Stocks making new 52-week highs are clearly in uptrends and leading. Even though Paypal is just shy of a 52-week high, the bigger uptrend and wedge point to new highs in the near future.

Stocks making new 52-week highs are clearly in uptrends and leading. Even though Paypal is just shy of a 52-week high, the bigger uptrend and wedge point to new highs in the near future.

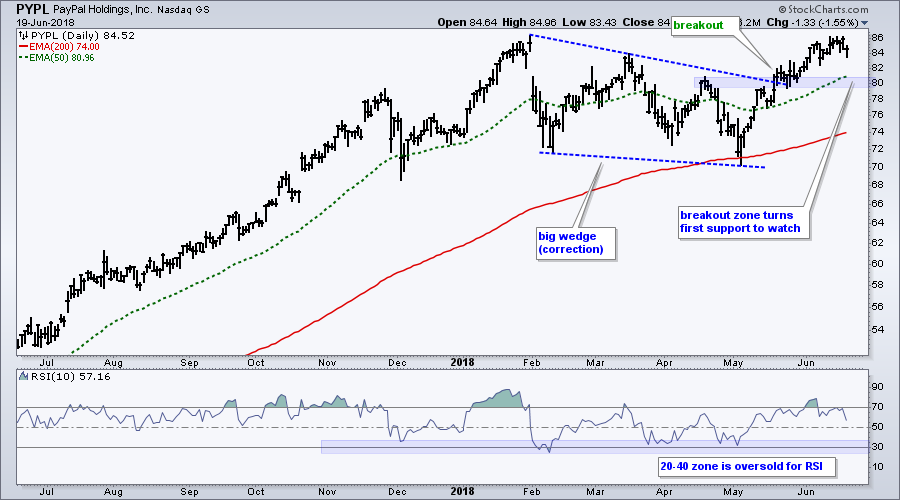

First and foremost, Paypal is in a long-term uptrend because the 50-day EMA is above the 200-day EMA and the close is above the rising 200-day EMA.

After hitting a new high in late January, the stock corrected with a large falling wedge into mid May. This correction was needed to work off the overbought conditions created in January. The falling wedge is a typical pattern for a correction and the breakout near 80 signaled an end to this correction.

This breakout argues for a continuation of the bigger uptrend and I would expect new highs in the coming weeks and months. The breakout zone around 80 turns first support to watch on a throwback (test of the breakout). A move into this zone could present an opportunity.

On Trend on Youtube

Available to everyone On Trend with Arthur Hill airs Tuesdays at 10:30AM ET on StockCharts TV and repeats throughout the week at the same time. Each show is then archived on our Youtube channel.

Topics for June 19th

- The Single Biggest Influence on Individual Stocks

- Seasonality and Sector Divisions (XLI, XLF)

- Watching Two Risk-Off Assets

- HON and UTX Stall as CAT Breakout Fails

- Tech Leaders (PFPT, ADSK, ACN, ADI)

- Exchange Leaders (NDAQ, CME, CBRE, ICE)

- Click here to Watch on Youtube

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill