It's been a very difficult environment for small caps ($SML) and mid caps ($MID) for quite awhile. We should take note of any stocks in these two asset classes that are moving higher because they're doing so completely against the grain. For instance, take a look at the following price relative charts over the last year and pay particular attention to the last three months (to the right of the blue-dotted vertical lines):

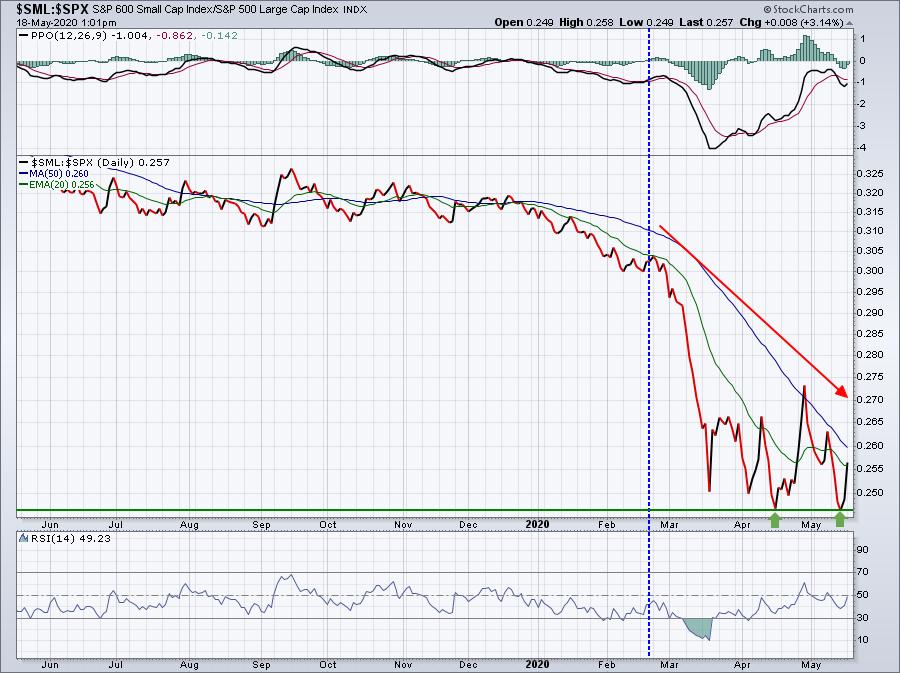

Small caps vs. S&P 500 ($SML:$SPX):

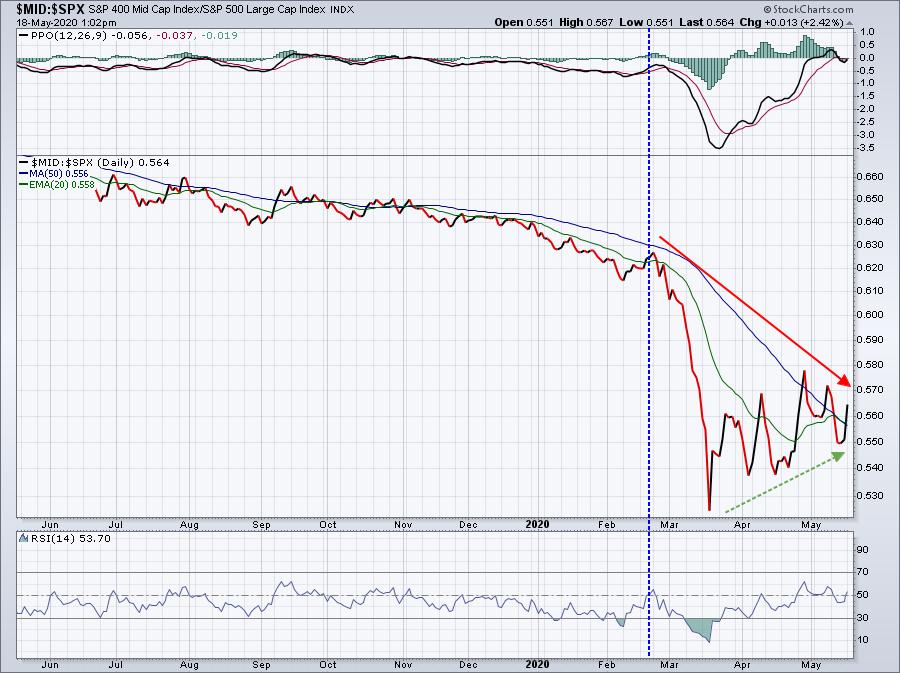

Mid caps vs. S&P 500 ($MID:$SPX):

The relative weakness in both of these asset classes is apparent (red directional lines), but the tide does seem to be changing as the recent relative recovery would indicate, especially among mid caps (green-dotted directional line). Still, to put together a portfolio of small and mid cap stocks during this pandemic would be the equivalent of financial suicide, right? Well, maybe not. At EarningsBeats.com, we announce portfolio changes every three months. We look for companies that show both fundamental and technical strength. Relative strength is a BIG piece of the selection puzzle. On February 19th, we announced our latest 10 stocks into our four portfolios, one of which was our Aggressive Portfolio, comprised mostly of small and mid cap stocks (9 of 10 stocks were either small cap or mid cap). The last three months' result has been staggering to say the least. Our Aggressive Portfolio is actually up since February 19th! By contrast, the S&P 500 is down 12.76% over that same period as of mid-day today. That's 13 percentage points of outperformance in 3 months in asset classes that have been trounced by the S&P 500. How'd we do it?

Well, to be honest, luck had something to do with it. Of the beaten-down sectors, we only had two representatives - one in energy and one in industrials. And the one in energy couldn't have performed much better. It was the leader of our Aggressive Portfolio - Enphase Energy (ENPH). Check out the chart:

ENPH has been a huge winner for three years now. Wall Street obviously likes the company and ENPH's relative strength has been superb, not to mention that the combination of high volume and a rising accumulation/distribution line suggests significant institutional accumulation. Finally, the Andrews Pitchfork tool is a great way to show a longer-term trend in a stock. I think it's safe to say that ENPH is trending higher and currently within the top and bottom borders of Andrews Pitchfork. It also shows the extreme volatility that the stock can experience from time to time. It's definitely not the right stock for everyone. You would need to accept a ton of risk to own ENPH as the lower end of the pitchfork would represent a 50% drop from its current price.

ENPH is up 55% since February 19th and has helped our Aggressive Portfolio dominate the S&P 500, even though small and mid cap stocks in general have been weak. Will it make our Aggressive Portfolio again next quarter? What other stocks will be represented in our Aggressive Portfolio? How about our Model Portfolio, Income Portfolio, and Strong AD Portfolio? As a side note, our Model Portfolio is up close to 70% since its inception on November 19, 2018. The S&P 500, by comparison, is higher by less than 10%. Relative strength works, especially when combined with strong fundamentals.

Tomorrow, in a members-only webinar, I'll be divulging the 10 equal-weighted stocks that will reside in each of the four portfolios for the next 90 days. But if you'd like to see more information on how these portfolios are constructed and check out performance results, we have a "Sneak Preview" FREE public event today at 4:30pm ET, just after the closing bell. The room will open promptly at 3:00pm ET today and you can access it using the following link:

https://us02web.zoom.us/j/87100050334

We'll make sure to add you to our free 3x per week newsletter, EB Digest, as well. If you have any problems with the room link above, you can go to www.earningsbeats.com and we'll have a link set up on our home page as well.

Happy trading!

Tom