A classic death cross occurs when the 50-day moving average moves below the 200-day moving average. On the flip side, a golden cross occurs when the 50-day SMA moves above the 200-day SMA. The 50-day SMAs have been above the 200-day SMAs for all major stock indexes this entire year - until this week. These indexes include the S&P 500, Dow Industrials, S&P Small-Cap 600, S&P Mid-Cap 400, Russell 2000, Nasdaq, Nasdaq 100 and NY Compsite.

A classic death cross occurs when the 50-day moving average moves below the 200-day moving average. On the flip side, a golden cross occurs when the 50-day SMA moves above the 200-day SMA. The 50-day SMAs have been above the 200-day SMAs for all major stock indexes this entire year - until this week. These indexes include the S&P 500, Dow Industrials, S&P Small-Cap 600, S&P Mid-Cap 400, Russell 2000, Nasdaq, Nasdaq 100 and NY Compsite.

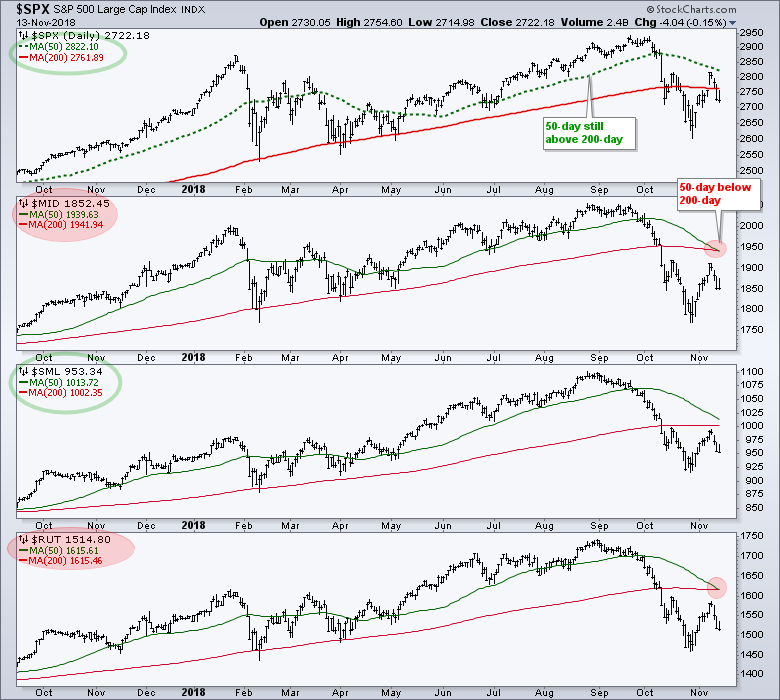

The chart below highlights four indexes and two experienced death crosses this week. The 50-day SMA is green, the 200-day SMA is red and the values are shown in the upper left corner of each window. Notice that the 50-day SMAs turned lower in October and moved towards the 200-day SMAs. This downturn was most extreme for the S&P Mid-Cap 400 and Russell 2000, both of which experienced death crosses.

It is not shown on the chart, but the NY Composite also has a death cross working. As the first indexes with death crosses, this tells us that the Russell 2000, S&P Mid-Cap 400 and NY Composite are leading on the way down. They are clearly weakest. The S&P Small-Cap 600 is holding up better than the Russell 2000 because it has yet to experience a death cross. The Force is not completely out of it because the S&P 500 and Nasdaq brothers have yet to fold, but the Death Star is looming large over the market right now.

On Trend on Youtube

Available to everyone, On Trend with Arthur Hill airs Tuesdays at 10:30AM ET on StockCharts TV and repeats throughout the week at the same time. Each show is then archived on our Youtube channel.

Topics for Tuesday, November 12-13:

- Big Advances and Big Ranges

- Failing in Key Retracement Zones

- Appetite for Risk Remains Low

- Charting Weekly Breadth Indicators

- What's Up (Down) with the Big Banks

- Bloomberg Commodity Indexes

- Click here to Watch

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill