Analog Devices (ADI) is a large semiconductor stock and a leader in the internet of things (IoT). The stock is in a long-term uptrend and recently broke short-term resistance to reverse a short-term pullback.

Analog Devices (ADI) is a large semiconductor stock and a leader in the internet of things (IoT). The stock is in a long-term uptrend and recently broke short-term resistance to reverse a short-term pullback.

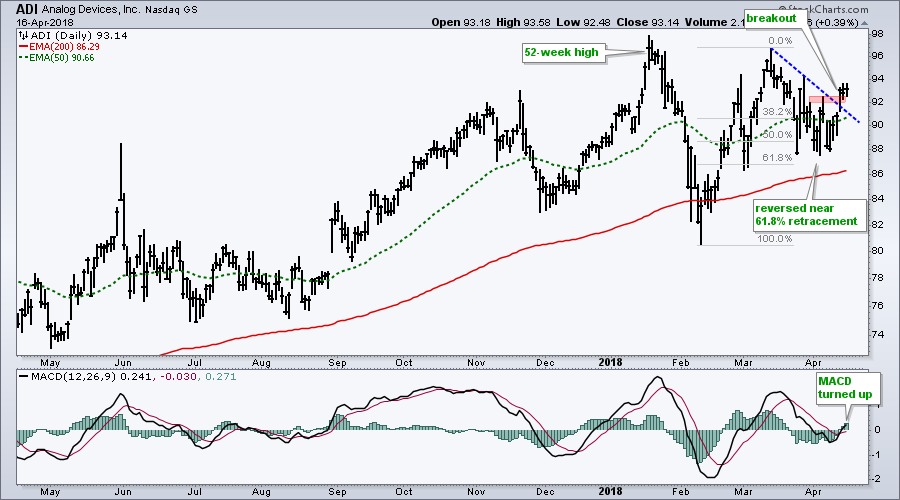

First and foremost, the long-term trend is up. The stock hit a 52-week high in January, the 50-day EMA is above the 200-day EMA and the price is above the rising 200-day EMA.

The stock has been moving sideways since November with a least five price swings greater than 9 percent. The decline from mid-March to early April marks the last downswing and the stock reversed this downswing with a breakout near 92 last week.

The indicator window shows MACD turning up over the last six days and moving back into positive territory. This means the 12-day EMA is above the 26-day EMA and this reinforces the new short-term uptrend.

Given the long-term uptrend and recent breakout, I would expect ADI to move to new highs in the coming weeks. A close below 90 would warrant a re-evaluation.

Programming Note: On Trend is this Tuesday at 10:30AM on StockCharts TV. Tune in to see how the golden cross works with QQQ, IJR, MDY and DIA. I will also cover some chart setups.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill