class as compared to the other assets. It also signaled an onset of "risk-on" environment. It is important to note that, from May 29 until the week ending October 23 (i.e. in 22 weeks), the equities have gained ~37%.

From the few early signs that can be seen, there is a possibility that this risk-on environment may have come to an end.

The above Relative Rotation Graph is as of the week ending October 23, 2020. The Equities, as an asset class (represented by ITOT), have completed the rotation and slipped in the weakening quadrant. This marks the end of outperformance of Equities against the other less risky asset classes. On the other hand, safer assets like US Treasury Bonds, represented by GOVT, and High Yield Corporate Bonds, represents by HYG, have entered the improving quadrant. This means that these safer assets have ended their underperformance and should start outperforming the Equities.

The above chart corroborates this view. The chart above shows the Relative Strength (RS) line of GOVT (US Treasury Bonds ETF), HYG (High Yield Corporate Bond ETF) and Dollar Index against ITOT (Equities – US Stock Market ETF). They have all tested their crucial pattern supports and it would not be a surprise if we see them attempting to improve and inch higher over the coming weeks.

WHAT DO I UNDERSTAND FROM ALL THIS?

The point of reference is the risk-on environment that we were in currently and the outperformance of equities compared to other asset classes.

The above development does not mean a sudden end to the up moves that the stocks are currently seeing. It also does not set a stage for a large decline in equities. What it points out that the Equities may continue to perform individually, but may not outperform the other asset classes, which can likely mark an end to the "risk-on" setup that we are in right now. The Equities taking a breather, and preference being shifted to less risky assets should not come as a big surprise to us in the coming weeks.

As a trader or an investor, this should mean focusing on defensive stocks more than before. All such rotation towards other, safer asset classes may not happen overnight; it often happens gradually. However, this technical development is important for investors from a "situational awareness" point of view.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst