Titan Industries Limited - TITAN.IN

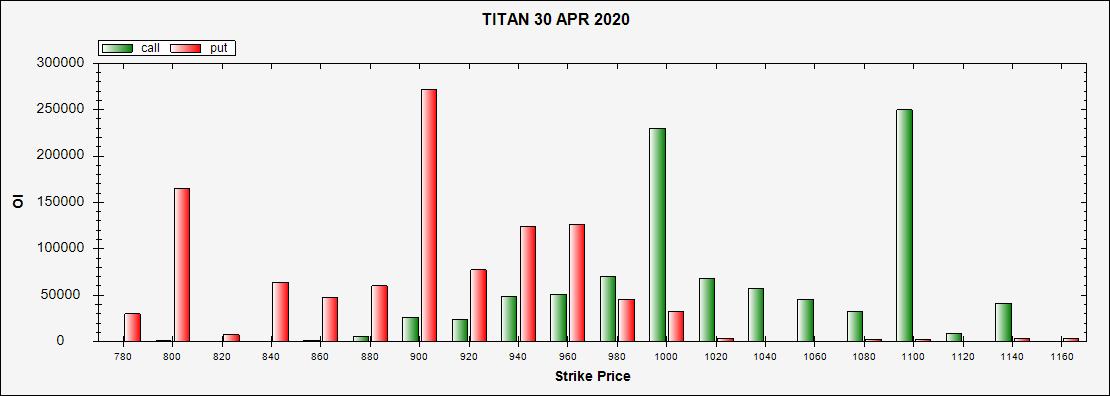

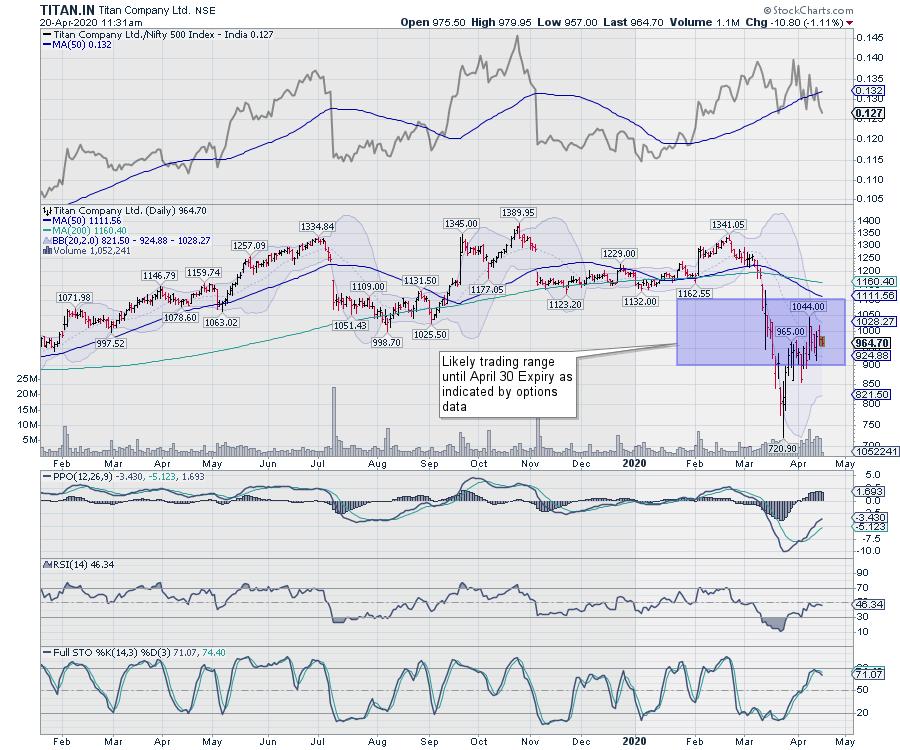

The chart above shows highest Put OI in Titan at 900 and maximum Call OI at 1100 for the April 30 expiry. To interpret this data, that means that it is highly unlikely that the stock will find strong support at 900 and strong resistance at 1100. The most likely closing of the stock by expiry day is between these two levels.

Short-term traders have opportunity to write options and collect premiums here.

Selling 1100 CE at 7.55 and Selling 900 PE at 19.20 can be considered. This pair trade will see net receipt of premium of Rs. 5662 and Rs. 14400 through respective trades. Total premium received would be 20062.

Any move of price below 900 or above 1100 on a closing basis should be taken as an exit time for this trade.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst,

Disclosure pursuant to Clause 19 of SEBI (Research Analysts) Regulations 2014: Analyst, Family Members or his Associates holds no financial interest below 1% or higher than 1% and has not received any compensation from the Companies discussed.