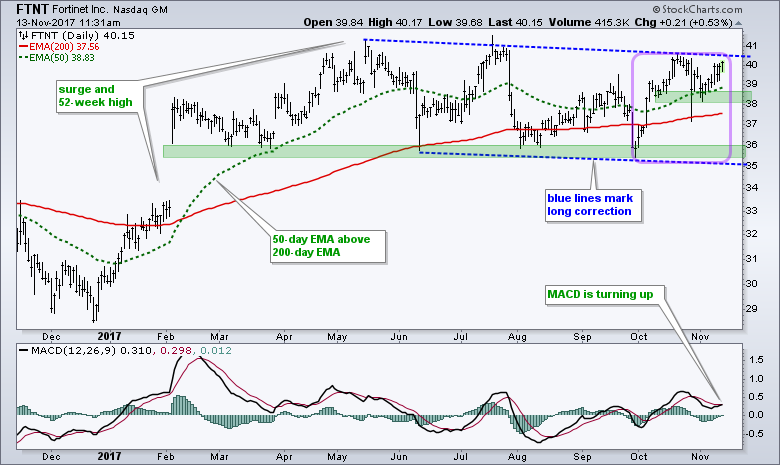

Stocks close to new highs are usually in uptrends and have a good chance of recording new highs in the near future. Fortinet looks poised for a new high as challenges a channel line after an upturn last week. First and foremost, Fortinet is in a long-term uptrend with the 50-day EMA above the 200-day EMA and a 52-week high this summer. The stock peaked in early July, but has been pretty much flat since June with the blue lines marking a correction. Corrections can sometimes overstay their welcome by extending longer than we expect. Nevertheless, I try to keep the bigger picture in mind and set my bias based on the bigger trend. The bigger trend is still up and this means I still view the slight decline marked by the falling channel as a correction within a bigger uptrend. There are signs that this correction may be ending because the stock surged above 40 in October, fell back in early November and turned up the last seven days (purple outline). A channel breakout could be in the making and this would signal a resumption of the prior advance (late December to mid May).

Follow me on Twitter @arthurhill - Keep up with my 140 character commentaries.

****************************************

Thanks for tuning in and have a good day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************