While the markets have been suffering from fractured breadth and the NIFTY moved below 10950 (its breakout level) following a strong throwback, the CNXIT index has crawled back into the leading quadrant of the Relative Rotation Graph (RRG). This means that the IT pack is likely to relatively out-perform the broader markets.

With that in mind, the IT pack stock MINDTREE.IN deserves a look.

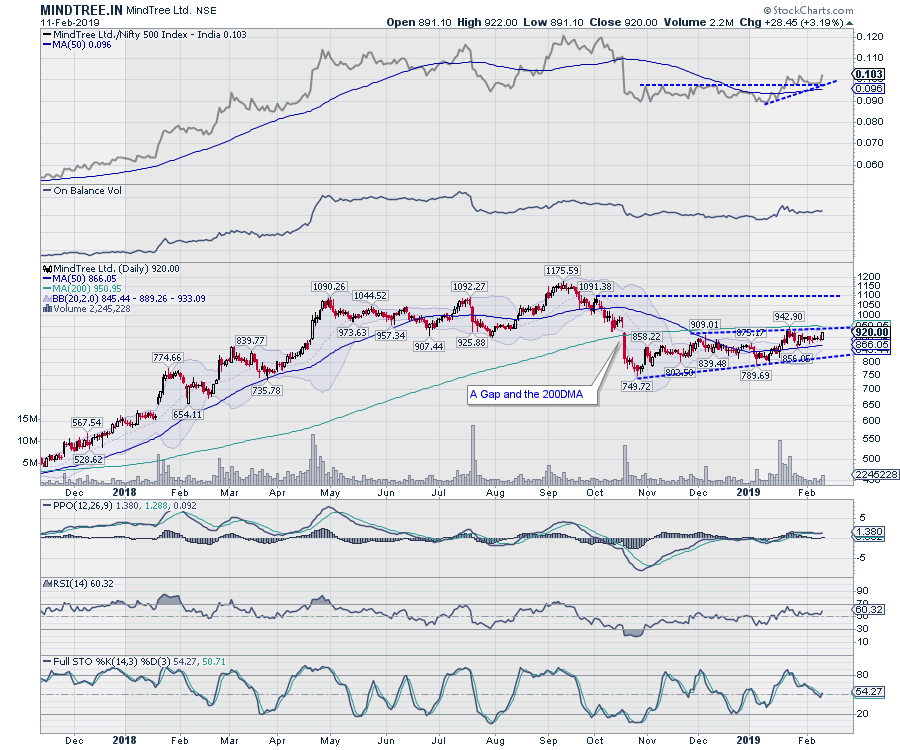

MindTree Ltd. (MINDTREE.IN)

- After peaking near 1175, the stock saw a corrective move that took down near 749. During this corrective decline, the MINDTREE.IN also suffered a downward gap near the 927 level.

- Over the last couple of months, the stock has seen a capped move in the 749-945 zone. The 200-DMA, which is presently at 950 moves along the above-mentioned gap and almost acts as a proxy trend line for the present formation.

- The RS Line, when benchmarked against the broader CNX500 index, has broken out from a sideways move and penetrated its 50-DMA. The weekly RS Line has also moved past its 50-week MA.

- The daily MACD has shown a positive crossover; weekly MACD remains in continuing buy mode and is trading above its signal line.

- The Bollinger Bands are 51.10% narrower than normal. The narrow width of the bands suggests low volatility as compared to MINDTREE's normal range. Therefore, the probability of volatility increasing with a sharp price move has increased for the near-term.

- Though some consolidation in the 920-950 range cannot be ruled out, the probability of a significant price move will increase the longer that the bands remain in this narrow range.

- If the price action panes out on analyzed lines, the stock may test the 1080-1100 level in the coming weeks from its current price of 920. Any move below 860 will be negative for the stock.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia

Disclosure pursuant to Clause 19 of SEBI (Research Analysts) Regulations 2014: Analyst, Family Members or his Associates hold no financial interest below 1% or higher than 1% and have not received any compensation from the Companies discussed.