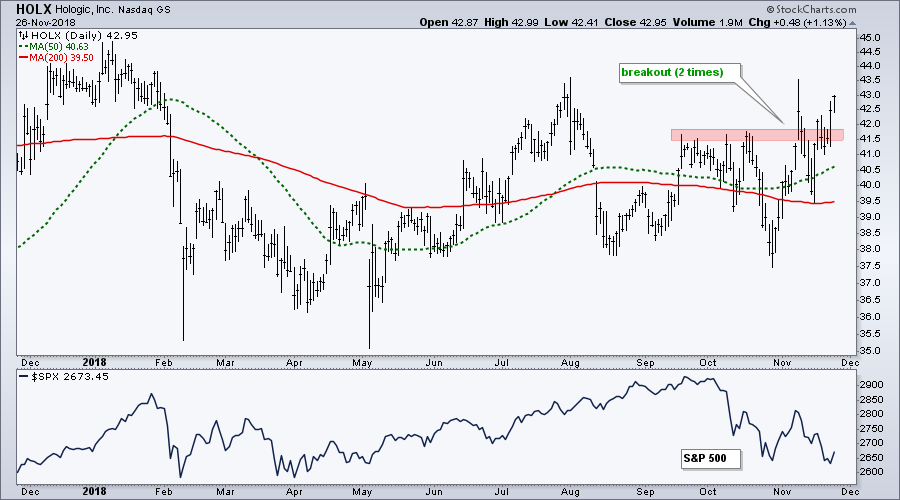

While the S&P 500 toys with its October low, Hologic its flirting with its summer highs and showing strength over the last few months.

The chart below shows Hologic (HOLX), which his part of the Medical Devices ETF (IHI), with its 50-day SMA above the 200-day SMA and price well above the 200-day SMA. Even though the stock has moved sideways for most of the year, the bias is now bullish based on these moving averages.

Most recently, the stock managed to break above resistance twice in November. The first breakout did not hold as the stock fell back to the 200-day SMA in mid November. Hologic is doubling down on the breakout with another attempt and its highest close since late July.

Even though the broad market environment is shaky, at best HOLX, is holding up well and attracting buying pressure.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill